Peak gold ahead, but it will hardly change anything for a bullion - analysts reflect

Less supply usually means higher prices and more profit. The story is different for gold.

With bullion near a five-year trough and investors getting rid of the metal they hoarded for about a decade, some mining companies are losing money and

output is set to drop for the first time since 2008.

However, history shows that the cutbacks will hardly have any impact on the market.

When mines last reduced operations, bullion still dropped as much as 29 percent into a bear market. Even surpluses in 2010 and 2011 didn’t stop prices from touching records.

Global mine output jumped 24 percent in a decade to a record 3,114 metric tons in 2014, as firms dug more to exploit a 12-year bull market in prices, according

to data from industry researcher GFMS.

Almost 65 percent of bullion that’s mined or recycled is applied in jewelry and industry, and the rest is sold to investors.

In September 2011 gold has dropped 40 percent from a record $1,921.17 an ounce as investors lost faith in the metal as a safe haven. Expectations of higher U.S. rates and a robust dollar pushed the yellow metal to $1,077.40 on July 24, the lowest since February 2010.

Even with today's rally, prices aren’t high enough for some producers, says Bloomberg. About 10 percent of the world’s mines have lost money, according to London-based researcher Metals Focus Ltd.

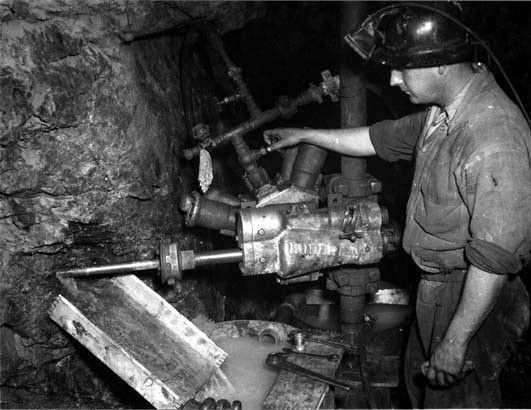

Associated Gold Mine, Kalgoorlie, Australia, 1951

Many analysts consider that output will start dipping as soon as next year.

Polymetal International Plc. Gold Fields Ltd.’s CEO expects a big fall from about 2018, while HSBC Holdings Plc forecast the drop will be 25 tons this year.

With prices at about $1,100, production probably will drop

18 percent by the end of the decade, Metals Focus estimates.

This will happen probably because the industry, on average, requires about $1,200 to break even when all costs are considered, says James Sutton, a portfolio manager at JPMorgan Chase & Co.’s $2 billion Natural Resources Fund.

Barrick Gold Corp., the world’s largest producer, will trim output in the next few years, Moody’s Investors Service

said earlier, after lowering the company’s credit rating to one level

above junk status.

Trimming output by 5 percent would help balance the market and support prices, according to

Mark Bristow, CEO of Jersey, Channel Islands-based Randgold.

Meanwhile, HSBC predicts that the yellow metal will recover 19 percent by 2017, partly as supply tightens.

Barclays considers that the implied gold surplus, which estimates mine output and recycling vs demand from jewelers, manufacturers and investors, will fall to 999 tons in 2016, the lowest since 2012, after reaching 1,476 tons in 2013.

Cutting production may take a while to influence prices because demand can be faced by recycling jewelry and using metal held in vaults, according to Georgette Boele, an analyst at ABN Amro Bank NV in Amsterdam. She predicts the yellow metal to touch $800 by December 2016.