All Blogs

Central bank impotence and a potential bottom in the euro mean that most of the volatility for EUR/GBP will likely be supplied by referendum speculation...

The USDJPY continues to fall after the retail sales disappoint. The control group which feeds into the GDP saw the number come in at 0.0% vs +0.2%. The revision shaved a healthy amount off of the January number (from +0.6% to +0.2%). What was a great start to 2016 (+0...

Trade in the euro exchange rate complex over recent days has therefore been undestandably tricky to decode. The EUR to USD pair continues to drift lower, yet it still retains the majority of the gains registered following the ECB meetingfrom last week...

The EUR/USD has opened Tuesday’s trading moving inside of a 53-pip range. Despite today’s US Advanced Retail Sales figures posting better than expected at -0...

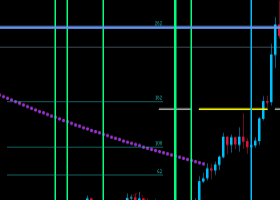

EUR/USD spotlight remains on the “point of breakout” and 200- day average at 1.1068/44, notes Credit Suisse. "We look for this to ideally hold to keep the bias higher in the range for 1.1176, then a test of the recent price high at 1.1218. "Extension through here can aim at gap and 78...

After testing key levels 1.06/1.05 last year, EUR/USD is undergoing broad consolidation. Downtrend is still in place; 1.06/1.05 will decide next leg of down cycle. Short term though, the pair revisited February lows (1.08) and looks to show a rebound towards 1.1250. Graphical levels at 1...

The ECB has taken yet another step towards trying to heal the European economy. However, underlying arguments for further easing measures are still the same: inflation will remain far from target. Although rates are unlikely to be lowered further, the ECB will continue to expand its balance sheet...

With the US economy continuing to grow above trend, printing very robust employment gains month after month, and with unemployment at 4.9% and a sharper-than-expected acceleration in core inflation, rates hikes will be on the agenda for this FOMC meeting...

Buying the Franc may be the best way to protect your sterling exposure ahead of the EU referendum. HSBC’s global head of research has recommended going long the Swiss Franc as the ideal hedge in case of the sterling weakening following a Brexit vote...

Nomura doesn't expect the FOMC to change policy at tomorrow’s meeting. "Recent commentary from Fed officials does not suggest that a change is imminent. The more interesting question will be how the FOMC’s forecast for the economy and interest rates change...

BNP Paribas expects the weakness of the commodity currencies verses the USD to continue as markets prepare for a more hawkish message from the Fed at this week’s FOMC meeting...

This year, the world’s billionaires clocked in an aggregate net worth of $6.48 trillion, according to the Forbes Billionaires list released this month, with the usual suspects topping the list – including Bill Gates ($75 billion), Inditex ITX, -0...

Buying the Swiss franc may be the best hedge against the United Kingdom voting to quit the European Union (EU), according to HSBC — but not everybody agrees. The British bank said the Swiss currency would likely rally strongly on a "Brexit," but would not weaken if the U.K...

The BOJ decision to leave policy unchanged was a catalyst for this morning’s risk aversion though no-one was looking for any move and the fact that the oil bounce ran out of steam could be blamed just as much...

A result of a long position in #EURUSD was fixed on a signal of the red Alligator's line crossing i.e. with a profit. Then we went short on a breakthrough of a fractal down at 1.1077. Find out more by checking out the Source Link...

A result of a long position in #USDJPY was fixed with a small loss. Here we have already opened a new order to sale in accordance with the System rules. Currently it brings a slight #profit. Find out more by checking out the Source Link...

The pound to euro exchange rate needs to extricate itself out of its current quagmire if it is to avoid significant falls lower. The longer sterling remains unable to extricate itself from where it currently finds itself against the euro, the stronger the downside bias is likely to become...

If you are looking to buy a holiday home in the U.S, in somewhere like Florida, you are going to need US dollars, and to get those you are going to have to exchange British pounds...

The negative rate environment is having unintended consequences, one of which is the ressurection of gold. Gold is on the rise. The precious metal has rallied sharply from lows in the 1040s to its current rate in the 1230s - a rise of nearly 20% since only the end of last year...