All Blogs

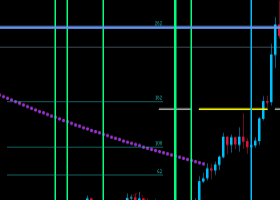

Chart:https://bi0l.blogspot.com/2016/06/eurusd-d1-monthly-analysis-2016-05_1.html Weather (Monthly): Calculated monthly level: Support (S1 MN / S2 / S3 = 1.1083 / 1.0961 / 1.0763), resistance (R1 MN / R2 / R3 = 1.1480 / 1.1602 / 1.1801). Key level (1st from 1.1143 to 1...

Chart: https://bi0l.blogspot.com/2016/06/eurusd-d1-monthly-analysis-2016-05.html Analysis (2016-05-Monthly): Last month the couple began 1.1461 (Open) breakdown of 1.1472 (S1 MN) and reaching 1.1616 (High) to the achievement of the expected goals purchases (R2 MN...

The nominal yield spread between the US and Japan is set to widen further with the Fed likely to raise rates for the second time in either June or July, thus providing support for USD/JPY. Copy signals, Trade and Earn $ on Forex4you - https://www.share4you.com/en...

In today’s capital markets, matters can change very quickly...

Brent: The Month Started with the Declining Price. Technical Analysis as of 01.06.2016 Overview and dynamics Since the opening of today's trading day, the oil price has been declining. In Asia, Brent crude oil fell by nearly $0.5, and during the European session the decrease continued...

Brent: Will the Recent Peaks be Updated? Fundamental Analysis as of 01.06.2016 Oil quotes have dropped today in the Asian market in the run-up to tomorrow's Opec meeting in Vienna that is not expected to change the cartel's policy...

ISM: Moderate Manufacturing Recovery Amid Rising Prices May’s ISM report signals continued moderate gains in the manufacturing sector. Production, new orders and export orders support the case for growth. Prices paid hint at rising input costs for manufacturers...

NZD/USD Fails to Benefit from Higher Dairy Prices NZD/USD is rising for the second day in a row and during the American session, it has been consolidating gains. The pair peaked earlier at 0.6830, the highest level since May 17 and then pulled back modestly. It was trading at 0.6804/08, up 0...

USD/CAD Drops to Lows ahead of ISM, API After briefly testing the 1.3100 neighbourhood, USD/CAD lost upside momentum and is now trading in the mid-1.3000s ahead of US data...

S&P Affirms Indonesia's Ratings at 'bb+/b', Outlook Positive Rating agency S&P has affirmed Indonesia's 'BB+' long-term and 'B' short-term sovereign credit ratings...

EUR/GBP: Above 0.7750/0.7800 It Could Re-Test 0.82 - Lloyds Analysts from Lloyds Bank warned that the 0.7750-0.7800 region in the EUR/GBP pair is a strong area and a break higher could lead to a re-test of 0.82. Key Quotes: “A strong bull day, after continuing to hold channel support in the 0...

USD/JPY Moves Off Lows, Still Vulnerable USD/JPY managed to recover some ground during the New York session, as the dollar benefitted from upbeat US manufacturing data, although the bounce has been limited, leaving the pair near daily lows. US ISM Manufacturing PMI rose to 51...

Sell-Off Ramps Up ahead of OPEC • Investors head for the hills, as Crude and indices plummet • OPEC meeting unlikely to help Oil prices • Volatility expected to rise as risk events come thick and fast June has started with less of a bang and more of a pop today, as investors were sent packing tow...

USD/CAD Door Still Open for a Test of 1.33 – Scotiabank FX Strategist at Scotiabank Eric Theoret remains bullish on the pair in the near term and believes it could test 1.33. Key Quotes “USDCAD has yet to break from recent congestion around its 9 day MA (1...

WTI Wobbles Near $48.00, API Eyed Crude oil prices are prolonging its weekly decline today, prompting the West Texas Intermediate to drop below the $48.00 mark per barrel, or multi-day lows...

Gold Turns Negative after US Dollar Trim Losses on Stronger ISM Data Gold is reversing from 100-day SMA near $1220 level and has now turned negative to currently trade below $1215 after the US Dollar trimmed its losses on the back of better-than-expected ISM manufacturing data...

Elliott Wave Analysis On 10 Year US Notes And Yen The wave count on 10 year US notes shows new three wave recovery in play back to 130'14 which means that for now JPY can be headed higher. GBPJPY is the weakest, followed by CADJPY...

The US Manufacturing ISM Improved Unexpectedly in May European shares opened slightly lower but lost further ground during the session as sentiment weakened at the start of the new month. Currently, European shares lose up to 1%. US equities opened lower too...

Optimistic Draghi Not Enough to Save the EUR The European Central Bank is expected to leave its massive bond-purchase program unchanged in its June monetary policy meeting, but Mario Draghi may have a reason to be optimistic this time, despite inflation in the EU remains subdued and far below the...