All Blogs

The greenback, gauged by the US Dollar Index, is sharply appreciating vs. its main rivals on Tuesday, flirting with daily tops in the mid-97.00s. US Dollar gives away gains post-US releases The index has abandoned the area of session highs after another disappointment from the US docket...

Monday’s bland US ISM manufacturing PMI of 50.1 diluted the spice of last week’s hawkish FOMC statement which had benefited the USD bulls. This has been the lowest ISM figure in two and a half years, and one which slowly gravitates to contractionary levels below 50...

After climbing near 1.3160, or session highs, USD/CAD has now returned to the 1.3120 area following the US releases. USD/CAD trims gains on US results Spot has surrendered part of the earlier gains after US Factory Orders have surprised investors to the downside during September, contracting 1...

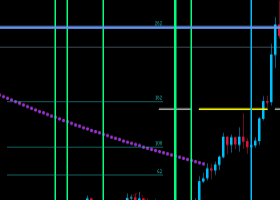

Prices continue to trade near daily lows despite dismal US data as traders remain focused on fEd rate outlook. Eyes key fib support The metal is trading within a touching distance from USD 1120.60/Oz, which is the 61.8% of Jul low to Oct high move...

The dollar gathered momentum and dragged EUR/USD to fresh lows sub-1.0950 despite the latest string of US data came in the soft side. US factory orders fell 1.0% in September against a decrease of 0.9% expected, while prior months’ were revised down to -2.1% from -1.9...

The slide in the GBP/USD stalled, making way for a minor correction after the US reported a drop in its factory orders in October, along with a fall in IBD/TIPP economic optimism index. Back above hourly 100-MA The spot is now back above its hourly 100-MA at 1...

The greenback keeps the upbeat tone vs. the Japanese currency on Tuesday, nw sending USD/JPY to session tops in the boundaries of 121.20...

With the US Federal Reserve much more hawkish than expected, this week looks to be a further round of musical chairs as investors figure out where each central bank stands - ahead of the Fed, or dovishly far behind it. Expect volatilty in gold, and in AUD this week. Will prices of gold rise...

EUR/CHF sellers stood their ground and buyers retreated in recent sessions as MACD (26, 12, 9) has fallen off below its median line. On a 4hr chart, this technical condition may be taken by many trend-following traders as a trigger to liquidate long positions...

prices in EUR terms are trading around the previous session’s low of EUR 1026.13, but stay relatively resilient compared to Gold (USD) on account of a drop in the EUR/USD pair...

Senior Analyst at Danske Bank Signe Roed-Frederiksen has assessed the recent figures from the key indicator in the US economy. Key Quotes “The US manufacturing ISM for October declined to 50.1 from 50.2 (consensus expectations 50.0, Danske Bank 49...

Oil prices rallied despite the broad based USD strength ahead of the weekly supply data in the US. At the time of writing, the Brent futures were up 77 cents or 1.5% higher at USD 49.56/barrel, while WTI futures were up 95 cents or 2% at USD 47.09/barrel. The USD index rose 0...

RUSSIA The perspective for the Russian currency remains neutral for the time being, according to BofA Merrill Lynch Global Research. Key Quotes “We remain neutral on RUB, as our commodity team sees stable oil prices through yearend and with the CBR committed to buying USD if RUB falls below 60...

U.S. stocks opened slightly lower Tuesday as investors took a pause after a big rally during the previous session...

US Dollar - "The ECB and PBoC have vowed more easing while the RBA and RBNZ have warned more rate cuts may be appropriate. One of the top spring boards to this point, the BoJ seems a bit winded on QE...

Oil erased early losses on Tuesday, but stayed below $50, pressured by an oversupply and worries about a vulnerable demand outlook...

Testing on a real tick story - EURUSD,H1 Broker #1: RoboForex (market execution, commission $4/lot, stops level 0) 1. Testing with standard parameters on EURUSD,H1 (25.05.2015-26.06.2015): 2. Testing with standard parameters on EURUSD,H1 (25.01.2015-26.06.2015): 3...

Professional market analysis by Jarratt Davis is now featured straight in MetaTrader 4 and MetaTrader 5. The news feed from the famous British trader has been integrated into MetaQuotes' trading platforms...

Trading recommendations and Technical Analysis – HERE! Released yesterday, the business activity index of purchasing managers (PMI) in the manufacturing sector by Markit Economics in the UK in October, was higher than forecast (55.5 instead of the 51.3 forecast and 51.5 in September...