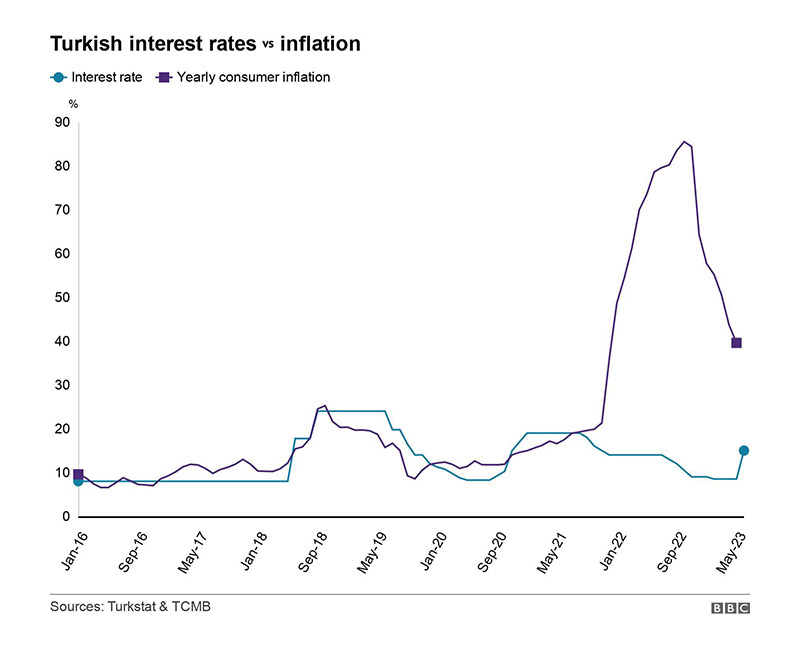

Turkey's Central Bank has raised interest rates for the first time in more than two years. From 8.5% to 15%.

What does it mean? What is an interest rate? Let's figure it out.

In simple words, the value of the interest rate is the value of money. The interest rate is the percentage per annum at which the Central Bank lends to commercial banks. Further down the chain. Commercial banks lend to households and firms. Naturally, more expensive. Because the trading business means buy cheaper, sell more expensive, and the banking business means borrow cheaper, lend more expensive.

The interest rate also affects the amount of interest on deposits for citizens and entrepreneurs in commercial banks. The higher the rate, the more expensive the loans and the more profitable the deposits. And vice versa.

Central banks keep inflation in check by raising interest rates. The higher the rate, the more expensive the money and the higher the value of the money. And accordingly, the lower inflation. Higher interest rates slow down economic growth. Money becomes more expensive and investors are less willing to part with it. This is why central banks are so careful with interest rates.

Turkey's Central Bank has been hesitant to raise rates for more than two years. Now the time has come.

My solutions: Vladimir Toropov's products for traders