Momentum Pinball trading strategy

Alexander Puzanov | 8 January, 2018

Introduction

In this article, we continue programming of trading strategies described in a section of the book by L. Raschke and L. Connors Street Smarts: High Probability Short-Term Trading Strategies, devoted to testing of range limits by price. The last of full-fledged TS in the section is Momentum Pinball, which operates the pattern consisting of two daily bars. By the first bar, trade direction on the second day is defined, and price movement in the beginning of the second bar should specify certain trade levels for entries and exits from the market.

The purpose of this article is to demonstrate to the programmers who have already mastered MQL5, one of the variants for realizing Momentum Pinball TS, in which simplified methods of object-oriented programming will be applied. From the full-fledged OOP, the code will differ by the absence of classes - they will be replaced by structures. As opposed to classes, design in the code and application of objects of this type differs minimally from the procedural programming familiar to most starting coders. On the other hand, features being provided by structures are more than enough to resolve such tasks.

Like in the previous article, first, create a signal block module, then - an indicator for manual trading and history marking, which uses this module. The third program will be Expert Advisor for automated trading; it will also use the signal module. In conclusion, we will test the Expert Advisor on fresh quotes because authors of the book worked with 20-year old quotes.

Rules of the Momentum Pinball TS

L. Raschke and L. Connors faced uncertainty when using the trading techniques described by George Taylor which became the reason for compiling rules of this trading strategy. Taylor’s strategy prior to the beginning of another day defines direction of its trade - whether this will be a day of sells or a day of buys. However, the author's actual trading often violates this arrangement which, in the opinion of book authors, would get trading rules tangled.

In order to more definitely determine trading direction of the next day, authors applied ROC (Rate Of Change) indicator. RSI (Relative Strength Index) oscillator was applied to its values and cyclicity of ROC values has become well visible. Finally, TS authors added signal levels - borders of overbought and oversold areas on RSI chart. Presence of the line of such indicator (it was named LBR/RSI, from Linda Bradford Raschke) in a respective area is designated to detect most probable sell days and buy days. LBR/RSI is detailed below.

Complete rules of the Momentum Pinball TS for buy entries are formulated as follows.

- On D1, the value of LBR/RSI of the last closed day should be within the oversold area - below 30.

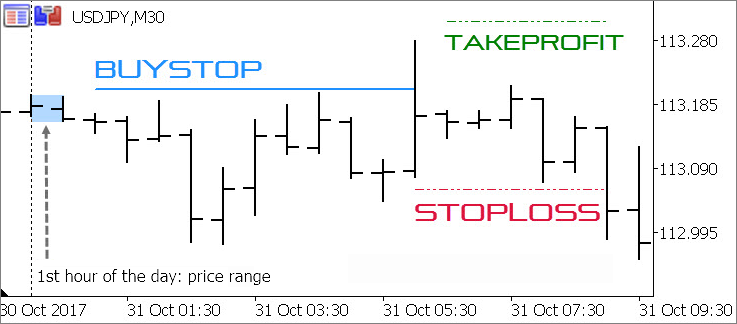

- After closing the first hourly bar of a new day, place the pending buy order higher than that bar maximum.

- After triggering of the pending order, place Stop Loss to the Low of the first hourly bar.

- If a position is closed with the loss, once again place the pending sell order at the same level.

- If by the end of the day, the position remains profitable, leave it for the next day. On the second trading day, the position has to be closed.

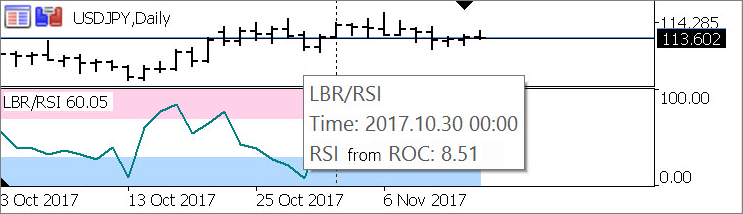

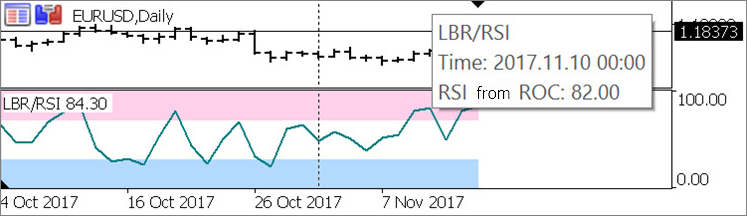

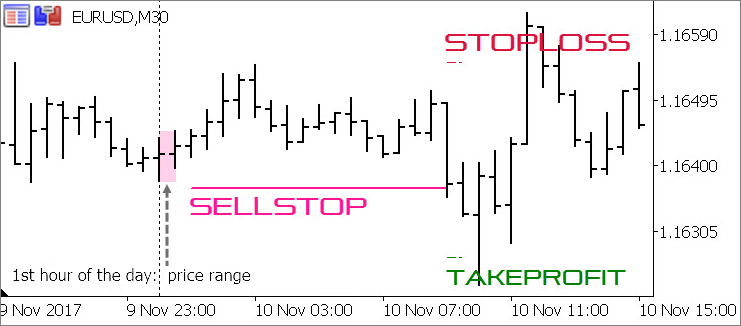

Visualization of entry rules with the help of two indicators described below, looks as follows:

— LBR/RSI on daily timeframe is in oversold area (see 30 October, 2017)

— indicator TS_Momentum_Pinball on undefined timeframe (from M1 to D1) displays trading levels and price range of the first hour of the day, on which basis these levels are calculated:

The rules for exiting the market are not clearly defined in the book: authors say about the use of trailing, about closing on the next morning and about exit higher then the first trading day High.

The rules for sell entries are similar - LBR/RSI should be within overbought area (higher than 70), a pending order should be placed at the Low of the first hourly bar.

LBR/RSI indicator

Of course, all the computations necessary for receiving a signal may be performed in the very signal module, but apart from automated trading the plan of this article provides manual trading as well. Having a separate indicator LBR/RSI with highlighting of overbought/oversold areas will be useful for convenience of visual identification of manual version pattern. And in order to optimize our efforts, we will not program two several versions of LBR/RSI estimation (‘buffer’ one for indicator and ‘bufferless’ for robot). Let’s connect an external indicator to the signal module through the standard iCustom function. This indicator will not carry out resource-intensive assessments and there is no need to question it at each tick - in the TS, the value of the indicator at closed daily bar is used. We do not care about a continuously altering current value. Therefore, there are no substantial hindrances for such solution.

Here, unite computing algorithms ROC and RSI, which will paint the resulting oscillator curve. In order to detect needed values easily, add filling of overbought and oversold areas in various colors. For doing this, we need five buffers to display and four more - for auxiliary computations.

Add standard settings (RSI period and values of borders of two areas) with another one which is not provided by original trading system rules. For calculations, you will be able to use not only daily bar closing price, but also more informative median, typical or weighted average price. Actually, for his experiments the user can choose between any of the seven variants provided by ENUM_APPLIED_PRICE.

Declaration of buffers, user text boxes and initialization block will look as follows:

#property indicator_separate_window #property indicator_buffers 9 #property indicator_plots 3 #property indicator_label1 “Overbought area" #property indicator_type1 DRAW_FILLING #property indicator_color1 C'255,208,234' #property indicator_width1 1 #property indicator_label2 “Oversold area" #property indicator_type2 DRAW_FILLING #property indicator_color2 C'179,217,255' #property indicator_width2 1 #property indicator_label3 "RSI от ROC" #property indicator_type3 DRAW_LINE #property indicator_style3 STYLE_SOLID #property indicator_color3 clrTeal #property indicator_width3 2 #property indicator_minimum 0 #property indicator_maximum 100 input ENUM_APPLIED_PRICE TS_MomPin_Applied_Price = PRICE_CLOSE; // Price for ROC calculation input uint TS_MomPin_RSI_Period = 3; // RSI Period input double TS_MomPin_RSI_Overbought = 70; // RSI Oversold level input double TS_MomPin_RSI_Oversold = 30; // RSI overbought level double buff_Overbought_High[], buff_Overbought_Low[], // overbought area background buff_Oversold_High[], buff_Oversold_Low[], // oversold area background buff_Price[], // array of bar calculated prices buff_ROC[], // ROC array from calculated prices buff_RSI[], // RSI from ROC buff_Positive[], buff_Negative[] // auxiliary arrays for RSI calculation ; int OnInit() { // designation of indicator buffers: // overbought area SetIndexBuffer(0, buff_Overbought_High, INDICATOR_DATA); PlotIndexSetDouble(0, PLOT_EMPTY_VALUE, EMPTY_VALUE); PlotIndexSetInteger(0, PLOT_SHOW_DATA, false); SetIndexBuffer(1, buff_Overbought_Low, INDICATOR_DATA); // oversold area SetIndexBuffer(2, buff_Oversold_High, INDICATOR_DATA); PlotIndexSetDouble(1, PLOT_EMPTY_VALUE, EMPTY_VALUE); PlotIndexSetInteger(1, PLOT_SHOW_DATA, false); SetIndexBuffer(3, buff_Oversold_Low, INDICATOR_DATA); // RSI curve SetIndexBuffer(4, buff_RSI, INDICATOR_DATA); PlotIndexSetDouble(2, PLOT_EMPTY_VALUE, EMPTY_VALUE); // auxiliary buffers for RSI calculation SetIndexBuffer(5, buff_Price, INDICATOR_CALCULATIONS); SetIndexBuffer(6, buff_ROC, INDICATOR_CALCULATIONS); SetIndexBuffer(7, buff_Negative, INDICATOR_CALCULATIONS); SetIndexBuffer(8, buff_Positive, INDICATOR_CALCULATIONS); IndicatorSetInteger(INDICATOR_DIGITS, 2); IndicatorSetString(INDICATOR_SHORTNAME, "LBR/RSI"); return(INIT_SUCCEEDED); }

In the standard event handler OnCalculate, arrange two separate loops: the first one prepares ROC data array, the second one calculates oscillator values based on this array data.

In Rates Of Change version suggested by Linda Raschke, we should compare not the prices of bars following each other, but missing one bar between them. In other words, in the TS, they use price variations of the days standing off from the trading day one and three business days respectively. This is rather easy to do; along the way, in this loop arrange background filling of overbought and oversold areas. Also, make sure to implement the price type selection feature:

int i_RSI_Period = int(TS_MomPin_RSI_Period), // transfer of RSI period into int type i_Bar, i_Period_Bar // two bar indices for simultaneous application ; double d_Sum_Negative, d_Sum_Positive, // auxiliary variables for RSI calculation d_Change // auxiliary variable for ROC calculation ; // Fill in ROC buffer and fill areas: i_Period_Bar = 1; while(++i_Period_Bar < rates_total && !IsStopped()) { // calculated bar price: switch(TS_MomPin_Applied_Price) { case PRICE_CLOSE: buff_Price[i_Period_Bar] = Close[i_Period_Bar]; break; case PRICE_OPEN: buff_Price[i_Period_Bar] = Open[i_Period_Bar]; break; case PRICE_HIGH: buff_Price[i_Period_Bar] = High[i_Period_Bar]; break; case PRICE_LOW: buff_Price[i_Period_Bar] = Low[i_Period_Bar]; break; case PRICE_MEDIAN: buff_Price[i_Period_Bar] = 0.50000 * (High[i_Period_Bar] + Low[i_Period_Bar]); break; case PRICE_TYPICAL: buff_Price[i_Period_Bar] = 0.33333 * (High[i_Period_Bar] + Low[i_Period_Bar] + Open[i_Period_Bar]); break; case PRICE_WEIGHTED: buff_Price[i_Period_Bar] = 0.25000 * (High[i_Period_Bar] + Low[i_Period_Bar] + Open[i_Period_Bar] + Open[i_Period_Bar]); break; } // difference of bar calculated prices (ROC value): if(i_Period_Bar > 1) buff_ROC[i_Period_Bar] = buff_Price[i_Period_Bar] - buff_Price[i_Period_Bar - 2]; // background filling: buff_Overbought_High[i_Period_Bar] = 100; buff_Overbought_Low[i_Period_Bar] = TS_MomPin_RSI_Overbought; buff_Oversold_High[i_Period_Bar] = TS_MomPin_RSI_Oversold; buff_Oversold_Low[i_Period_Bar] = 0; }

The second loop (RSI calculation) has no peculiarities, it almost completely repeats the algorithm of a standard oscillator of this type:

i_Period_Bar = prev_calculated - 1; if(i_Period_Bar <= i_RSI_Period) { buff_RSI[0] = buff_Positive[0] = buff_Negative[0] = d_Sum_Positive = d_Sum_Negative = 0; i_Bar = 0; while(i_Bar++ < i_RSI_Period) { buff_RSI[0] = buff_Positive[0] = buff_Negative[0] = 0; d_Change = buff_ROC[i_Bar] - buff_ROC[i_Bar - 1]; d_Sum_Positive += (d_Change > 0 ? d_Change : 0); d_Sum_Negative += (d_Change < 0 ? -d_Change : 0); } buff_Positive[i_RSI_Period] = d_Sum_Positive / i_RSI_Period; buff_Negative[i_RSI_Period] = d_Sum_Negative / i_RSI_Period; if(buff_Negative[i_RSI_Period] != 0) buff_RSI[i_RSI_Period] = 100 - (100 / (1. + buff_Positive[i_RSI_Period] / buff_Negative[i_RSI_Period])); else buff_RSI[i_RSI_Period] = buff_Positive[i_RSI_Period] != 0 ? 100 : 50; i_Period_Bar = i_RSI_Period + 1; } i_Bar = i_Period_Bar - 1; while(++i_Bar < rates_total && !IsStopped()) { d_Change = buff_ROC[i_Bar] - buff_ROC[i_Bar - 1]; buff_Positive[i_Bar] = (buff_Positive[i_Bar - 1] * (i_RSI_Period - 1) + (d_Change> 0 ? d_Change : 0)) / i_RSI_Period; buff_Negative[i_Bar] = (buff_Negative[i_Bar - 1] * (i_RSI_Period - 1) + (d_Change <0 ? -d_Change : 0)) / i_RSI_Period; if(buff_Negative[i_Bar] != 0) buff_RSI[i_Bar] = 100 - 100. / (1. + buff_Positive[i_Bar] / buff_Negative[i_Bar]); else buff_RSI[i_Bar] = buff_Positive[i_Bar] != 0 ? 100 : 50; }

Let’s name the indicator LBR_RSI.mq5 and place it into a standard indicator folder of the terminal data catalog. It is this name that will be specified in the iCustom function of the signal module, therefore you should not change it.

Signal module

In the signal module connected to the Expert Advisor and indicator, place user settings of Momentum Pinball trading strategy. The authors provide fixed values for calculating the LBR/RSI indicator (period RSI = 3, overbought level = 30, oversold level = 70). But we will make them changeable for experiments, just like position closing methods - the book mentions three variants. We will program all of them and the user will have a feature of selecting the required option:

- to close position by Stop Loss level trailing;

- to close it in the morning of the following day;

- to wait on the second day for breakthrough of extremum of the position opening day.

“Morning” is a rather intangible notion, to formalize rules a more certain definition is required. Raschke and Connors do not say about it, but it is reasonable to suppose that binding to new day first bar (applied in other TS rules) will point to ‘morning’ label of 24 hrs time scale.

Remember about two more TS settings - offsets from borders of the first hour of a day; the offsets should specify levels of pending order placement and StopLoss level:

enum ENUM_EXIT_MODE { // List of exit methods CLOSE_ON_SL_TRAIL, // only by trailing CLOSE_ON_NEW_1ST_CLOSE, // by closing of the 1st bar of the following day CLOSE_ON_DAY_BREAK // by break-through of extremum of the position opening day }; // user settings input ENUM_APPLIED_PRICE TS_MomPin_Applied_Price = PRICE_CLOSE; // Momentum Pinball: Prices for ROC calculation input uint TS_MomPin_RSI_Period = 3; // Momentum Pinball: RSI period input double TS_MomPin_RSI_Overbought = 70; // Momentum Pinball: RSI oversold level input double TS_MomPin_RSI_Oversold = 30; // Momentum Pinball: RSI overbought level input uint TS_MomPin_Entry_Offset = 10; // Momentum Pinball: Offset of entry level from borders H1 (in points) input uint TS_MomPin_Exit_Offset = 10; // Momentum Pinball: Offset of exit level from borders H1 (in points) input ENUM_EXIT_MODE TS_MomPin_Exit_Mode = CLOSE_ON_SL_TRAIL; // Momentum Pinball: Profitable position closing method

The main module function fe_Get_Entry_Signal will be unified with the signal module function of the previous trading strategy from Raschke and Connors book, as well with subsequent analogic modules of other TS described in this source. This means that the function should have such package of parameters passed to it, links to variables and the same type of returned value:

ENUM_ENTRY_SIGNAL fe_Get_Entry_Signal( // Two-candle pattern analysis (D1 + H1) datetime t_Time, // current time double& d_Entry_Level, // entry level (link to the variable) double& d_SL, // StopLoss level (link to the variable) double& d_TP, // TakeProfit level (link to the variable) double& d_Range_High, // high of the range's 1st hourly bar (link to the variable) double& d_Range_Low // low of the range's 1st hourly bar (link to the variable) ) { // function body }

Like in the previous version, we will not calculate everything once again at each tick when calling the function from robot. Instead, we will store between ticks the calculated levels in static variables. However, working with this function in manual trading indicator will have substantial differences; and zeroing of static variables at calling the function from indicator should be provided. In order to distinguish between a call from indicator and a call from robot, apply t_Time variable. The indicator will invert it, i.e. make its value negative:

static ENUM_ENTRY_SIGNAL se_Trade_Direction = ENTRY_UNKNOWN; // trading direction for today static double // variables for storing calculated levels between ticks sd_Entry_Level = 0, sd_SL = 0, sd_TP = 0, sd_Range_High = 0, sd_Range_Low = 0 ; if(t_Time < 0) { // only for call from indicator sd_Entry_Level = sd_SL = sd_TP = sd_Range_High = sd_Range_Low = 0; se_Trade_Direction = ENTRY_UNKNOWN; } // by default apply earlier saved levels of entries/exits: d_Entry_Level = sd_Entry_Level; d_SL = sd_SL; d_TP = sd_TP; d_Range_High = sd_Range_High; d_Range_Low = sd_Range_Low;

Below, find the code for receiving the LBR/RSI indicator handle when calling the function for the first time:

static int si_Indicator_Handle = INVALID_HANDLE; if(si_Indicator_Handle == INVALID_HANDLE) { // to receive indicator handle when calling the function for the first time: si_Indicator_Handle = iCustom(_Symbol, PERIOD_D1, "LBR_RSI", TS_MomPin_Applied_Price, TS_MomPin_RSI_Period, TS_MomPin_RSI_Overbought, TS_MomPin_RSI_Oversold ); if(si_Indicator_Handle == INVALID_HANDLE) { // indicator handle not received if(Log_Level > LOG_LEVEL_NONE) PrintFormat("%s: error of receiving LBR_RSI indicator handle #%u", __FUNCTION__, _LastError); return(ENTRY_INTERNAL_ERROR); } }

Once per 24 hours robot should analyze indicator value on the last closed daily bar and establish the trading direction allowed for today. Or it should disable trading if LBR/RSI value is in neutral area. The retrieval code of this value from indicator buffer and its analysis, with logging functions, subject to possible errors and peculiarities of calling from manual trading indicator:

static int si_Indicator_Handle = INVALID_HANDLE; if(si_Indicator_Handle == INVALID_HANDLE) { // receiving indicator handle at first function call: si_Indicator_Handle = iCustom(_Symbol, PERIOD_D1, "LBR_RSI", TS_MomPin_Applied_Price, TS_MomPin_RSI_Period, TS_MomPin_RSI_Overbought, TS_MomPin_RSI_Oversold ); if(si_Indicator_Handle == INVALID_HANDLE) { // handle not received if(Log_Level > LOG_LEVEL_NONE) PrintFormat("%s: error of indicator handle receipt LBR_RSI #%u", __FUNCTION__, _LastError); return(ENTRY_INTERNAL_ERROR); } } // to find out the time of previous day daily bar: datetime ta_Bar_Time[]; if(CopyTime(_Symbol, PERIOD_D1, fabs(t_Time), 2, ta_Bar_Time) < 2) { if(Log_Level > LOG_LEVEL_NONE) PrintFormat("%s: CopyTime: error #%u", __FUNCTION__, _LastError); return(ENTRY_INTERNAL_ERROR); } // previous day analysis, if this is the 1st call today: static datetime st_Prev_Day = 0; if(t_Time < 0) st_Prev_Day = 0; // only for call from indicator if(st_Prev_Day < ta_Bar_Time[0]) { // zeroing of previous day parameters: se_Trade_Direction = ENTRY_UNKNOWN; d_Entry_Level = sd_Entry_Level = d_SL = sd_SL = d_TP = sd_TP = d_Range_High = sd_Range_High = d_Range_Low = sd_Range_Low = 0; // retrieve value LBR/RSI of previous day: double da_Indicator_Value[]; if(1 > CopyBuffer(si_Indicator_Handle, 4, ta_Bar_Time[0], 1, da_Indicator_Value)) { if(Log_Level > LOG_LEVEL_NONE) PrintFormat("%s: CopyBuffer: error #%u", __FUNCTION__, _LastError); return(ENTRY_INTERNAL_ERROR); } // if anything is wrong with LBR/RSI value: if(da_Indicator_Value[0] > 100. || da_Indicator_Value[0] < 0.) { if(Log_Level > LOG_LEVEL_NONE) PrintFormat("%s: Indicator buffer value error (%f)", __FUNCTION__, da_Indicator_Value[0]); return(ENTRY_UNKNOWN); } st_Prev_Day = ta_Bar_Time[0]; // attempt counted // remember trading direction for today: if(da_Indicator_Value[0] > TS_MomPin_RSI_Overbought) se_Trade_Direction = ENTRY_SELL; else se_Trade_Direction = da_Indicator_Value[0] > TS_MomPin_RSI_Oversold ? ENTRY_NONE : ENTRY_BUY; // to log: if(Log_Level == LOG_LEVEL_DEBUG) PrintFormat("%s: Trading direction for %s: %s. LBR/RSI: (%.2f)", __FUNCTION__, TimeToString(ta_Bar_Time[1], TIME_DATE), StringSubstr(EnumToString(se_Trade_Direction), 6), da_Indicator_Value[0] ); }

We have clarified the allowed trading direction. The next task will be determining entry levels and loss limitation (Stop Loss). It is also sufficient to do it once per 24 hours - right after closing the date first bar on hourly timeframe. However, subject to peculiarities of manual trading indicator functioning, we will complicate the algorithm a little. This is caused by the fact that indicator should not only detect real-time signal levels, but also to make marks on history:

// no signal search today if(se_Trade_Direction == ENTRY_NONE) return(ENTRY_NONE); // analysis of today’s first bar H1, unless this is already done: if(sd_Entry_Level == 0.) { // to receive data of last 24 bars H1: MqlRates oa_H1_Rates[]; int i_Price_Bars = CopyRates(_Symbol, PERIOD_H1, fabs(t_Time), 24, oa_H1_Rates); if(i_Price_Bars == WRONG_VALUE) { // handling of CopyRates function error if(Log_Level > LOG_LEVEL_NONE) PrintFormat("%s: CopyRates: error #%u", __FUNCTION__, _LastError); return(ENTRY_INTERNAL_ERROR); } // among 24 bars to find the 1st bar of today and to remember High, Low: int i_Bar = i_Price_Bars; while(i_Bar-- > 0) { if(oa_H1_Rates[i_Bar].time < ta_Bar_Time[1]) break; // last bar H1 of previous day // borders of H1 1st bar range: sd_Range_High = d_Range_High = oa_H1_Rates[i_Bar].high; sd_Range_Low = d_Range_Low = oa_H1_Rates[i_Bar].low; } // H1 1st bar is not closed yet: if(i_Price_Bars - i_Bar < 3) return(ENTRY_UNKNOWN); // to calculate trading levels: // level of market entry: d_Entry_Level = _Point * TS_MomPin_Entry_Offset; // auxiliary calculations sd_Entry_Level = d_Entry_Level = se_Trade_Direction == ENTRY_SELL ? d_Range_Low - d_Entry_Level : d_Range_High + d_Entry_Level; // initial level SL: d_SL = _Point * TS_MomPin_Exit_Offset; // auxiliary calculations sd_SL = d_SL = se_Trade_Direction == ENTRY_BUY ? d_Range_Low - d_SL : d_Range_High + d_SL; }

After that, we only should stop the function by returning the detected trading direction:

Now, let’s program analysis of conditions for position signal closing. We have three variants, one of which (Stop Loss level trailing) is already realized in the Expert Advisor code of previous versions. Two other variants, in the aggregate, require price and time of entry, position direction for calculations. We will pass them together with the current time and selected closing method to the function fe_Get_Exit_Signal:

ENUM_EXIT_SIGNAL fe_Get_Exit_Signal( // Detection of position closing signal double d_Entry_Level, // entry level datetime t_Entry_Time, // entry time ENUM_ENTRY_SIGNAL e_Trade_Direction, // trade direction datetime t_Current_Time, // current time ENUM_EXIT_MODE e_Exit_Mode // exit mode ) { static MqlRates soa_Prev_D1_Rate[]; // data of D1 bar for previous day static int si_Price_Bars = 0; // auxiliary counter if(t_Current_Time < 0) { // to distinguish a call from indicator and a call from Expert Advisor t_Current_Time = -t_Current_Time; si_Price_Bars = 0; } double d_Curr_Entry_Level, d_SL, d_TP, d_Range_High, d_Range_Low ; if(e_Trade_Direction < 1) { // no positions, to zero everything si_Price_Bars = 0; } switch(e_Exit_Mode) { case CLOSE_ON_SL_TRAIL: // only on trail return(EXIT_NONE); case CLOSE_ON_NEW_1ST_CLOSE: // on closing of next day 1st bar if((t_Current_Time - t_Current_Time % 86400) == (t_Entry_Time - t_Current_Time % 86400) ) return(EXIT_NONE); // day of position opening not finished yet if(fe_Get_Entry_Signal(t_Current_Time, d_Curr_Entry_Level, d_SL, d_TP, d_Range_High, d_Range_Low) < ENTRY_UNKNOWN ) { if(Log_Level > LOG_LEVEL_ERR) PrintFormat("%s: 1st bar of the following day is closed", __FUNCTION__); return(EXIT_ALL); } return(EXIT_NONE); // not closed case CLOSE_ON_DAY_BREAK: // upon break-through of extremum of the position opening day if((t_Current_Time - t_Current_Time % 86400) == (t_Entry_Time - t_Current_Time % 86400) ) return(EXIT_NONE); // position opening day not finished yet if(t_Current_Time % 86400 > 36000) return(EXIT_ALL); // time out if(si_Price_Bars < 1) { si_Price_Bars = CopyRates(_Symbol, PERIOD_D1, t_Current_Time, 2, soa_Prev_D1_Rate); if(si_Price_Bars == WRONG_VALUE) { // handling of CopyRates function error if(Log_Level > LOG_LEVEL_NONE) PrintFormat("%s: CopyRates: error #%u", __FUNCTION__, _LastError); return(EXIT_UNKNOWN); } if(e_Trade_Direction == ENTRY_BUY) { if(soa_Prev_D1_Rate[1].high < soa_Prev_D1_Rate[0].high) return(EXIT_NONE); // did not break-through if(Log_Level > LOG_LEVEL_ERR) PrintFormat("%s: price broke-through yesterday’s High: %s > %s", __FUNCTION__, DoubleToString(soa_Prev_D1_Rate[1].high, _Digits), DoubleToString(soa_Prev_D1_Rate[0].high, _Digits)); return(EXIT_BUY); } else { if(soa_Prev_D1_Rate[1].low > soa_Prev_D1_Rate[0].low) return(EXIT_NONE); // did not break through if(Log_Level > LOG_LEVEL_ERR) PrintFormat("%s: price broke through yesterday’s Low: %s < %s", __FUNCTION__, DoubleToString(soa_Prev_D1_Rate[1].low, _Digits), DoubleToString(soa_Prev_D1_Rate[0].low, _Digits)); return(EXIT_SELL); } } return(EXIT_NONE); // for each } return(EXIT_UNKNOWN); }

Here, we have a ‘cap’ in case if ‘trailing exit’ option is selected - the function returns signal absence without any analysis. For two other options, occurrence of events ‘morning has come’ and ‘yesterday’s extremum is broken through’ is identified. Variants of the values of ENUM_EXIT_SIGNAL type returned by function are very similar to the analogous list of entry signal values (ENUM_ENTRY_SIGNAL):

enum ENUM_EXIT_SIGNAL { // The list of exit signals EXIT_UNKNOWN, // not identified EXIT_BUY, // close buys EXIT_SELL, // close sells EXIT_ALL, // close all EXIT_NONE // close nothing };

Indicator for manual trading

The above described signal module should be applied in the robot for automated trading. Let us detail this application method below. First, let us create a tool for more explicit consideration of TS peculiarities at charts in the terminal. This will be an indicator applying the signal module without any changes and displaying the trade levels calculated in it - pending order placement level and Stop Loss level. Closing a profitable deal in this indicator will be provided only by one simplified variant - when the preset level (TakeProfit) is reached. As you remember, in the module we have programmed more complicated algorithms for detecting deal exit signals, but let’s leave them for implementation in robot.

In addition to trade levels, the indicator will fill bars of the first hour of a day, in order to make it clear why it is these levels that are applied. Such marking will help visually evaluate advantages and disadvantages of most rules of the Momentum Pinball strategy - to discover things that cannot be obtained from strategy tester reports. Visual analysis added with tester statistics will facilitate making TS rules more efficient.

In order to apply indicator for ordinary manual trading, let’s add a real-time trader notification system to it. Such notification will contain the entry direction recommended by signal module jointly with placement levels of pending order and emergency exit (Stop Loss). There will be three ways of notice delivery - a standard pop-up window with text and sound signal, e-mail message and push notification to the mobile phone.

All the requirements to indicator are listed. Thus, we may proceed to programming. In order to draw on the chart all the objects we planned, the indicator should have: one buffer of DRAW_FILLING type (to fill bar range of the first hour of a day) and three buffers to display trade levels (entry level, take profit level, stop loss level). One of them (pending order placement level) should have a feature to change color (DRAW_COLOR_LINE type) depending on trading direction, for two others it is enough to have a single-color type DRAW_LINE:

#property indicator_chart_window #property indicator_buffers 6 #property indicator_plots 4 #property indicator_label1 “1st hour of a day" #property indicator_type1 DRAW_FILLING #property indicator_color1 C'255,208,234', C'179,217,255' #property indicator_width1 1 #property indicator_label2 “Entry level" #property indicator_type2 DRAW_COLOR_LINE #property indicator_style2 STYLE_DASHDOT #property indicator_color2 clrDodgerBlue, clrDeepPink #property indicator_width2 2 #property indicator_label3 "Stop Loss" #property indicator_type3 DRAW_LINE #property indicator_style3 STYLE_DASHDOTDOT #property indicator_color3 clrCrimson #property indicator_width3 1 #property indicator_label4 "Take Profit" #property indicator_type4 DRAW_LINE #property indicator_color4 clrGreen #property indicator_width4 1

Now, declare lists, part of which are not required in indicator (they are used only by Expert Advisor), but they are engaged in signal module functions. These variables of enum type are required for working with logging and various methods of position closing; we will omit them in indicator also - let me remind that here we have only imitation of simple take profit at preset level (Take Profit). Following declaration of those variables we may connect the external module, list user settings and declare global variables:

enum ENUM_LOG_LEVEL { // The list of logging levels LOG_LEVEL_NONE, // logging disabled LOG_LEVEL_ERR, // only info about errors LOG_LEVEL_INFO, // errors + robot comments LOG_LEVEL_DEBUG // all without exclusions }; enum ENUM_ENTRY_SIGNAL { // List of entry signals ENTRY_BUY, // buy signal ENTRY_SELL, // sell signal ENTRY_NONE, // no signal ENTRY_UNKNOWN, // status indefinite ENTRY_INTERNAL_ERROR // internal function error }; enum ENUM_EXIT_SIGNAL { // The list of exit signals EXIT_UNKNOWN, // not identified EXIT_BUY, // close buys EXIT_SELL, // close sells EXIT_ALL, // close all EXIT_NONE // close nothing }; #include <Expert\Signal\Signal_Momentum_Pinball.mqh> // signal module of ‘Momentum Pinball’ TS input uint TS_MomPin_Take_Profit = 10; // Momentum Pinball: Take Profit (in points) input bool Show_1st_H1_Bar = true; // Show day 1st hourly bar range? input bool Alert_Popup = true; // Alert: Show pop-up window? input bool Alert_Email = false; // Alert: Send e-mail? input string Alert_Email_Subj = ""; // Alert: Subjects of e-mail alert input bool Alert_Push = true; // Alert: Send push-notification? input uint Days_Limit = 7; // History layout depth (calendar days) ENUM_LOG_LEVEL Log_Level = LOG_LEVEL_DEBUG; // Logging mode double buff_1st_H1_Bar[], buff_1st_H1_Bar_Zero[], // buffers for filling day 1st hourly bar range buff_Entry[], buff_Entry_Color[], // buffers of pending order line buff_SL[], // buffer of StopLoss line buff_TP[], // buffer of TakeProfit line gd_Entry_Offset = 0, // TS_MomPin_Entry_Offset in symbol prices gd_Exit_Offset = 0 // TS_MomPin_Exit_Offset in symbol prices ;

Initialization function has nothing remarkable - here, assign indices of indicator buffers to the arrays declared for these buffers. As well, here let’s convert user settings from points to symbol prices; this should be done to reduce resource consumption at least a little and not to perform such conversion thousands of times during the run of the main program:

int OnInit() { // converting points to symbol prices: gd_Entry_Offset = TS_MomPin_Entry_Offset * _Point; gd_Exit_Offset = TS_MomPin_Exit_Offset * _Point; // designation of indicator buffers: // day 1st hourly bar range rectangle SetIndexBuffer(0, buff_1st_H1_Bar, INDICATOR_DATA); PlotIndexSetDouble(0, PLOT_EMPTY_VALUE, 0); SetIndexBuffer(1, buff_1st_H1_Bar_Zero, INDICATOR_DATA); PlotIndexSetDouble(1, PLOT_EMPTY_VALUE, 0); // pending order placement line SetIndexBuffer(2, buff_Entry, INDICATOR_DATA); PlotIndexSetDouble(1, PLOT_EMPTY_VALUE, 0); SetIndexBuffer(3, buff_Entry_Color, INDICATOR_COLOR_INDEX); // line SL SetIndexBuffer(4, buff_SL, INDICATOR_DATA); PlotIndexSetDouble(2, PLOT_EMPTY_VALUE, 0); // line TP SetIndexBuffer(5, buff_TP, INDICATOR_DATA); PlotIndexSetDouble(3, PLOT_EMPTY_VALUE, 0); IndicatorSetInteger(INDICATOR_DIGITS, _Digits); IndicatorSetString(INDICATOR_SHORTNAME, "Momentum Pinball"); return(INIT_SUCCEEDED); }

In the indicator code of this series' previous article, some program structure was created, its designation is to store information of any type between ticks. You may read there why it is needed and how it is built here. We will just engage it without any modifications. In this indicator version out of the complete function set of ‘Brownie’, only the flag of the beginning of a new bar will be engaged. But if you want to make the manual trading indicator more advanced, other ‘Brownie’ features will be of use. The complete code of go_Brownie is provided in the end of indicator’s source code file (TS_Momentum_Pinball.mq5) attached to this article. As well, there you can see the notification-push function code f_Do_Alert — it also has no modifications if compared to the previous indicator of this series of articles, therefore, there is no necessity to consider it in detail.

Inside the standard tick-receiving event handler (OnCalculate), prior to the beginning of the program main loop, the necessary variables must be declared. If this is not the first call of the main loop, the re-calculation range should be limited only by currently actual bars - for this trading strategy these are yesterday’s and today’s bars. If this is the first loop call after initialization, clearing of indicator buffers from remaining data should be arranged. If this is not done, already not-actual areas will remain filled when switching a timeframe. Besides, calling of the main function should be limited once per one bar. It is convenient to do it using the go_Brownie structure:

go_Brownie.f_Update(prev_calculated, prev_calculated); // “feed” data to Brownie datetime t_Time = TimeCurrent(); // last known server time int i_Period_Bar = 0, // auxiliary counter i_Current_TF_Bar = 0 // loop beginning bar index ; if(go_Brownie.b_First_Run) { // if this is the 1st launch i_Current_TF_Bar = rates_total — Bars(_Symbol, PERIOD_CURRENT, t_Time — t_Time % 86400 — 86400 * Days_Limit, t_Time); // clearing buffer at re-initialization: ArrayInitialize(buff_1st_H1_Bar, 0); ArrayInitialize(buff_1st_H1_Bar_Zero, 0); ArrayInitialize(buff_Entry, 0); ArrayInitialize(buff_Entry_Color, 0); ArrayInitialize(buff_TP, 0); ArrayInitialize(buff_SL, 0); } else if(!go_Brownie.b_Is_New_Bar) return(rates_total); // waiting for bar closing else { // new bar // minimum re-calculation depth - from day beginning: i_Current_TF_Bar = rates_total — Bars(_Symbol, PERIOD_CURRENT, t_Time — t_Time % 86400, t_Time); } ENUM_ENTRY_SIGNAL e_Entry_Signal = ENTRY_UNKNOWN; // entry signal double d_SL = WRONG_VALUE, // SL level d_TP = WRONG_VALUE, // TP level d_Entry_Level = WRONG_VALUE, // entry level d_Range_High = WRONG_VALUE, d_Range_Low = WRONG_VALUE // pattern's 1 st bar range borders ; datetime t_Curr_D1_Bar = 0, // current D1 bar time (pattern's 2 nd bar) t_Last_D1_Bar = 0, // time of the last bar D1, on which signal was available t_Entry_Bar = 0 // pending order placement bar time ; // making sure that initial re-calculation bar index is within allowed frames: i_Current_TF_Bar = int(fmax(0, fmin(i_Current_TF_Bar, rates_total — 1)));

Now, let us program the main working loop. In the beginning of each iteration, we should receive data from signal module, control performance, availability of errors and arrange transition to the next loop iteration, if no signal is available:

while(++i_Current_TF_Bar < rates_total && !IsStopped()) { // iterate over the current TF bars // receiving data from signal module: e_Entry_Signal = fe_Get_Entry_Signal(-Time[i_Current_TF_Bar], d_Entry_Level, d_SL, d_TP, d_Range_High, d_Range_Low); if(e_Entry_Signal == ENTRY_INTERNAL_ERROR) { // error of data copying from external indicator buffer // calculations and drawing should be repeated on the next tick: go_Brownie.f_Reset(); return(rates_total); } if(e_Entry_Signal > 1) continue; // no active signal on this bar

If the module detected a signal on the bar in question and returned the estimated entry level, first calculate the take profit level (Take Profit):

And then this trade in process will be plotted, laid out on history, if this is the first bar of a new day:

t_Curr_D1_Bar = Time[i_Current_TF_Bar] - Time[i_Current_TF_Bar] % 86400; // start of the day the bar belongs to if(t_Last_D1_Bar < t_Curr_D1_Bar) { // this is 1st bar of the day, on which signal is available t_Entry_Bar = Time[i_Current_TF_Bar]; // remember the time of trading start

Starting with background filling of day’s first hour bars, used in level calculations:

// Background filling 1st hour bars: if(Show_1st_H1_Bar) { i_Period_Bar = i_Current_TF_Bar; while(Time[--i_Period_Bar] >= t_Curr_D1_Bar && i_Period_Bar > 0) if(e_Entry_Signal == ENTRY_BUY) { // bullish pattern buff_1st_H1_Bar_Zero[i_Period_Bar] = d_Range_High; buff_1st_H1_Bar[i_Period_Bar] = d_Range_Low; } else { // bearish pattern buff_1st_H1_Bar[i_Period_Bar] = d_Range_High; buff_1st_H1_Bar_Zero[i_Period_Bar] = d_Range_Low; } }

Then, draw the pending order placement line until the moment when the pending order becomes an open position, i.e. when the price touches this level:

// Entry line till crossed by a bar: i_Period_Bar = i_Current_TF_Bar - 1; if(e_Entry_Signal == ENTRY_BUY) { // bullish pattern while(++i_Period_Bar < rates_total) { if(Time[i_Period_Bar] > t_Curr_D1_Bar + 86399) { // day end e_Entry_Signal = ENTRY_NONE; // pending order did not trigger break; } // extend line: buff_Entry[i_Period_Bar] = d_Entry_Level; buff_Entry_Color[i_Period_Bar] = 0; if(d_Entry_Level <= High[i_Period_Bar]) break; // entry was on this bar } } else { // bearish pattern while(++i_Period_Bar < rates_total) { if(Time[i_Period_Bar] > t_Curr_D1_Bar + 86399) { // day end e_Entry_Signal = ENTRY_NONE; // pending order did not trigger break; } // extend line: buff_Entry[i_Period_Bar] = d_Entry_Level; buff_Entry_Color[i_Period_Bar] = 1; if(d_Entry_Level >= Low[i_Period_Bar]) break; // entry was on this bar } }

If price failed to achieve the calculated level before the day end, proceed to the following step of the main loop:

if(e_Entry_Signal == ENTRY_NONE) { // pending order did not trigger before the day end i_Current_TF_Bar = i_Period_Bar; // this day bars are not interesting to us any more continue; }

If this day is not finished yet and pending order future is still indefinite, there is no sense to continue the main program loop:

After these two filters, only one possible variant of events remains - pending order triggered. Let’s find pending order execution bar and, starting with this bar, draw Take Profit and Stop Loss levels until one of them is crossed by the price, i.e. until position closing. If position opening and closing take place on a single bar, the line should be extended by one bar to the past so that it is visible on the chart:

// order triggered, find position closing bar: i_Period_Bar = fmin(i_Period_Bar, rates_total - 1); buff_SL[i_Period_Bar] = d_SL; while(++i_Period_Bar < rates_total) { if(TS_MomPin_Exit_Mode == CLOSE_ON_SL_TRAIL) { if(Time[i_Period_Bar] >= t_Curr_D1_Bar + 86400) break; // this is the following day bar // Lines TP and SL until the bar crossing one of them: buff_SL[i_Period_Bar] = d_SL; buff_TP[i_Period_Bar] = d_TP; if(( e_Entry_Signal == ENTRY_BUY && d_SL >= Low[i_Period_Bar] ) || ( e_Entry_Signal == ENTRY_SELL && d_SL <= High[i_Period_Bar] )) { // SL exit if(buff_SL[int(fmax(0, i_Period_Bar - 1))] == 0.) { // beginning and end on a single bar, extend it by 1 bar to the past buff_SL[int(fmax(0, i_Period_Bar - 1))] = d_SL; buff_TP[int(fmax(0, i_Period_Bar - 1))] = d_TP; } break; } if(( e_Entry_Signal == ENTRY_BUY && d_TP <= High[i_Period_Bar] ) || ( e_Entry_Signal == ENTRY_SELL && d_SL >= Low[i_Period_Bar] )) { // TP exit if(buff_TP[int(fmax(0, i_Period_Bar - 1))] == 0.) { // beginning and end on a single bar, extend it by 1 bar to the past buff_SL[int(fmax(0, i_Period_Bar - 1))] = d_SL; buff_TP[int(fmax(0, i_Period_Bar - 1))] = d_TP; } break; } } }

After position closing remaining bars of the day may be omitted in program’s main loop:

i_Period_Bar = i_Current_TF_Bar; t_Curr_D1_Bar = Time[i_Period_Bar] - Time[i_Period_Bar] % 86400; while( ++i_Period_Bar < rates_total && t_Curr_D1_Bar == Time[i_Period_Bar] - Time[i_Period_Bar] % 86400 ) i_Current_TF_Bar = i_Period_Bar;

Here the main loop code is finished. Now, notification should be arranged if a signal is detected on the current bar:

i_Period_Bar = rates_total - 1; // current bar if(Alert_Popup + Alert_Email + Alert_Push == 0) return(rates_total); // all disabled if(t_Entry_Bar != Time[i_Period_Bar]) return(rates_total); // no signal on this bar // message wording: string s_Message = StringFormat("ТС Momentum Pinball: needed %s @ %s, SL: %s", e_Entry_Signal == ENTRY_BUY ? "BuyStop" : "SellStop", DoubleToString(d_Entry_Level, _Digits), DoubleToString(d_SL, _Digits) ); // alert: f_Do_Alert(s_Message, Alert_Popup, false, Alert_Email, Alert_Push, Alert_Email_Subj);

The full indicator code is provided in TS_Momentum_Pinball.mq5 file attached below.

Expert Advisor for testing the Momentum Pinball TS

Features of the basic Expert Advisor should be somewhat extended when preparing for testing of another trading strategy from Raschke Connors book. You can find the source code taken as the basis of this version together with detailed description in the previous article. Here, we will not repeat ourselves, studying only substantial changes and supplements, and there are two of them.

The first supplement - the list of exit signals, which was not available in the previous version of trade robot. Additionally, ENTRY_INTERNAL_ERROR status was added to the list of entry signals. These numbered lists do not differ from the same enum lists in the above studied indicator. In the robot code, we place them before the connection string of standard library trading operations class. In Street_Smarts_Bot_MomPin.mq5 file of attachment to the article, these are strings 24..32.

The second change is connected with the fact that the signal module now provides position closing signals as well. Let’s add corresponding code block to work also with this signal. In the previous robot version, there is a conditional operator ‘if’ for checking whether the existing position is new (string 139); the checkup is used to calculate and place StopLoss initial level. In this version, let’s add to ‘if’ operator through alternative ‘else’ a corresponding code block for calling the signal module. If calling result so requires, the Expert Advisor should close a position:

} else { // not new position // conditions for position closing ready? ENUM_EXIT_SIGNAL e_Exit_Signal = fe_Get_Exit_Signal(d_Entry_Level, datetime(PositionGetInteger(POSITION_TIME)), e_Entry_Signal, TimeCurrent(), TS_MomPin_Exit_Mode); if(( e_Exit_Signal == EXIT_BUY && e_Entry_Signal == ENTRY_BUY ) || ( e_Exit_Signal == EXIT_SELL && e_Entry_Signal == ENTRY_SELL ) || e_Exit_Signal == EXIT_ALL ) { // it must be closed CTrade o_Trade; o_Trade.LogLevel(LOG_LEVEL_ERRORS); o_Trade.PositionClose(_Symbol); return; } }

In robot source code, these are strings 171..186.

There are some changes in the code of the function controlling sufficiency of distance to trade levels fb_Is_Acceptable_Distance (strings 424..434).

Strategy backtesting

We have created a couple of tools (indicator and Expert Advisor) for studying a trading system which became well-known due to a book by L. Raschke and L. Connors. The principle purpose of the Expert Advisor backtesting is to check up viability of trade robot which is one of those tools. Therefore, I did not optimize parameters, testing was performed with default settings.

Full results of all the runs are provided in the attached archive; here, only balance variation charts will be supplied. Only as illustration of the second (by significance) purpose of testing - rough (without parameter optimization) evaluation of TS performance under modern market conditions. Let me remind, that the authors illustrated the strategy by charts from the late last century.

Balance variation chart at Expert Advisor testing from the beginning of 2014 on quotes of MetaQuotes demo server. Symbol — EURJPY, timeframe — H1:

Similar chart for EURUSD symbol, same timeframe and same testing period:

When testing without setting modification on quotes of one of metals (XAUUSD) for the same period and on the same timeframe, the balance variation chart looks as follows:

Conclusion

The rules for the Momentum Pinball trading system listed in Street Smarts: High Probability Short-Term Trading Strategies are carried to the code of indicator and Expert Advisor. Unfortunately, description is not so detailed as it might be and provides more than one variant for the rules of position tracking and closing. Therefore, for those who want to research trading system peculiarities in detail, there is a rather wide field for selecting optimal parameters and algorithms of robot activities. The created code enables to do it; besides, hopefully, source codes will be useful at studying object-oriented programming.

Source codes, compiled files and library in MQL5.zip are placed in respective catalogs. Designation of each of them:

| # | File name | Type | Description |

|---|---|---|---|

| 1 | LBR_RSI.mq5 | indicator | Indicator which consolidated ROC and RSI. Used to determine trade direction (or its disabled status) of a starting day |

| 2 | TS_Momentum_Pinball.mq5 | indicator | Indicator for manual trading by this TS. Displays calculated levels of entries and exits, highlights the first hour range, on which basis calculations are performed |

| 3 | Signal_Momentum_Pinball.mqh | library | Library of functions, structures and user settings. Used by indicator and Expert Advisor |

| 4 | Street_Smarts_Bot_MomPin.mq5 | Expert Advisor | Expert Advisor for automated trading by this TS |