Another 10K contraction in German Unemployment may encourage a near-term rebound in EUR/USD as it raises the prospects for a stronger recovery in the euro-area...

It is hard to overestimate effect of austerity measures over Portugal. On the one hand, many economists, including authorities, are saying the worst is over...

The European currency fell against the US dollar after the weaker than expected German Ifo index report. Janet Yellen’s speech did not move the market. Janet Yellen announced that the rates would be at the current level for a while...

The Greek-EU standoff did not much influence European bond markets. Now that, Greece has formally obtained the extension, the country should fade from investors' focus. However, there are other risks emerging from the eurozone...

Looking at yesterdays Market Profile for EURUSD during the Wall Street session, things seemed in favour of buyers. Long buying tail early in the session and a close at the top part of the range, as well as the stacked up prints were all showing keen buyers...

EURUSD remains trapped between 1.1267 and 1.1450 - here are potential targets on a breakout...

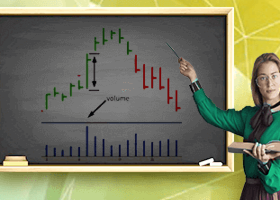

EUR/USD Technical Strategy: Flat Support: 1.1276, 1.1185, 1.0970 Resistance:1.1533, 1.1659, 1.1832 The Euro continues to stall having carved out a bottom against the US Dollar as expected after showing a bullish Morning Star candle pattern. Near-term resistance is at 1...

USD/CHF Technical Strategy: Flat Support:0.9343, 0.9076, 0.8793 Resistance: 0.9498, 0.9781, 1.0239 The US Dollar may be preparing to turn lower against the Swiss Franc after producing a Bearish Engulfing candlestick pattern. A daily close below resistance-turned-support at 0...

GBP/USD Technical Strategy: Long at 1.5373 Support: 1.5322, 1.5194, 1.4950 Resistance: 1.5551, 1.5737, 1.5923 The British Pound paused to digest gains once again having fallen short of overcoming the 1.55 figure against the US Dollar. A daily close above the 38.2% Fibonacci retracement at 1...

AUD/USD Technical Strategy: Flat Support:0.7783, 0.7717, 0.7619 Resistance:0.7881, 0.7960, 0.8039 The Australian Dollar remains locked in a familiar range below the 0.79 figure against its US counterpart as prices await defined direction cues. Near-term resistance is at 0.7881, the 38...

NZD/USD Technical Strategy:Flat Support: 0.7469, 0.7405, 0.7301 Resistance:0.7532, 0.7616, 0.7721 The New Zealand Dollar is attempting to renew its down trend against the US Dollar but follow-through is lacking for the time being. Near-term support is at 0.7469, the 14...

EUR/GBP Technical Strategy: Short at 0.7341 Support: 0.7290, 0.7219, 0.7131 Resistance: 0.7361, 0.7449, 0.7503 The Euro looks vulnerable to deeper losses against the British Pound after prices turned downward from trend line resistance in play since early January...

RSI values of above 70 are considered to be overbought; traders consider points above the 70 level as market tops and good points for taking profits...

Currencies are great to trade , but can be very volatile as recent events such as the Swiss bank move have proven. Why not add stock Indexes? All the techniques you use on currencies work well - often better on stock Indexes...

The indicator of OsMA, marking the height of activity of parties (at the beginning divergence, after going down), gives founding to priority of planning of trade operations of correction and to date...

The indicator of OsMA, marking both going down and divergence, gives founding to priority of planning of trade operations of lateral correction to date...

AUD/USD: Short One short position with a trailing stop is still open for the last four weeks. See for more information my weekly reviews on my strategy lately. The AUD is having a currency a score of 4 and and the USD is down 1 point from 8 to a score of 7 compared to last weekend...

Classic divergence is used as a possible sign for a trend reversal. Classic divergence is used when looking for an area where price could reverse and start going in the opposite direction...

After reaching the Friday "truce" between Athens and the creditors on the Greece loans issue for four months under the guarantee of performing reforms, the market focused its attention on the J. Yellen two-day speech , the Federal Reserve governor which will be held on February 24 and 25...