This is part of the larger UTM Manager Guide - Other - 30 January 2023 - Traders' Blogs (mql5.com)

Reporting

If you are experiencing any bugs or problems with the UTM Manager, please follow the steps below to assist the developer in troubleshooting the issue:

- Enable Debugging Logs:

- Launch the the UTM Manager.

- Go to the "Settings"

- In the Settings, enable "Debugging Logs" checkbox.

-

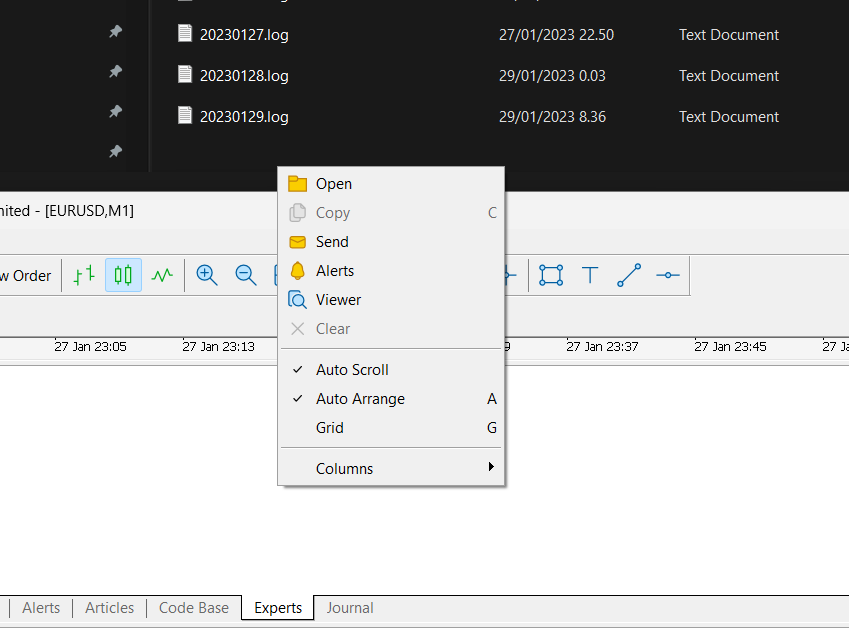

Clear Logs (Optional, for shorter logs):

- In the MT5, click on the "Experts" tab located at the bottom of the GUI.

- Right-click on the experts tab and select "Clear" to remove any existing log entries.

-

Reproduce the Issue you had:

- Perform the actions in the UTM Manager that led to the problem or bug you are experiencing.

-

Retrieve Log Files:

- After reproducing the issue, go back to the "Experts" tab.

- Right-click on the experts tab and select "Open" to access the file folder located at "\MQL5\Logs".

- A file explorer window will open, showing the logs folder.

- Locate the most recent log files in this folder.

- Contact the Developer:

- Contact the developer through the MQL5 marketplace chat (from the seller profile) for the product.

- Send a private message to the developer.

- In the message, provide a detailed description of the problem, including the version of the manager you are using.

- Attach the most recent log files from the "\MQL5\Logs" folder to the message.

To reach out to the developer:

- Go to the product page of the UTM Manager on the MQL5 marketplace.

- Click on the seller's name. This will lead you to the seller's profile.

- Here, click on the 'Send Message' button to initiate a conversation with the developer.

When reporting an issue, ensure to provide the following details:

- The version of the UTM Manager you're currently using.

- The sequence of actions you undertook that led to the problem.

- Attach the most recent log files, which can be found in the '\MQL5\Logs' location. (Instructions for accessing these files are provided above.)

This information will assist the developer in understanding the issue better and facilitating a swift resolution.

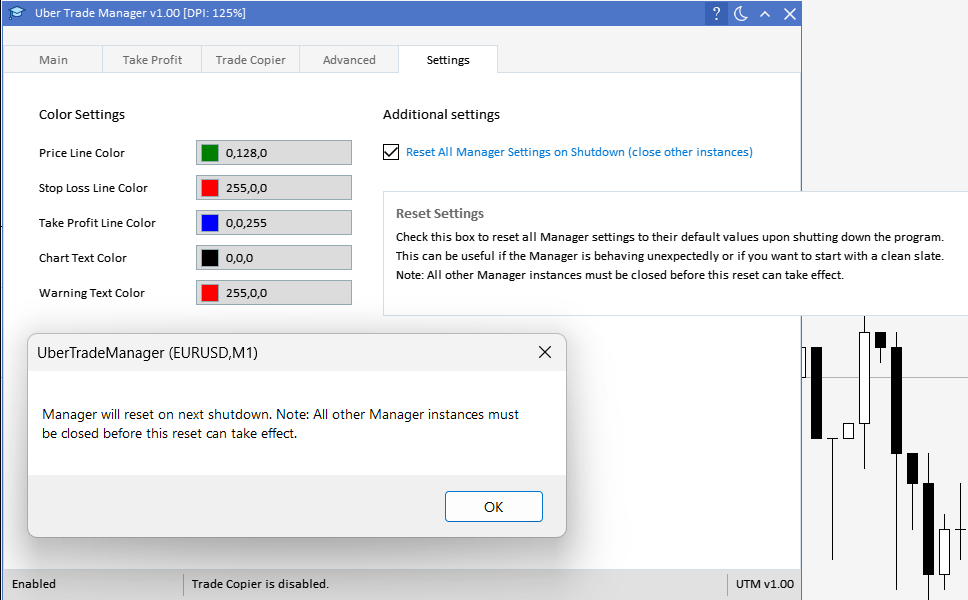

Reset All Manager Settings

The Manager includes a feature to "Reset all Manager settings" which can be useful if the Manager is behaving unexpectedly or if the user wants to start with a clean slate. To access this feature, check the "Reset All Manager Settings on Shutdown" checkbox in the Manager settings. Note that all other Manager instances must be closed before this reset can take effect.

Hotkey's do not work

Make sure you are using them only in 'execution mode' (ESC key by default), as they do not work outside of execution mode.

Why Does the Manager Appear to Risk Too Much?

Problem Statement

Beginner traders often come in with the complaint: "My Lot size is too big, why did the manager calculate it wrong?" At first glance, it may seem like the manager's calculations are off, but the issue often lies elsewhere. Specifically, the problem can arise due to small Stop Loss (SL) sizes being affected by slippage and spread changes, which the manager cannot predict.

Understanding the Issue

Stop Loss and Slippage

1. Stop Loss (SL): This is the price level at which your trade will automatically close to prevent further losses.

2. Slippage: This is the difference between the expected price of a trade and the price at which the trade is executed. Slippage can occur during high volatility or low liquidity.

The Math Behind It

Let's say the manager initially calculated a Stop Loss of 1.4 pips and accounted for a spread of 0.1 pips, making the total SL size 1.5 pips. If slippage of 0.3 pips occurs, the effective SL becomes 1.8 pips.

The slippage of 0.3 pips on a 1.5 pip SL is a 20% increase. If your initial risk was $50, the slippage would increase the risk to $60, which is also a 20% increase.

Why This Is Not the Manager's Fault

1. Unpredictable Slippage: The manager has no way to predict slippage, which can happen due to market conditions.

2. Spread Fluctuations: Brokers can change the spread at execution time, and the manager cannot account for this in real-time.

Solutions and Best Practices

1. Use Larger Stop Loss: If you use a Stop Loss of 4 pips or more, the impact of slippage will be less significant.

2. Risk Management: If you insist on using small SL sizes, then risk less capital to account for potential slippage.

Ignore Spread Mode: Sometimes Result in Unexpected Risk Levels in Pending Orders?

Problem Statement

In the context of the "Spread Ignore" mode, traders may notice that the risk on buy orders can sometimes appear either too high or too low compared to the intended risk level. This discrepancy is not a miscalculation by the manager but a result of how "Spread Ignore" mode interacts with EMA Smoothed Spreads.

Understanding the Issue

EMA Smoothed Spreads in "Spread Ignore" Mode

When using "Spread Ignore" mode for buy positions, the manager employs EMA Smoothed Spreads to approximate the spread costs at the time the trade will be activated. This is a forecast system designed to anticipate future spread levels.

Fluctuating Spreads

The EMA Smoothed Spreads are generally a good approximation but can sometimes be off, especially during times of high market volatility or low liquidity. This can cause the actual executed risk to deviate from the intended risk level.

Why This Is Not the Manager's Fault

1. Unpredictable Spreads: Just like slippage, spreads can be volatile and unpredictable. The manager uses EMA Smoothed Spreads as a best guess but cannot guarantee accuracy.

2. High Volatility: During high volatility, spreads can widen significantly, causing the EMA Smoothed Spreads to be less accurate.

Solutions and Best Practices

1. Adjust EMA Smoothed Spreads: If you notice consistent discrepancies in risk levels, consider adjusting the EMA Smoothed Spreads to better align with actual market conditions.

2. Risk Management: Be prepared for some level of risk deviation when using "Spread Ignore" mode and adjust your trading strategy accordingly.

Conclusion

While "Spread Ignore" mode offers several advantages, including more precise entry and exit points, it's essential to understand that it can also introduce some level of risk variability. Being aware of this and adjusting your strategies accordingly is key to effective risk management.

Ignore Spread Mode: Risking less in Pending Buy Orders

The "Ignore Spread" mode is designed to account for the additional spread costs that are inherent in buy orders, and it can sometimes result in the perceived risk on these orders appearing lower than the intended risk level.When using "Ignore Spread" mode for buy positions, the manager employs EMA Smoothed Spreads to approximate the spread costs at the time the trade will be activated. This is a predictive system designed to anticipate future spread levels.

To ensure that the actual executed risk aligns as closely as possible with the intended risk level, the manager actively reduces the risk on buy orders in "Spread Ignore" mode. This reduction is calculated to compensate for the anticipated spread costs. For instance, if the intended risk on a buy order is $1000, the manager might reduce the risk to $800 to account for the expected spread costs. As a result, when the trade is executed, the actual risk should be very close to the intended risk, say $997, which is slightly less or more than $1000.

This approach is not a miscalculation or a fault of the manager, but a strategic decision designed to manage the inherent variability and unpredictability of spreads. By actively reducing the risk on buy orders in this way, the manager is able to keep the actual executed risk close to the intended risk level.

Ignore Spread Mode:Understanding the Discrepancy in Buy Position Executed Prices

Problem Statement

Using the "Ignore Spread" mode in your trading manager allows trades to bypass the usual spread costs at the price level by always executing at the bid price. This characteristic can create a significant difference in "real" entries for buy positions, particularly noticeable by traders not fully acquainted with the bid and ask pricing structure in trading.

Understanding the Issue

In the "Ignore Spread" mode, all trades are executed at the bid price, including buy positions, which are traditionally executed at the ask price by brokers. This fundamental aspect creates a discrepancy in the executed prices for buy positions, with the actual price being higher by a spread margin.

Note to Users

This discrepancy isn't a flaw in the system but a reflection of the inherent market mechanics where the ask price is higher than the bid price. It's important for users to recognize that while the mode ignores spread in price level terms, the inherent spread costs in trading still apply.

Solutions and Best Practices

To prevent misunderstandings and to navigate this mode effectively, traders are encouraged to:

-

Educate Themselves: Enhance understanding of the intricacies of bid and ask prices and the function of spreads in trading, possibly through research or practical experience in demo accounts.

-

Gain Practical Experience: Engage actively in demo environments to grasp the nuances of the "Ignore Spread" mode and to develop strategies that mitigate its effects on trades