This is part of the larger UTM Manager Guide - Other - 30 January 2023 - Traders' Blogs (mql5.com)

Spread Management

Spread management is a feature in a manager that allows traders to handle the impact of bid-ask spreads on their trades.

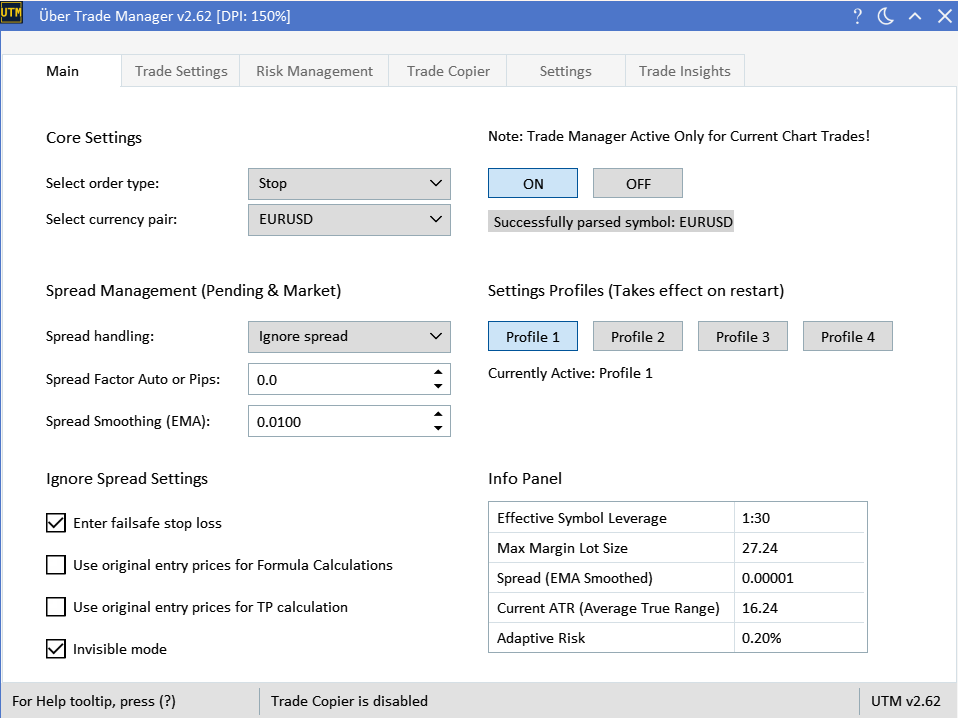

Spread Factor: Adaptive Spread Management

The 'Spread Factor' method provides a dynamic way to handle spreads during trading. By incorporating a specific spread amount to your entry or stop loss prices, it offers added protection against unpredictable spread fluctuations. It's recommended to consult the EMA smoothed spreads to make informed decisions about the correct spread amount to integrate.

For instance, if you set a spread factor of 0.2 pips, during a sell action, this extra 0.2 pips will be added to the stop loss price to compensate for the spread. This approach ensures your stop loss activates closer to the 'candle price' on the chart, preventing premature triggers caused by the spread alone. Similarly, for buy actions, 0.2 pips will be added to the entry price, ensuring your trade is executed closer to the desired 'candle price'.

When the 'Spread Factor Auto or Pips:' is set to 0, the system will automatically use the EMA-smoothed spread, transitioning it to the 'Auto factor' mode. This mode permits real-time spread adaptations in line with current market dynamics without any manual input. However, for traders who prefer a more hands-on approach and desire to manually specify a value, it becomes crucial to be well-versed with the prevailing market spread. Ensuring that your custom spread factor aligns well with the ongoing market conditions and your unique trading methodology is essential. For a deeper understanding of EMA Smoothed spread and insights on fine-tuning it to your requirements, please refer to the guide below.

Ignore Spread: Refined Spread Management Mimicking Manual Market Execution

Note: To avoid confusion, the "Ignore Spread" mode is intended for advanced traders who understand how bid, ask, and spread work in trading.

The 'Ignore Spread' functionality offers an advanced approach to managing spreads. Instead of accommodating the spread, this mode lets traders operate as if there's no spread at all. Essentially, it emulates manual market execution at the candle's bid price, acting as a fully-automated Spread Factor mode without manual tweaks.

Using this mode brings several advantages:

- Trading on LTF: Allows trading on higher spread pairs without the regular constraints.

- Precision: Ensures trades are entered at the exact candle prices.

- Risk Management: Minimizes the chance of premature entries and exits caused by spread shifts.

When using 'Ignore Spread', both entry and stop loss prices are consistently executed at the bid price.

For buy positions, this mode employs the EMA Smoothed Spreads in the lot size calculation to anticipate the spread during the potential execution of a pending trade. The goal here is to approximate the spread costs when the trade is activated. This "forecast" system can sometimes cause the anticipated risk on buy orders to appear slightly lower than intended, especially during high spreads. For instance, it might show a risk of 0.7% when your target is 0.8%. However, the actual executed risk often aligns closely with the desired value. There are times, though, where a combination of unexpected spreads or additional slippages can push the risk slightly above the target.

For the best outcome, traders are advised to adjust the smoothed spread value to establish a consistent average spread, reducing significant spikes or drops. The aim is to align this value closely with typical trading conditions, ensuring that the forecasted spread aligns with actual market behavior.

Nonetheless, it's crucial to recognize that 'Ignore Spread' doesn't actually eliminate spreads. In a losing sell trade scenario, the spread cost is factored into the stop loss size, which might slightly inflate the loss. For buy trades, the order executes at the ask price, positioning the 'real' entry a bit higher than the bid price. This pattern is similar to the Spread Factor mode's behavior. The primary advantage with 'Ignore Spread' is the consistent achievement of the perfect candle price during execution, devoid of manual tweaking.

To summarize, it's a balancing act: the benefits of precise candle prices come at the cost of marginally higher losses on adverse trades. However, the 'Ignore Spread' mode promises a streamlined experience, empowering traders to work with higher spread pairs on LTF without worrying about spread-related interferences.

Important! A stable internet connection is crucial as most orders are market executed, not directly entered to the broker. Delays can occur with a poor connection. Please ensure a reliable internet connection when using this mode.

When employing the 'Ignore Spread' method, you can fine-tune the feature using several checkboxes:

- 'Ignore Spread: Enter Failsafe Stop Loss': This checkbox allows you to set an additional failsafe stop loss (2x original stop loss size) at the broker's end, in addition to the 'Invisible' stop loss set by the manager. This can be handy in instances where the manager doesn't place the stop loss at the broker's end (such as in sell situations) or in case of network errors, computer crashes, or specific prop firm requirements.

- 'Ignore Spread: Use Original entry prices for Formula Calculations': This checkbox allows you to base 'Trade Management Formula' calculations on the original entry price, as opposed to the 'positional' entry price that factors in spread and slippage. For instance, if your initial entry price was 100, but your 'positional' entry price, including spread and slippage, is 110, the formula will use 100 for its calculations. Activate this setting to ensure your trading strategy aligns with backtesting conditions, effectively enabling a 'true ignore spread mode'

- 'Ignore spread: Use original entry prices for TP calculation': This checkbox allows you to calculate take profit levels based on the original entry price rather than the final (positional) entry price. This keeps take profit levels in line with backtesting and enables a 'true ignore spread mode'.

- 'Ignore Spread: Invisible Mode': This checkbox allows all orders and stop loss levels to be fully invisible to the broker by executing them through the manager. This can help in avoiding your trading strategy from being detected by the broker. Note that all 'Ignore Spread' orders are managed by the manager queue system, instead of half of them, as required for the regular 'Ignore Spread' mode.

Order Flow in Ignore Spread Mode:

In the 'Ignore Spread' mode, only half of the orders and stop losses are sent to the broker. This is how it works:

- BUY Orders: The manager executes the entry using the BID price, and the stop loss is sent to the broker.

- SELL Orders: The entry is directly sent to the broker, and the stop loss is executed by the manager using the BID price.

If you enable the 'Invisible Ignore Spread' mode, all orders and stop losses are executed solely by the manager, meaning no orders are sent to the broker.

Spread Smoothing (EMA)

Spreads in trading can fluctuate rapidly. Our "Spread Smoothing" feature assists in presenting a more consistent view of these spreads, employing the Exponential Moving Average (EMA) technique.

With the "Spread Smoothing (EMA)" setting, you can determine the desired consistency for the spread visualization. This adjustment ranges between 0 and 1:

- Value 1: No smoothing. Spreads are showcased in real-time.

- Value 0: The spread remains static and unchanging.

A typical recommended range might be between 0.1-0.001, with the default set to 0.01. The duration and type of your orders can influence the optimal setting:

- For short-term averaging: Opt for a higher value to reflect more immediate spread shifts.

- For long-term averaging: A diminished value yields a steady, prolonged average.

The EMA-smoothed spread finds its application in:

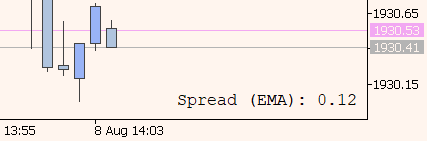

- Chart Display: Ensures a more stable visual representation on the chart.

- Lot Size Calculator: Useful in both 'Spread Ignore' mode for buy positions and 'Spread Factor' mode when the amount to factor is set to zero.

- Spread Factor Mode: Employed to factor average spread values into trades when the amount to factor is set to zero.

Select a value congruent with your trading routine and the insights you aim to gather.

You can review your active smoothed value here.