Banks and stock exchanges in Catholic countries are closed today on the occasion of Good Friday. All important macro statistics, which are usually published on Friday, were published on Thursday. In particular, yesterday's preliminary consumer sentiment index of Americans in April amounted to 65.7 (versus 59.4 in March and the forecast of 59.0), while expectations about the economy and personal finances have improved.

John Williams, President of the Federal Reserve Bank of New York and FOMC Vice Chairman, said last night that raising interest rates by half a percentage point at the Open Market Committee meeting appears to be "a very reasonable option."

The need for one or more half percentage point rate hikes has been announced recently by other Fed officials. U.S. annual inflation hit a 40-year high of 8.5% in March, according to the latest data from the Department of Labor, and to combat accelerating inflation, “the Fed may have to raise rates above neutral levels,” according to Williams (a neutral interest rate that does not stimulate or slow down economic growth, is, according to Williams, in the range from 2% to 2.5%. Now the range of this rate is from 0.25% to 0.5%).

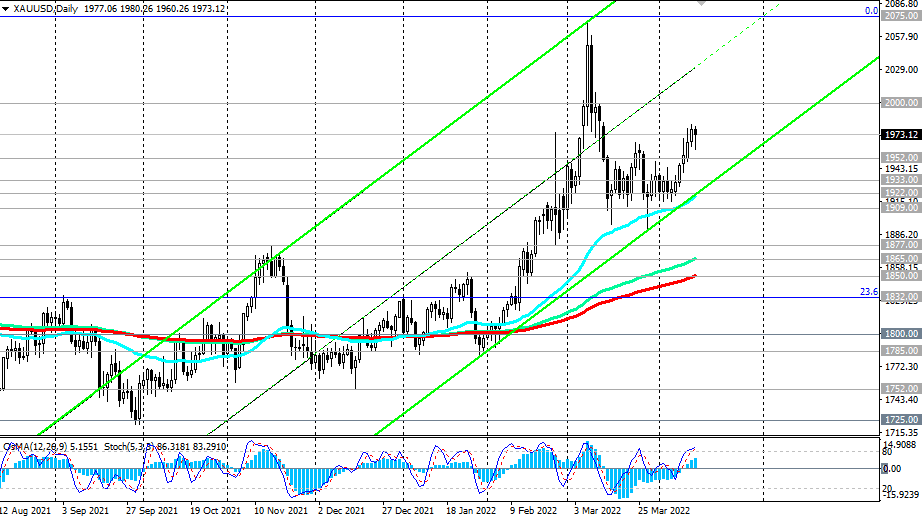

Despite the positive outlook for the dollar, gold, as we can see, is also growing in price, and the XAU/USD pair maintains a positive trend. Investors see gold as a hedging and store of value tool, protecting their investment from a variety of risks. The prevailing negative fundamental background on the market creates preconditions for further growth of gold quotes.

A signal to enter long positions may be a breakdown of the local resistance level of 1981.00 (a week high).

In an alternative scenario, and after the breakdown of the support level of 1952.00, XAU/USD will fall to the support levels of 1933.00 or 1922.00. Pending orders to buy can be placed near these levels.

Support levels: 1952.00, 1933.00, 1922.00, 1909.00, 1900.00, 1877.00, 1865.00, 1850.00, 1832.00, 1800.00

Resistance levels: 1981.00, 2000.00, 2070.00, 2075.00, 2100.00

*) see also “Technical analysis and trading recommendations” -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD

Source: InstaForex