This week (Thursday) a regular meeting of the Bank of England will take place, and its decision on the rate and program for the purchase of assets will be published at 12:00 (GMT).

Prior to this event, financial market participants will follow the Fed meeting, which will also be the final one this year. It is scheduled for December 15-16. Fed officials are likely to try to increase pressure on the dollar by underscoring their commitment to a very loose monetary policy and reassuring financial market participants that the current QE parameters will be maintained throughout 2021.

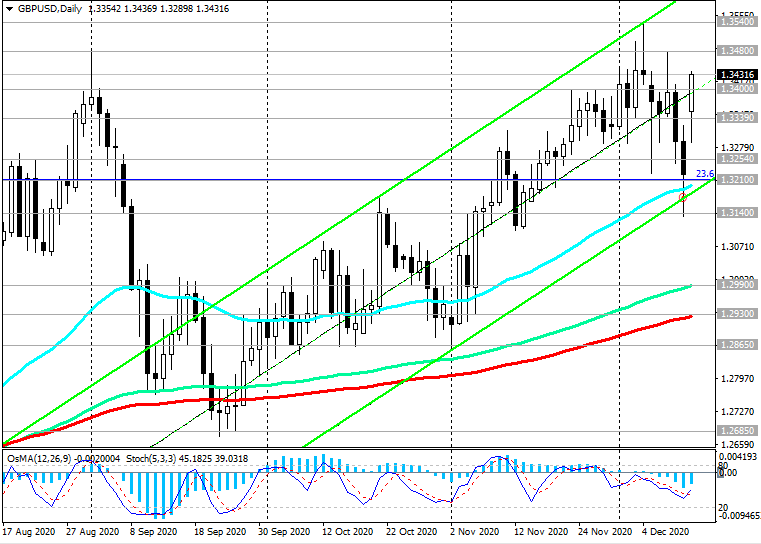

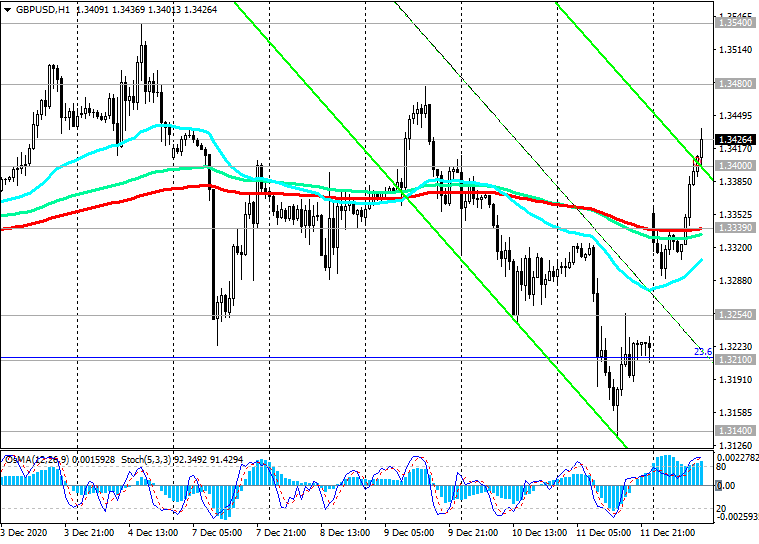

The GBP / USD continues to rise and at the beginning of today's European session is traded near the 1.3430 mark, 210 points higher than the closing price last Friday (see Technical Analysis and Trading Recommendations)

There are no plans to publish important macro data for the second half of today's European trading session and for the American session. Probably, the current negative for the dollar and positive for the pound dynamics will remain on the market. If the Bank of England refrains from changes in the parameters of its current monetary policy and does not make any important statements, then the positive dynamics of the GBP / USD will probably continue until the end of the year, while investors await the conclusion of a trade agreement between the UK and the EU.

In the alternative scenario, and after the breakdown of support levels 1.3254 (ЕМА200 on the 4-hour chart), 1.3210 (Fibonacci level 23.6%), 1.3140 (December lows), one should expect a decline towards support levels 1.2990 (ЕМА144 on the daily chart), 1.2930 (ЕМА200 on the daily chart). And again, a signal for the implementation of this scenario may be a breakdown of the short-term important support level 1.3339 (ЕМА200 on the 1-hour chart)

*) for trading, I choose THIS BROKER and use VPS (to receive a bonus, enter the promo code - zomro_17601)