Daily Analysis of Major Pairs for April 5, 2016

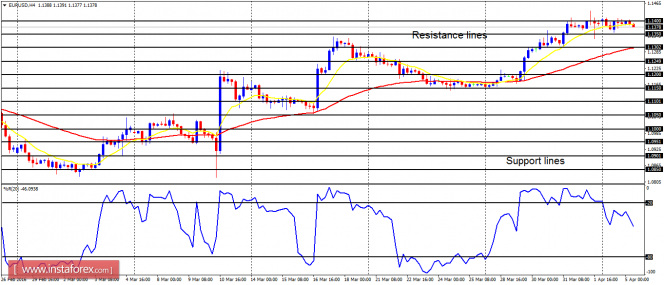

EUR/USD: Once EUR/USD tested the resistance line at 1.1400, it became difficult for the price to go above that line. Bulls have been battering that defense line since last week. As the bullish outlook on the market is valid, there is a high probability that the resistance line would be breached to the upside today or tomorrow.

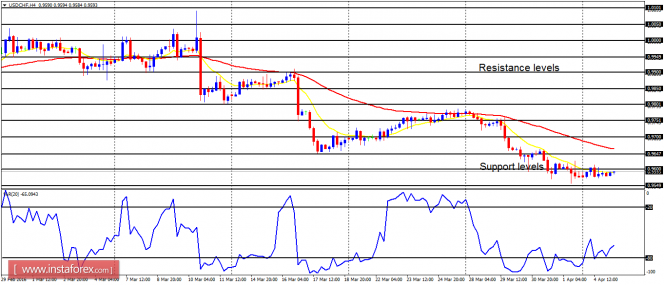

USD/CHF: This currency trading instrument did not make any serious movements on Monday. There is a bearish confirmation pattern on the chart. The EMA 11 is below the EMA 56, while the Williams' % Range period 20 is in the oversold region. Further southward movement is possible, though there could also be a rally this week.

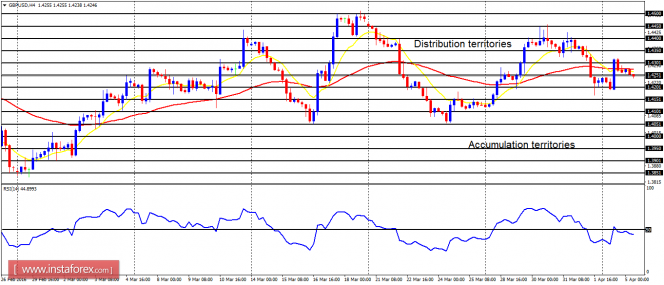

GBP/USD: The situation surrounding the cable is tricky now. The bulls and bears are struggling for domination. While further bearish correction is not ruled out, a rally is a great possibility because the April outlook for GBP is rather bright. This strength would be seen in most GBP pairs.

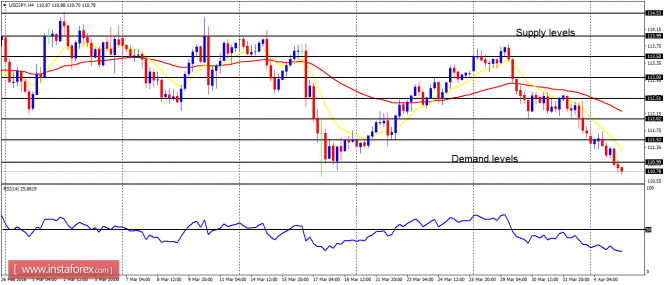

USD/JPY: Since last Tuesday, this pair has been moving downwards. The price has declined by 260 pips, now it is below the supply level at 111.00. The EMA 11 is below the EMA 56 and the RSI period 14 is below the 50 level. The next target for bears is located around the demand levels at 110.50 and 110.00.

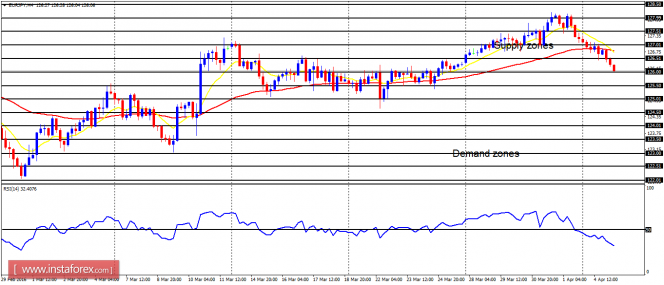

EUR/JPY: There is a "sell" signal in EUR/JPY; and now there is a bearish confirmation pattern on the 4-hour chart. This cross started a bearish correction on April 1, 2016 and has continued it so far. The demand zone at 126.00 has been tested and it might be breached to the downside.

The material has been provided by InstaForex Company - www.instaforex.com