All Blogs

The Swiss/Liechtenstein-based ‘Crypto Valley’ continues to boom: company numbers are up 20% in the past year to 750 in total, including four unicorns. Blockchain technologies remain highly attractive, despite the plunge in cryptocurrencies last year...

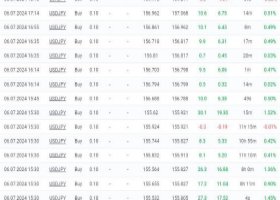

Over the last few days, the greenback has been trading with an upward bias, remaining insensitive to the publication of economic data – good or bad. Indeed, the trade negotiation between the US and China remains the main driver in the FX market...

The rise in inventories continues, and attention is turning to OPEC+ members which have tightened supply, pushing Brent, WTI and Shanghai future up by 4.15%, 3.13% and 2.95%, their highest in 3 months...

December’s retail sales gave a stark reminder that the economy is not rosy anymore. They contracted 1.2% monthly in December versus +0.1% expected, and November’s figures were downwardly revised. This is the largest contraction since September 2009...

Pivot (invalidation): 54.20 Our preference Long positions above 54.20 with targets at 55.00 & 55.45 in extension. Alternative scenario Below 54.20 look for further downside with 53.80 & 53.10 as targets...

Pivot (invalidation): 15.5200 Our preference Long positions above 15.5200 with targets at 15.6300 & 15.6800 in extension. Alternative scenario Below 15.5200 look for further downside with 15.4700 & 15.4300 as targets...

Pivot (invalidation): 1308.00 Our preference Long positions above 1308.00 with targets at 1315.50 & 1318.00 in extension. Alternative scenario Below 1308.00 look for further downside with 1305.00 & 1302.00 as targets...

Pivot (invalidation): 2737.00 Our preference Long positions above 2737.00 with targets at 2762.00 & 2775.00 in extension. Alternative scenario Below 2737.00 look for further downside with 2723.00 & 2710.00 as targets...

Pivot (invalidation): 11190.00 Our preference Short positions below 11190.00 with targets at 11040.00 & 10970.00 in extension. Alternative scenario Above 11190.00 look for further upside with 11315.00 & 11373.00 as targets...

Pivot (invalidation): 5.2620 Our preference Long positions above 5.2620 with targets at 5.2960 & 5.3220 in extension. Alternative scenario Below 5.2620 look for further downside with 5.2420 & 5.2300 as targets...

Pivot (invalidation): 0.7110 Our preference Short positions below 0.7110 with targets at 0.7070 & 0.7050 in extension. Alternative scenario Above 0.7110 look for further upside with 0.7135 & 0.7150 as targets...

Pivot (invalidation): 1.3270 Our preference Long positions above 1.3270 with targets at 1.3340 & 1.3370 in extension. Alternative scenario Below 1.3270 look for further downside with 1.3255 & 1.3230 as targets...

Pivot (invalidation): 1.0070 Our preference Short positions below 1.0070 with targets at 1.0035 & 1.0020 in extension. Alternative scenario Above 1.0070 look for further upside with 1.0095 & 1.0110 as targets...

Pivot (invalidation): 110.60 Our preference Short positions below 110.60 with targets at 110.10 & 109.90 in extension. Alternative scenario Above 110.60 look for further upside with 110.80 & 110.95 as targets...

Pivot (invalidation): 1.2830 Our preference Short positions below 1.2830 with targets at 1.2770 & 1.2740 in extension. Alternative scenario Above 1.2830 look for further upside with 1.2850 & 1.2875 as targets...

Pivot (invalidation): 1.1270 Our preference Long positions above 1.1270 with targets at 1.1310 & 1.1325 in extension. Alternative scenario Below 1.1270 look for further downside with 1.1245 & 1.1230 as targets...

A bullish engulfing pattern occurs in the candlestick chart of a currency pair when a large bull candlestick fully engulfs a smaller bear candlestick from the period before. This pattern during a downtrend is thought to signal the beginning of a bullish trend...

GBPUSD weakens on further bear pressure following its Wednesday losses. Support sits at 1.2750 level. Further down, support comes in at the 1.2700 level where a break will turn focus to the 1.2650 level. Further down, support lies at the 1.2600 level...