All Blogs

Market mood before it became better in a very busy week. Will the Fed and the BOJ go dovish? Apart from these rate decisions, we have GDP data from the US and the UK as well as other key releases . These are the main events on our calendar. Here is an outlook on the main highlights coming our way...

Risk sentiment by the end of the week has stabilised, mainly in reaction to ECB President Draghi making a case of considering additional policy action as soon as March...

First, a few words about the forecast for the previous week: ■ with regard to EUR/USD, the experts’ opinion on the "bearish" mood of the pair proved to be quite true - the pair fell by 120 points during the week. However, it lacked exactly the same amount to the minimum of 1...

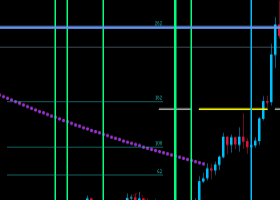

YEN has been weak for the last couple of days, and thus AUDJPY has gone north, after making Double Bottom. In fact, this is one of the textbook reversal patterns – Double Bottom + Higher High. (Bullish divergence is a plus!) When we see this patter, we should look for Higher Low, and buy...

How Will a Volatile Market React to the Fed Decision, US GDP? Saturday, Jan 23, 2016 7:05 am +03:00...

Why Negative Balance Protection is so Important The recent CHF debacle has been quite instructive for a number of reasons. We all agree that low volatility is a bad thing in retail forex, but too much of it can be catastrophic...

Hedge fund manager turned pharma bro Martin Shkreli has turned again, into a constitutional law scholar. Why? Because Martin Shkreli is a genius… and necessity is the mother of (re)invention...

ince the stock market began falling at the beginning of this year, there seems to have been a palpable change in the stories we have been hearing. Suddenly there is more willingness to entertain the possibility of a major stock market correction, or of an economic recession...

Here we go again on the euro The implication from yesterday’s comments from Draghi is that the single currency is once again entering a six week period of uncertainty and guessing as to what the ECB will do come the March meeting...

Currency dealing coaching through either a Currency dealing course or a guidance program (ideally both) are by far the most critical factors of an equation towards achieving economical success when dealing Currency dealing...

Hello friends, I am presenting here a simple indicator and coding for you. Sometimes maybe we need to draw some comment on our Meta Trader chart. That times we need to draw from MT4 tool box. But now you can use your own comment in your chart with this simple indicator...

The following are the latest technical setups for EUR/USD, USD/JPY, GBP/USD, USD/CHF, AUD/USD, and NZD/USD as provided by the technical strategy team at Barclays Capital. EUR/USD: Our bearish view was encouraged by the break below 1.0805. Our initial downside targets are towards 1.0710...

Pivot Points _ Hourly Last Updated: Jan 22, 4:00 pm +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.07817 1.08014 1.08092 1.08211 1.08289 1.08408 1.08605 USD/JPY 117.966 118.084 118.152 118.202 118.27 118.32 118.438 GBP/USD 1.42235 1.42688 1.42954 1.43141 1.43407 1.43594 1.44047 USD/CHF 1.00885 1...

Pivot Points - HOURLY Last Updated: Jan 22, 3:00 pm +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.07942 1.0813 1.08215 1.08318 1.08403 1.08506 1.08694 USD/JPY 117.959 118.083 118.133 118.207 118.257 118.331 118.455 GBP/USD 1.42043 1.42418 1.4266 1.42793 1.43035 1.43168 1.43543 USD/CHF 1.00681 1...

More and more traders are making the smart move towards swing trading. Everyday I receive emails from traders interested in a medium, or long term approach with price action trading...

USDJPY: Having followed through higher on the back of its Thursday gains on Friday, further bullishness is expected. On the downside, support comes in at the 117.50 level where a break if seen will aim at the 117.00 level. A cut through here will turn focus to the 116...

Pre US Open, Daily Technical Analysis Friday, January 22, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: under pressure. Pivot: 1.0865 Most Likely Scenario: short positions below 1...

The U.S. #currency continues to strengthen against the #euro and the #yen after yesterday's speech of Mario #Draghi. The head of the Bank of Japan Haruhiko Kuroda said that currently he sees no reasons to consider a negative interest rate. Find out more by checking out the Source Link...