This is part of the larger UTM Manager Guide - Other - 30 January 2023 - Traders' Blogs (mql5.com)

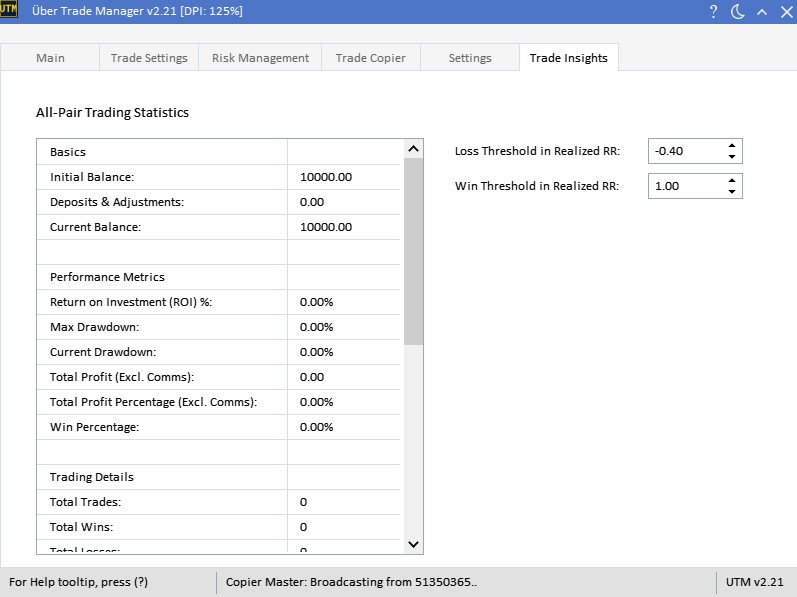

Trade Insights

Note on Trade Inclusion in Insights: Only trades with an initial stop-loss, either set during pending order, market execution, or found in subsequent deals, are included in win/loss/break-even and profit RR calculations. All UTM trades are always counted, regardless of their initial setup. Insights is updated only after all positions are closed.

Basics

Initial Balance: The starting account balance.

Deposits & Adjustments: Any additional deposits or balance adjustments made.

Current Balance: Your live account balance calculated from MT5 history. If this is wrong, then it is a sign we have not calculated everything and there is a problem somewhere.

Performance Metrics

Return on Investment (ROI) %: Tracks the percentage of return on your initial investment, calculated from the initial balance plus all possible deposits and adjustments.

Max Drawdown: The highest percentage of loss from the peak account value.

Current Drawdown: The present percentage of loss from the peak account value.

Win Percentage: Ratio of profitable trades to total trades made.

Trading Details

Total Trades: Sum of all trades executed.

Total Wins/Losses: Number of profitable and non-profitable trades respectively.

Total Break Evens (BE): Trades that neither resulted in a win nor a loss.

Total Unknown Trades: Number of trades without a stop loss, not included in wins/losses/break-even/profit-rr calculations.

Total Profit in RR (Incl. Comms): Aggregated returns, in terms of Risk-Reward, that accounts for commissions, swap, and fees.

Average Profit in RR (Incl. Comms): Average returns, in terms of Risk-Reward, that accounts for commissions, swap, and fees.

Average Holding Time: Mean time each trade remains open.

Average Trades Per Day: An average count of trades executed daily, only counting days where at least one trade was executed.

Costs & Fees

Total Commission: The aggregate commission fee for all trades.

Average & Total Commission Percentage: Mean commission fee and total commission, both expressed as a percentage, calculated from the initial balance plus all possible deposits and adjustments.

Total Swap: Total of swap fees.

Total Fee: Any other additional fees incurred.

Adjusting Trade Classification with Realized RR Thresholds

In the 'Trade Insights' tab, you have the ability to fine-tune how trades are categorized based on their realized Risk-Reward (RR) outcomes:

-

Loss Threshold in Realized RR:

Here, you can specify the negative RR threshold that determines a trade as a loss. For instance, by entering a value of '-0.5', any trade that realizes an RR equal to or less than -0.5 will be classified as a loss. This feature allows you to align the trade insights with your personal risk management approach. -

Win Threshold in Realized RR:

In contrast to the loss threshold, this edit box lets you designate the positive RR value above which a trade is deemed a win. An entry like '1.0' means trades with a realized RR of 1.0 or more will be considered as wins.

Trades that fall between these two RR thresholds, i.e., neither reaching the win threshold nor falling to or below the loss threshold, are classified as 'break evens'. This provides a more nuanced view of your trading performance, ensuring the insights reflect a deeper understanding of trade outcomes based on your specified parameters.

Resetting Stats / Reloading All Data:

-

Adjusting Thresholds: Changing the "Loss Threshold in Realized RR" or "Win Threshold in Realized RR" will automatically reload all the data. This ensures that the trade classifications are updated according to the new thresholds you have specified.

-

Important Changes in Development: If there are any significant updates or changes made to the trading system or analysis code, it may be necessary to reload all stats to ensure consistency and accuracy.

-

Manual Reload: Depending on your interface, you may also have the option to manually reload all data or reset stats. This can be useful for starting fresh or recalibrating the insights based on new parameters or preferences.