Mirza Baig / Profile

- Information

|

10+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

::: You must expect to be stung by bees when in search of honey :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

Friends

301

Requests

Outgoing

Mirza Baig

::: Natural gas futures higher in U.S. trade :::

Investing.com - Natural gas futures were higher in U.S. trade on Thursday.

On the New York Mercantile Exchange, Natural gas futures for January delivery traded at USD3.933 per million British thermal units at time of writing rising 1.79%.

It earlier traded at a session high USD3.942 per million British thermal units. Natural gas was likely to find support at USD3.788 and resistance at USD3.942.

US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, fell 0.12% to trade at USD80.63.

Elsewhere on the Nymex, Crude oil for January delivery fell 1.54% to trade at USD92.24 a barrel while Heating oil for January delivery fell 0.23% to trade at USD3.0356 per gallon.

Investing.com - Natural gas futures were higher in U.S. trade on Thursday.

On the New York Mercantile Exchange, Natural gas futures for January delivery traded at USD3.933 per million British thermal units at time of writing rising 1.79%.

It earlier traded at a session high USD3.942 per million British thermal units. Natural gas was likely to find support at USD3.788 and resistance at USD3.942.

US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, fell 0.12% to trade at USD80.63.

Elsewhere on the Nymex, Crude oil for January delivery fell 1.54% to trade at USD92.24 a barrel while Heating oil for January delivery fell 0.23% to trade at USD3.0356 per gallon.

Mirza Baig

::: Gold prices up in early Asian trade following U.S. Thanksgiving holiday :::

Investing.com - Gold prices rose in early Asian trade on Friday, lifted by a slightly weaker dollar and prospects for a solid holiday shopping season.

On the Comex division of the New York Mercantile Exchange, gold futures for February delivery traded at USD1,244.60 a troy ounce, up 0.25%, with the contract settling 0.29% lower on Wednesday to end at USD1,237.90 a troy ounce. Comex gold fell to a four-and-a-half-month low of USD1,226.40 a troy ounce on Nov. 25.

Trade volumes were light on Thursday, with Comex floor trading scheduled to remain closed for Thanksgiving. An abbreviated session was slated for Friday.

The U.S. dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, traded at 80.63, down 0.12%.

Investing.com - Gold prices rose in early Asian trade on Friday, lifted by a slightly weaker dollar and prospects for a solid holiday shopping season.

On the Comex division of the New York Mercantile Exchange, gold futures for February delivery traded at USD1,244.60 a troy ounce, up 0.25%, with the contract settling 0.29% lower on Wednesday to end at USD1,237.90 a troy ounce. Comex gold fell to a four-and-a-half-month low of USD1,226.40 a troy ounce on Nov. 25.

Trade volumes were light on Thursday, with Comex floor trading scheduled to remain closed for Thanksgiving. An abbreviated session was slated for Friday.

The U.S. dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, traded at 80.63, down 0.12%.

Mirza Baig

::: NYMEX crude oil up in Asian trade following U.S. Thanksgiving holiday :::

Investing.com - Crude oil prices rose in early Asian trade on Friday, moving slightly off a six month low in thin trading with U.S. markets closed for the Thanksgiving holiday overnight though electronic trading continued.

On the New York Mercantile Exchange, light sweet crude futures for delivery in January traded at USD92.31 a barrel, up 0.08%,

NYMEX floor trading closed for the Thanksgiving Day holiday in the U.S. An abbreviated session was slated for Friday.

In focus for the contract are bulging U.S. oil supplies that rose more-than-expected last week.

The U.S. Energy Information Administration said in its weekly report that crude oil inventories rose by 3 million barrels last week to hit 391.4 million barrels, the most since June.

Domestic output rose to 8.02 million barrels a day, the highest level in almost 25 years.

European benchmark Brent fell back from near seven-week highs to close down at $110.68 a barrel on the ICE Futures Exchange, but remains supported by unrest in Libya that threatens exports.

Investing.com - Crude oil prices rose in early Asian trade on Friday, moving slightly off a six month low in thin trading with U.S. markets closed for the Thanksgiving holiday overnight though electronic trading continued.

On the New York Mercantile Exchange, light sweet crude futures for delivery in January traded at USD92.31 a barrel, up 0.08%,

NYMEX floor trading closed for the Thanksgiving Day holiday in the U.S. An abbreviated session was slated for Friday.

In focus for the contract are bulging U.S. oil supplies that rose more-than-expected last week.

The U.S. Energy Information Administration said in its weekly report that crude oil inventories rose by 3 million barrels last week to hit 391.4 million barrels, the most since June.

Domestic output rose to 8.02 million barrels a day, the highest level in almost 25 years.

European benchmark Brent fell back from near seven-week highs to close down at $110.68 a barrel on the ICE Futures Exchange, but remains supported by unrest in Libya that threatens exports.

Mirza Baig

::: Crude oil futures edge higher but still near 5-month lows :::

Investing.com - Crude oil futures edged higher during early European trading hours on Friday, but remained close to five-month lows as concerns over rising U.S. inventories and increased production levels continued to weigh.

On the New York Mercantile Exchange, light sweet crude futures for delivery in January traded at USD92.48 a barrel during European morning trade, up 0.19%.

Nymex floor trading remained closed on Thursday for the Thanksgiving Day holiday in the U.S.

Oil futures were likely to find support at USD91.79 a barrel, Wednesday's low and resistance at USD93.58 a barrel, Wednesday's high.

Oil prices remained under pressure after a government report on Wednesday showed that U.S. oil supplies rose more-than-expected last week.

The U.S. Energy Information Administration said in its weekly report that crude oil inventories rose by 3 million barrels last week to hit 391.4 million barrels, the most since June.

Domestic output rose to 8.02 million barrels a day, the highest level in almost 25 years.

Traders also remained focused on developments in Iran, following a recent internationa agreement on the country's nuclear program.

U.N. inspectors were invited to visit a nuclear-related heavy water facility in Iran, marking an initial concrete step towards resolving the dispute.

Elsewhere, on the ICE Futures Exchange, Brent oil futures for January delivery fell 0.20% to trade at USD110.66 a barrel, with the spread between the Brent and crude contracts standing at USD18.18 a barrel.

Investing.com - Crude oil futures edged higher during early European trading hours on Friday, but remained close to five-month lows as concerns over rising U.S. inventories and increased production levels continued to weigh.

On the New York Mercantile Exchange, light sweet crude futures for delivery in January traded at USD92.48 a barrel during European morning trade, up 0.19%.

Nymex floor trading remained closed on Thursday for the Thanksgiving Day holiday in the U.S.

Oil futures were likely to find support at USD91.79 a barrel, Wednesday's low and resistance at USD93.58 a barrel, Wednesday's high.

Oil prices remained under pressure after a government report on Wednesday showed that U.S. oil supplies rose more-than-expected last week.

The U.S. Energy Information Administration said in its weekly report that crude oil inventories rose by 3 million barrels last week to hit 391.4 million barrels, the most since June.

Domestic output rose to 8.02 million barrels a day, the highest level in almost 25 years.

Traders also remained focused on developments in Iran, following a recent internationa agreement on the country's nuclear program.

U.N. inspectors were invited to visit a nuclear-related heavy water facility in Iran, marking an initial concrete step towards resolving the dispute.

Elsewhere, on the ICE Futures Exchange, Brent oil futures for January delivery fell 0.20% to trade at USD110.66 a barrel, with the spread between the Brent and crude contracts standing at USD18.18 a barrel.

Mirza Baig

::: Gold futures rise, but remain under pressure in thin trade :::

Investing.com - Gold futures rose in thin trade on Friday, but remained under pressure as ongoing expectations for the Federal Reserve to soon begin tapering its asset-purchase program continued to weigh.

On the Comex division of the New York Mercantile Exchange, gold futures for February delivery traded at USD1,247.3 a troy ounce during European afternoon trade, up 0.76%.

Gold futures were likely to find support at USD1,234.70 a troy ounce, Wednesday's low and resistance at USD1,254.95, the high from November 26.

Comex floor trading remained closed on Thanksgiving day and an abbreviated session was slated for Friday.

Gold prices remained under pressure after upbeat U.S. employment and consumer confidence data released earlier in the week fuelled expectations the Fed will start to taper its stimulus program at one of its next few meetings.

Prices of the precious metal are down approximately 26% this year on concerns the Fed would start tapering its USD85-billion-a-month asset-purchase program by the end of the year.

Elsewhere on the Comex, silver for March delivery jumped 1.39% to trade at USD19.955 a troy ounce, while copper for March delivery climbed 0.52% to trade at USD3.207 a pound.

Investing.com - Gold futures rose in thin trade on Friday, but remained under pressure as ongoing expectations for the Federal Reserve to soon begin tapering its asset-purchase program continued to weigh.

On the Comex division of the New York Mercantile Exchange, gold futures for February delivery traded at USD1,247.3 a troy ounce during European afternoon trade, up 0.76%.

Gold futures were likely to find support at USD1,234.70 a troy ounce, Wednesday's low and resistance at USD1,254.95, the high from November 26.

Comex floor trading remained closed on Thanksgiving day and an abbreviated session was slated for Friday.

Gold prices remained under pressure after upbeat U.S. employment and consumer confidence data released earlier in the week fuelled expectations the Fed will start to taper its stimulus program at one of its next few meetings.

Prices of the precious metal are down approximately 26% this year on concerns the Fed would start tapering its USD85-billion-a-month asset-purchase program by the end of the year.

Elsewhere on the Comex, silver for March delivery jumped 1.39% to trade at USD19.955 a troy ounce, while copper for March delivery climbed 0.52% to trade at USD3.207 a pound.

Mirza Baig

::: South African trade balance falls unexpectedly :::

Investing.com - South Africa’s trade balance fell unexpectedly last month, official data showed on Friday.

In a report, South African Revenue Service said that South African Trade Balance fell to -20.97B, from -18.94B in the preceding month whose figure was revised up from -18.94B.

Analysts had expected South African Trade Balance to rise to -12.75B last month.

Investing.com - South Africa’s trade balance fell unexpectedly last month, official data showed on Friday.

In a report, South African Revenue Service said that South African Trade Balance fell to -20.97B, from -18.94B in the preceding month whose figure was revised up from -18.94B.

Analysts had expected South African Trade Balance to rise to -12.75B last month.

Mirza Baig

::: Canadian GDP rises more-than-expected :::

Investing.com - Canadian gross domestic product rose more-than-expected last month, official data showed on Friday.

In a report, Statistics Canada said that GDP rose to a seasonally adjusted 0.3%, from 0.3% in the preceding month.

Analysts had expected GDP to rise 0.1% last month

Investing.com - Canadian gross domestic product rose more-than-expected last month, official data showed on Friday.

In a report, Statistics Canada said that GDP rose to a seasonally adjusted 0.3%, from 0.3% in the preceding month.

Analysts had expected GDP to rise 0.1% last month

Mirza Baig

::: Chilean retail sales rises unexpectedly :::

Investing.com - Retail sales in Chile rose unexpectedly last month, official data showed on Friday.

In a report, Estadisticas de Chile said that Chilean Retail Sales rose to an annual rate of 13.4%, from 7.1% in the preceding month whose figure was revised up from 7.0%.

Analysts had expected Chilean Retail Sales to fall to 6.0% last month.

Investing.com - Retail sales in Chile rose unexpectedly last month, official data showed on Friday.

In a report, Estadisticas de Chile said that Chilean Retail Sales rose to an annual rate of 13.4%, from 7.1% in the preceding month whose figure was revised up from 7.0%.

Analysts had expected Chilean Retail Sales to fall to 6.0% last month.

Mirza Baig

::: China manufacturing PMI remains unchanged unexpectedly :::

Investing.com - Manufacturing activity in China remained unchanged unexpectedly last month, official data showed on Sunday.

In a report, China Logistics Information Center said that Chinese Manufacturing PMI remained unchanged at an annual rate of 51.4, from 51.4 in the preceding month.

Analysts had expected Chinese Manufacturing PMI to fall to 51.1 last month.

Investing.com - Manufacturing activity in China remained unchanged unexpectedly last month, official data showed on Sunday.

In a report, China Logistics Information Center said that Chinese Manufacturing PMI remained unchanged at an annual rate of 51.4, from 51.4 in the preceding month.

Analysts had expected Chinese Manufacturing PMI to fall to 51.1 last month.

Mirza Baig

Stephen Njuki

What extra 'deposit currency' options should we have?

-

31% (16)

-

12% (6)

-

59% (30)

-

14% (7)

-

14% (7)

Total voters: 51

Mirza Baig

Sergey Golubev

Comment to topic Something Interesting in Financial Video December 2013

17. How to trade the Stochastics indicator in Forex In this Forex training video we discuss how to trade the Stochastics indicator. We discuss three main ways to trade it and it is up to you and your

Mirza Baig

Added poll Do you trade for a living ?

-

51% (44)

-

37% (32)

-

13% (11)

Total voters: 87

Share on social networks · 1

11

Mirza Baig

Sergey Golubev

Comment to topic How to Start with Metatrader 5

The members of this forum asked this question by several threads : "Is it possible to create one EA, attach it to one chart for one pair, and this EA will trade many pairs ... possible?". Yes, it is

Mirza Baig

Sergey Golubev

Comment to topic How to Start with Metatrader 5

Analyzing Candlestick Patterns Plotting of candlestick charts and analysis of candlestick patterns is an amazing line of technical analysis. The advantage of candlesticks is that they represent data

Mirza Baig

Sergey Golubev

Comment to topic How to Start with Metatrader 5

An Example of a Trading System Based on a Heiken-Ashi Indicator With the appearance of candlestick chart in the U.S., more than two decades ago, there was a revolution in the understanding of how the

Mirza Baig

Sergey Golubev

Comment to topic How to Start with Metatrader 5

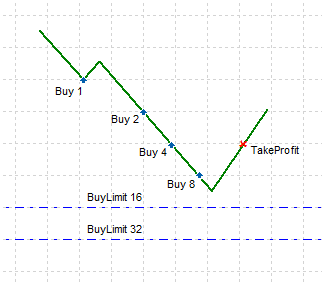

Order Strategies. Multi-Purpose Expert Advisor Scaling in Using Limit Orders You open an initial position and set one or more Limit orders in the same direction with increasing lot size. As Limit

Mirza Baig

::: US Week Ahead: Payrolls, ISM, GDP, Beige Book, Trade Balance, Housing, UMich Svy (eFxnews) :::

Holiday spending begins. Traditionally, the day after the US Thanksgiving holiday, is referred to as Black Friday – the point at which retailers’ profits are ‘in the black’. However, this mega-shopping event has become a 4-day sales marathon beginning on Thanksgiving Day and running through the weekend as folks begin their traditional year-end Christmas shopping. Retailers have scheduled heavy promotions throughout the period to get shoppers through the doors and spending as there are six fewer shopping days between Thanksgiving and Christmas relative to last year. The black Friday news reports on holiday spending figures may be more difficult to interpret this year. The inclusion of sales on Thanksgiving Day, when stores were traditionally closed, will be widespread and poor weather, expected to move through the eastern seaboard, may damp Thanksgiving sales. Retailers have been cautious in their inventory planning and conservative in guidance for holiday season sales expectations. Demand at high-end and low-end retailers has been outpacing mid-market department store sales. There has also been a consumer spending shift towards durable goods from soft goods.

The November ISM Manufacturing survey will likely decline 0.6 points to 55.8. Regional manufacturing surveys for November have generally moved lower. The Philadelphia Fed Business Outlook Survey dropped 13.3 points this month as new orders, shipments and the rate of employment growth slowed. Similar movements were seen in the Empire State Manufacturing Survey. While a decline in the ISM is expected, the level of our forecast for the index remains consistent with modest to moderate growth in the manufacturing sector during November-We forecast total vehicle sales to bounced back 3.6% to a 15.7 million-unit annual rate. While industry analysts report that sales got off to a slow start at the beginning, a significant boost from after-Thanksgiving deals is expected. Sales in September and October were held down by external factors. A 15.7 million unit rate in November would be 2.6% above a year earlier. The YoY growth will appear softer as we saw a jump in vehicle sales in November 2012 as many in the Northeast were replacing autos after Hurricane Sandy. Moreover, if our forecast is accurate, November retail sales are likely to come in strong and should contribute to solid personal consumption expenditures in Q4 GDP.

We look for a USD0.8bn narrowing in the October trade deficit to -USD41.0bn. Much of the narrowing in the trade deficit for October will be attributable to lower energy prices during the month, which will bring down the nominal size of the import bill for crude oil products. Elsewhere in the report, a small reversal in exports of foods, feeds and beverages is expected following last month’s USD1.4bn increase, alongside softer agricultural prices (-1.4% MoM in the export price index). The October ISM survey showed a pick-up in demand in new export orders, suggesting an increase in manufactured goods exports may offset other declines. On the import side, automotive imports likely increased alongside an expected pick-up in auto sales.

September and October data on new home sales will be released together after delays from the shutdown. We forecast September new home sales declined 0.1% to a 420K pace, and bounced back 1.2% in October to a 425K pace. Data on new building permits for October suggested that more positive housing activity was occurring in the multi-family sector, rather than in single-family homes where new building permits rose just 0.8%. Together with this, the National Association of Homebuilders’ survey also noted a more muted pace of present single family sales in October, suggesting a more modest gain for new home sales during the month.

Fed’s Beige Book likely more positive, on balance, alongside stronger consumer confidence and household spending in November. The Fed’s Beige Book for use at the upcoming December FOMC meeting is expected to show modest signs of increased activity compared to the previous report. Retail Sales in October held up relatively well despite the government shutdown. Our forecast for November auto sales suggests that household spending figures should be solid. Some monthly Fed manufacturing surveys have declined this month, suggesting that the Beige Book might contain reports of a moderation in manufacturing activity, though the outlook for the next six months remains strong. Employment gains likely continued at a modest to moderate rate in most regions.

Q3 Real GDP growth is expected to be revised higher due to higher inventories. Expect some payback in Q4. We look for Q3 real GDP growth to be revised up to a 3.1% annual rate from 2.8% in the BEA’s first estimate. The September inventory data came in well above BEA ‘guesstimates’, boosting Q3 growth. We believe that Q4 will see an inventory correction that will result in a sub-2% growth in Q4 despite an expected acceleration in consumer spending. No significant revision to the GDP deflator is anticipated.

October factory orders likely fell 1.6%, with softer nondurable orders alongside lower energy and commodity prices. Durable orders were previously reported down 2.0%, with lower transportation orders responsible for much of the decline. The new information in the report will be on nondurable orders, which we forecast fell nominally alongside lower energy and commodity prices.

Our preliminary nonfarm payrolls forecast looks for a 180K gain in November with the unemployment rate moving back down to 7.2% after the government shutdown impacted last months report. Employment related information released so far this month is consistent with a continued moderate pace of hiring. The November Consumer Confidence report suggested slight improvements in the labour market with fewer people reporting jobs as hard to get, and slightly more reporting jobs as plentiful. The employment component in the Dallas Fed’s Texas Service Sector Outlook survey moved lower but was consistent with a moderate pace of hiring in the private services sector. Regional manufacturing surveys such as the Philadelphia Fed Business Outlook Survey and the Empire State Manufacturing Survey pointed to a slowdown in the pace of hiring, suggesting a softer gain in factory hiring in November. The ADP Employment Report and ISM Manufacturing survey will round out the set of data we input into our forecasting models, and we will look at revising our forecast if these reports come in far from expectations.

We look for the unemployment rate to move back down to 7.2%, after impacts from the government shutdown in the October report resulted in an increase in the unemployment rate to 7.3%. The interpretation of the impacts of the shutdown on the household survey was not immediately clear. Furloughed government workers during the shutdown should have been technically classified as “unemployed, on temporary layoff,” though the household survey showed a 17K increase in the number of unemployed persons in October, alongside a 735K decline in the number of employed persons and a 720K drop in the labour force. We anticipate that we will see a rebound in both employment and the labour force. Moreover, we look for a decline in the number of unemployed persons to bring the unemployment rate down to 7.2%.

Personal income likely increased 0.3% in October, alongside a 0.3% increase in personal spending. Our forecast for the core PCE price index is for a 0.1% m/m increase. Last month’s employment report showed stronger payrolls gains alongside a modest increase in average hourly earnings and an unchanged workweek. Together the data suggest a 0.3% gain in personal income. The October retail sales report suggests a solid gain in personal spending. Durable goods spending is likely to be strong in the report, alongside moderate gains in nondurables and services spending. We look for a trend-like 0.1% increase in the core PCE price index, reflecting soft inflationary pressures seen earlier this month in the October CPI report. This would bring the YoY rate down 0.1 percentage point to 1.1%.

We look for the preliminary University of Michigan Consumer Sentiment index to rise to 76.0 from 75.1. Recent indicators suggest consumer confidence rebounded in the latter half of November as rising equity and home prices alongside lower gasoline prices support household wealth. A pickup in the consumer outlook would be a strong positive for retail sales during the holiday shopping season.

Holiday spending begins. Traditionally, the day after the US Thanksgiving holiday, is referred to as Black Friday – the point at which retailers’ profits are ‘in the black’. However, this mega-shopping event has become a 4-day sales marathon beginning on Thanksgiving Day and running through the weekend as folks begin their traditional year-end Christmas shopping. Retailers have scheduled heavy promotions throughout the period to get shoppers through the doors and spending as there are six fewer shopping days between Thanksgiving and Christmas relative to last year. The black Friday news reports on holiday spending figures may be more difficult to interpret this year. The inclusion of sales on Thanksgiving Day, when stores were traditionally closed, will be widespread and poor weather, expected to move through the eastern seaboard, may damp Thanksgiving sales. Retailers have been cautious in their inventory planning and conservative in guidance for holiday season sales expectations. Demand at high-end and low-end retailers has been outpacing mid-market department store sales. There has also been a consumer spending shift towards durable goods from soft goods.

The November ISM Manufacturing survey will likely decline 0.6 points to 55.8. Regional manufacturing surveys for November have generally moved lower. The Philadelphia Fed Business Outlook Survey dropped 13.3 points this month as new orders, shipments and the rate of employment growth slowed. Similar movements were seen in the Empire State Manufacturing Survey. While a decline in the ISM is expected, the level of our forecast for the index remains consistent with modest to moderate growth in the manufacturing sector during November-We forecast total vehicle sales to bounced back 3.6% to a 15.7 million-unit annual rate. While industry analysts report that sales got off to a slow start at the beginning, a significant boost from after-Thanksgiving deals is expected. Sales in September and October were held down by external factors. A 15.7 million unit rate in November would be 2.6% above a year earlier. The YoY growth will appear softer as we saw a jump in vehicle sales in November 2012 as many in the Northeast were replacing autos after Hurricane Sandy. Moreover, if our forecast is accurate, November retail sales are likely to come in strong and should contribute to solid personal consumption expenditures in Q4 GDP.

We look for a USD0.8bn narrowing in the October trade deficit to -USD41.0bn. Much of the narrowing in the trade deficit for October will be attributable to lower energy prices during the month, which will bring down the nominal size of the import bill for crude oil products. Elsewhere in the report, a small reversal in exports of foods, feeds and beverages is expected following last month’s USD1.4bn increase, alongside softer agricultural prices (-1.4% MoM in the export price index). The October ISM survey showed a pick-up in demand in new export orders, suggesting an increase in manufactured goods exports may offset other declines. On the import side, automotive imports likely increased alongside an expected pick-up in auto sales.

September and October data on new home sales will be released together after delays from the shutdown. We forecast September new home sales declined 0.1% to a 420K pace, and bounced back 1.2% in October to a 425K pace. Data on new building permits for October suggested that more positive housing activity was occurring in the multi-family sector, rather than in single-family homes where new building permits rose just 0.8%. Together with this, the National Association of Homebuilders’ survey also noted a more muted pace of present single family sales in October, suggesting a more modest gain for new home sales during the month.

Fed’s Beige Book likely more positive, on balance, alongside stronger consumer confidence and household spending in November. The Fed’s Beige Book for use at the upcoming December FOMC meeting is expected to show modest signs of increased activity compared to the previous report. Retail Sales in October held up relatively well despite the government shutdown. Our forecast for November auto sales suggests that household spending figures should be solid. Some monthly Fed manufacturing surveys have declined this month, suggesting that the Beige Book might contain reports of a moderation in manufacturing activity, though the outlook for the next six months remains strong. Employment gains likely continued at a modest to moderate rate in most regions.

Q3 Real GDP growth is expected to be revised higher due to higher inventories. Expect some payback in Q4. We look for Q3 real GDP growth to be revised up to a 3.1% annual rate from 2.8% in the BEA’s first estimate. The September inventory data came in well above BEA ‘guesstimates’, boosting Q3 growth. We believe that Q4 will see an inventory correction that will result in a sub-2% growth in Q4 despite an expected acceleration in consumer spending. No significant revision to the GDP deflator is anticipated.

October factory orders likely fell 1.6%, with softer nondurable orders alongside lower energy and commodity prices. Durable orders were previously reported down 2.0%, with lower transportation orders responsible for much of the decline. The new information in the report will be on nondurable orders, which we forecast fell nominally alongside lower energy and commodity prices.

Our preliminary nonfarm payrolls forecast looks for a 180K gain in November with the unemployment rate moving back down to 7.2% after the government shutdown impacted last months report. Employment related information released so far this month is consistent with a continued moderate pace of hiring. The November Consumer Confidence report suggested slight improvements in the labour market with fewer people reporting jobs as hard to get, and slightly more reporting jobs as plentiful. The employment component in the Dallas Fed’s Texas Service Sector Outlook survey moved lower but was consistent with a moderate pace of hiring in the private services sector. Regional manufacturing surveys such as the Philadelphia Fed Business Outlook Survey and the Empire State Manufacturing Survey pointed to a slowdown in the pace of hiring, suggesting a softer gain in factory hiring in November. The ADP Employment Report and ISM Manufacturing survey will round out the set of data we input into our forecasting models, and we will look at revising our forecast if these reports come in far from expectations.

We look for the unemployment rate to move back down to 7.2%, after impacts from the government shutdown in the October report resulted in an increase in the unemployment rate to 7.3%. The interpretation of the impacts of the shutdown on the household survey was not immediately clear. Furloughed government workers during the shutdown should have been technically classified as “unemployed, on temporary layoff,” though the household survey showed a 17K increase in the number of unemployed persons in October, alongside a 735K decline in the number of employed persons and a 720K drop in the labour force. We anticipate that we will see a rebound in both employment and the labour force. Moreover, we look for a decline in the number of unemployed persons to bring the unemployment rate down to 7.2%.

Personal income likely increased 0.3% in October, alongside a 0.3% increase in personal spending. Our forecast for the core PCE price index is for a 0.1% m/m increase. Last month’s employment report showed stronger payrolls gains alongside a modest increase in average hourly earnings and an unchanged workweek. Together the data suggest a 0.3% gain in personal income. The October retail sales report suggests a solid gain in personal spending. Durable goods spending is likely to be strong in the report, alongside moderate gains in nondurables and services spending. We look for a trend-like 0.1% increase in the core PCE price index, reflecting soft inflationary pressures seen earlier this month in the October CPI report. This would bring the YoY rate down 0.1 percentage point to 1.1%.

We look for the preliminary University of Michigan Consumer Sentiment index to rise to 76.0 from 75.1. Recent indicators suggest consumer confidence rebounded in the latter half of November as rising equity and home prices alongside lower gasoline prices support household wealth. A pickup in the consumer outlook would be a strong positive for retail sales during the holiday shopping season.

Mirza Baig

::: Europe Week Ahead: ECB, BoE, Ger Factory Orders, EZ PMI, UK PMI (eFxnews) :::

The ECB bought itself an insurance against adverse economic developments by cutting the Refi rate pre-emptively in November, so that the immediate pressure to act has receded. The rebound in Eurozone HICP inflation, to 0.9% YoY in November, as well as the uneven, albeit ongoing improvement in leading indicators, will provide some extra breathing space. Therefore we do not expect any ECB action on policy rates at the 5 December meeting. The staff forecasts will be revised lower, and the 2015 HICP projection will likely remain below target, but this will provide an ex post justification for the November cut. Still, several risks remain, including ongoing disinflationary pressures, credit contraction and renewed EUR strength. Importantly, the ECB might soon be forced to act to keep liquidity conditions consistent with its broader policy stance as the pace of LTRO repayments. While another v-LTRO targeting SME loans could still be implemented next year, in our view, other intermediate options include a cut in reserve requirement (all or part of the remaining EUR104bn) or a suspension in SMP sterilisation auctions (all or part of the remaining Eur184bn).

We expect little changes to final PMI indices for November in core Eurozone countries put aside a possible upward revision to French PMI indices after the strong disappointment from their flash readings. Next week the calendar will also provide us PMI indices in peripheral countries (Italy, Spain, Ireland, Greece). We expect them to reflect modest declines in business sentiment in November as the momentum has turned slightly downside since August.

German factory orders will likely contract in October (-1.5% MoM). This is a small setback coming after a very strong rebound in the previous month (3.3% MoM) which was triggered by foreign demand (Eurozone in particular).

BoE monetary policy meeting on 5 December is likely to be a non-event with no detailed statement expected either. The BoE will likely leave its current policy settings unchanged with the Bank rate left at 0.5% and the size of the asset purchase program at GBP375bn, in line with its forward guidance. The British economy continued to show resilience with no sign of a slowdown of activity in the final quarter of the year as suggested by the upbeat CBI and PMI surveys. The unemployment rate has continued to decline but the BoE made it crystal clear that the 7% threshold was not a trigger of a rate hike. The moderation of CPI inflation closer to the 2% target alleviates some pressure on the BoE to revise lower this threshold.

UK PMI manufacturing will likely decline in November for the second consecutive month to a still relatively high level at 55.7. Forward-looking components of the survey such as output and new orders fell both in October and November suggesting that the recent peak in business confidence might be behind us. In the key services sector however, the PMI has continued to increase reaching its highest since May 1997. The sustained improvement in the labour market continues to bode well for household consumption going forward, likely providing an offsetting effect to the continued squeeze in consumer purchasing power and hikes to energy prices. We expect only a small contraction in the PMI services to around 62.0.

The ECB bought itself an insurance against adverse economic developments by cutting the Refi rate pre-emptively in November, so that the immediate pressure to act has receded. The rebound in Eurozone HICP inflation, to 0.9% YoY in November, as well as the uneven, albeit ongoing improvement in leading indicators, will provide some extra breathing space. Therefore we do not expect any ECB action on policy rates at the 5 December meeting. The staff forecasts will be revised lower, and the 2015 HICP projection will likely remain below target, but this will provide an ex post justification for the November cut. Still, several risks remain, including ongoing disinflationary pressures, credit contraction and renewed EUR strength. Importantly, the ECB might soon be forced to act to keep liquidity conditions consistent with its broader policy stance as the pace of LTRO repayments. While another v-LTRO targeting SME loans could still be implemented next year, in our view, other intermediate options include a cut in reserve requirement (all or part of the remaining EUR104bn) or a suspension in SMP sterilisation auctions (all or part of the remaining Eur184bn).

We expect little changes to final PMI indices for November in core Eurozone countries put aside a possible upward revision to French PMI indices after the strong disappointment from their flash readings. Next week the calendar will also provide us PMI indices in peripheral countries (Italy, Spain, Ireland, Greece). We expect them to reflect modest declines in business sentiment in November as the momentum has turned slightly downside since August.

German factory orders will likely contract in October (-1.5% MoM). This is a small setback coming after a very strong rebound in the previous month (3.3% MoM) which was triggered by foreign demand (Eurozone in particular).

BoE monetary policy meeting on 5 December is likely to be a non-event with no detailed statement expected either. The BoE will likely leave its current policy settings unchanged with the Bank rate left at 0.5% and the size of the asset purchase program at GBP375bn, in line with its forward guidance. The British economy continued to show resilience with no sign of a slowdown of activity in the final quarter of the year as suggested by the upbeat CBI and PMI surveys. The unemployment rate has continued to decline but the BoE made it crystal clear that the 7% threshold was not a trigger of a rate hike. The moderation of CPI inflation closer to the 2% target alleviates some pressure on the BoE to revise lower this threshold.

UK PMI manufacturing will likely decline in November for the second consecutive month to a still relatively high level at 55.7. Forward-looking components of the survey such as output and new orders fell both in October and November suggesting that the recent peak in business confidence might be behind us. In the key services sector however, the PMI has continued to increase reaching its highest since May 1997. The sustained improvement in the labour market continues to bode well for household consumption going forward, likely providing an offsetting effect to the continued squeeze in consumer purchasing power and hikes to energy prices. We expect only a small contraction in the PMI services to around 62.0.

Mirza Baig

::: USD/JPY: 2 Scenarios After The Triangle Breakout - Citi (eFxnews) :::

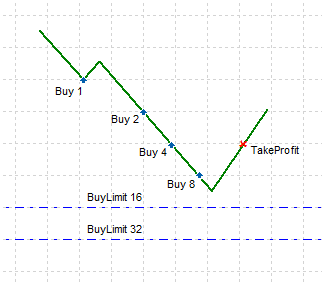

After the breach of the high in September at 100.61, it has been confirmed that USD/JPY rose up above the resistance line since this May, notes Citibank.

Thus, with the pair's ongoing rally, Citi points out to two scenarios from the formation analysis perspective.

"Namely, 1) the pair has already climbed up above the triangle and the upside target has been extended to around 108 (the apex of the triangle was around 98 and its width was about 10 big figures), and 2) the shape of the triangle is converting into an ascending one from a symmetrical one so far, with the new upper limit at around 103.7, this year high in May (Figure1)," Citi clarifies.

"But even in the latter case, the breach of the new upper limit would indicate a new extended target at 113, even while the high at 103.7 would act as a resistance in coming months. Thus, in the mid-term time horizon, the 108 level is recognized as a crucial target in either case," Citi projects.

After the breach of the high in September at 100.61, it has been confirmed that USD/JPY rose up above the resistance line since this May, notes Citibank.

Thus, with the pair's ongoing rally, Citi points out to two scenarios from the formation analysis perspective.

"Namely, 1) the pair has already climbed up above the triangle and the upside target has been extended to around 108 (the apex of the triangle was around 98 and its width was about 10 big figures), and 2) the shape of the triangle is converting into an ascending one from a symmetrical one so far, with the new upper limit at around 103.7, this year high in May (Figure1)," Citi clarifies.

"But even in the latter case, the breach of the new upper limit would indicate a new extended target at 113, even while the high at 103.7 would act as a resistance in coming months. Thus, in the mid-term time horizon, the 108 level is recognized as a crucial target in either case," Citi projects.

Mirza Baig

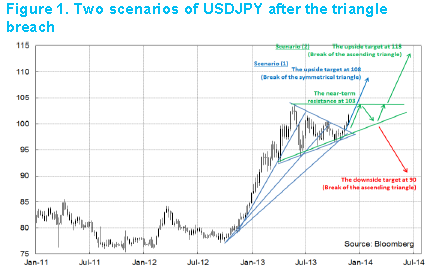

::: UK As A Currency Area: 'In For A Penny, In For The Pound' - Deutsche Bank (eFxnews) :::

Focus of the day:

"We examine whether the UK fits the bill for an optimum currency area. We find that in terms of business cycle correlations and imbalances the UK’s monetary union has major flaws even compared to the Eurozone. This is the result of asymmetries between one region, London, and the rest of the country. However, differentials in regional employment rates are kept low because of high labour mobility and significant fiscal transfers from surplus to deficit regions. Also history suggests that currency unions are the product of political processes, rather than economic symmetry.

Asymmetries still carry significant macroeconomic costs, however. These can include bubbles in asset prices which pose a threat to financial stability, the impaired transmission of monetary policy which can hinder economic rebalancing and negative feedback loops that further weaken the currency area.

The implications are that monetary policy may need to display a regional bias in order to take account of asymmetries. We find that interest rates have historically been ‘biased’ towards London, but believe that this may change. We do not find that sterling has been more correlated to London than the rest of the country, and suggest this may be because of the capital’s status as a global financial centre, which drives capital outflows.

Finally, we find that Scotland would not benefit from leaving the sterling area if it declared independence. The country’s business cycle is highly correlated to the rest of the UK, it is highly competitive and an exit from the sterling area could spark a market crisis if UK liabilities were transferred. We suggest that if the country were unable to remain formally part of the sterling area, it could peg its currency to the pound."

Focus of the day:

"We examine whether the UK fits the bill for an optimum currency area. We find that in terms of business cycle correlations and imbalances the UK’s monetary union has major flaws even compared to the Eurozone. This is the result of asymmetries between one region, London, and the rest of the country. However, differentials in regional employment rates are kept low because of high labour mobility and significant fiscal transfers from surplus to deficit regions. Also history suggests that currency unions are the product of political processes, rather than economic symmetry.

Asymmetries still carry significant macroeconomic costs, however. These can include bubbles in asset prices which pose a threat to financial stability, the impaired transmission of monetary policy which can hinder economic rebalancing and negative feedback loops that further weaken the currency area.

The implications are that monetary policy may need to display a regional bias in order to take account of asymmetries. We find that interest rates have historically been ‘biased’ towards London, but believe that this may change. We do not find that sterling has been more correlated to London than the rest of the country, and suggest this may be because of the capital’s status as a global financial centre, which drives capital outflows.

Finally, we find that Scotland would not benefit from leaving the sterling area if it declared independence. The country’s business cycle is highly correlated to the rest of the UK, it is highly competitive and an exit from the sterling area could spark a market crisis if UK liabilities were transferred. We suggest that if the country were unable to remain formally part of the sterling area, it could peg its currency to the pound."

: