All Blogs

We have released new tutorials on the official MetaQuotes YouTube-channel. Seven new videos are now available, demonstrating where to find and how to obtain a robot for automated trading on the financial markets...

City firm Investec has driven the rout in shares of commodity trading company Glencore today, with a very bearish analyst note, which also weighed on the market...

Fundamentals for EUR/USD: neutral. "Draghi and other ECB members were unable to provide new information on policy tools they could use, so the EUR weakness (as markets priced in a deposit rate cut) was limited...

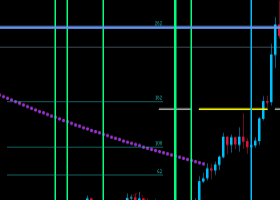

As you can see we went down all way long from S&D figure #1 (overbought) and till our S&D at figure #2 (oversold) now we can see we been at that level 3 times and now its our 4th time based on a DAILY chart -very- strong level here that takes up for an upward movement (bullish...

USD/JPY Today with Fundamental pressure for SELL [See FxStreet Source] however, we might expect a rise after we fall down to the 119.0 level based on the last two falls we had. Now we will NOT take this long UNLESS we have fundamental support for this rise (bullish) action. 4 Source: ForexEasy...

If we break underneath MA 100 (Aqua) with Fundamental support we might potentially gain some further great PIPs on bearish movement. Served by: www.ForexEasy.CLUB...

Traders will be inundated with an avalanche of macro-economic data this week. The inflation rates, confidence indicators and employment reports for various countries will be closely watched. Fed Chairwoman Janet Yellen will speak on Wednesday, ahead of the Non-Farm Payrolls report due on Friday...

On Friday palladium prices surged a more than 9% gain for the week, their largest since December 2011, as the Volkswagen scandal supported demand prospects for the metal...

Daily price is on ranging market condition located between bearish and bullish area of the chart with the following key support/resistance levels: 1.1713 key resistance level located far above Ichimoku cloud in the primary bullish area of the chart; 1...

On Monday Singapore’s FTSE Straits Times Index was down 1.6%, putting the index in bear market territory — defined as a 20% fall from a recent peak...

AUDUSD: AUDUSD closed lower to reverse its previous week gains and open the door for more decline the past week. But we are cautious of the 0.6911/0.6899 zone acting as a strong support. If that is able to hold off further downside pressure, we should see the pair return to the upside...

W1 price is located below yearly Central Pivot at 0.8556 and below S1 Pivot at 0.7609 for the primary bearish market condition with the secondary ranging: the price is breaking S2 Pivot at 0.7129 from above to below on close weekly bar for S3 Pivot at 0...

Good morning, Here is my (newbie) view on GBP/JPY this morning. This morning we have a range between high 184.76 and low 182.64, and the price currently is playing near the low. As always we never know where the market will drive the price to next, but we do have two scenarios here: 1...

I had mentioned about the high volatility in the eurusd price downward movement. The eurusd price is poised for a SUPER FALL from this week. Expected this month eurusd price to either close near 1.2 or 1.04, but both seem impossible with only 3 days left for the month end...

Expected this month to close either close to 1210 or below 1071. With only 3 days left in the month, both seem to be impossible. This could mean a SUPER FALL to a price level of 750 by December end...

GOLD: Having followed through higher on the back its previous week gains, further move higher is likely in the new week. This development if triggered leaves its key resistance at 1170.03 exposed. On the downside, support comes in at the 1140.00 level where a break will aim at the 1125.00 level...

Here’s the market outlook for this week: EURUSD Dominant bias: Bearish This pair fell 200 pips last week - almost touching the support line at 1.1100. Price then bounced 180 pips, only to correct lower again...

EUR/USD In the event that you take after my past compositions (a specialized Survey of the weekend), I demonstrated that the level was imperative in 1.1121 scale Every day, where truly the EUR/USD has ever tried this level when it bounce back from 1...

The Currency Score analysis is one of the parameters used for the Ranking and Rating list which was published earlier this weekend. Besides this analysis and the corresponding chart I also provide the Forex ranking and rating list...