Having found itself under strong pressure yesterday, the DXY dollar index recovered slightly today, gaining 13 points to the closing price of yesterday's trading day. At the time of publication of this article, DXY futures are trading near the 103.73 mark, yet higher (by 67 points) from the local (since July) low of 103.06, reached last week, when the results of the Fed meeting became known.

Yesterday, the DXY dollar index fell sharply, primarily due to the weakening of the dollar against the euro (its share in DXY is about 57%) and the yen (its share in DXY is about 14%). In turn, the sharp strengthening of the yen on Tuesday was facilitated by the results of the meeting of the Bank of Japan that ended on that day (see today's "Fundamental Analysis").

Today, the focus of market participants is the publication (at 13:30 GMT) of consumer price indices in Canada (consumer prices account for the majority of headline inflation, and an assessment of the inflation rate is important for central bank management in setting the parameters of the current monetary policy) and in 15:00 - Conference Board report on US Consumer Confidence Index (US consumer confidence in the country's economic development and in the stability of its economic position is a leading indicator of consumer spending, which accounts for most of the overall economic activity).

Obviously, during this period of time, another increase in market volatility is expected, primarily in the quotes of the Canadian and US dollars. In this regard, the new trading opportunities in the USD/CAD pair will probably be of the greatest interest to market participants.

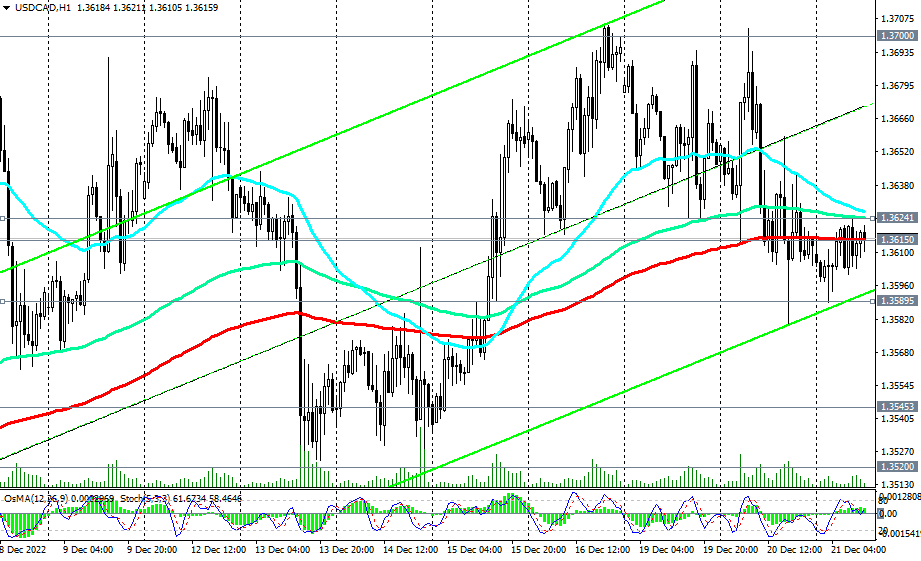

At the time of writing this article, the USD/CAD pair was trading near 1.3615, at an important short-term support level, remaining in the bull market zone.

Taking into account the general upward dynamics of the pair, we expect its further growth, and the publication of the above macro data may become a catalyst for this movement, however, if it turns out to be positive for USD and negative for CAD. In any case, when planning trading, do not forget about limiting stops (for an alternative scenario and more details, see "USD/CAD: technical analysis and trading recommendations for 12/21/2022"). At the current moment, the range between the levels 1.3625 and 1.3590 is allocated. The breakdown of these levels will open the way for the pair in one direction or another.

*) for the most important events of the week, see the Most important economic events of the week 12/19/2022 – 12/25/2022

Support levels: 1.3615, 1.3590, 1.3545, 1.3520, 1.3450, 1.3290, 1.3190, 1.3145

Resistance levels: 1.3625, 1.3700, 1.3800, 1.3830, 1.3900, 1.3977, 1.4000

- signals -> https://www.mql5.com/en/signals/author/edayprofit

- see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading