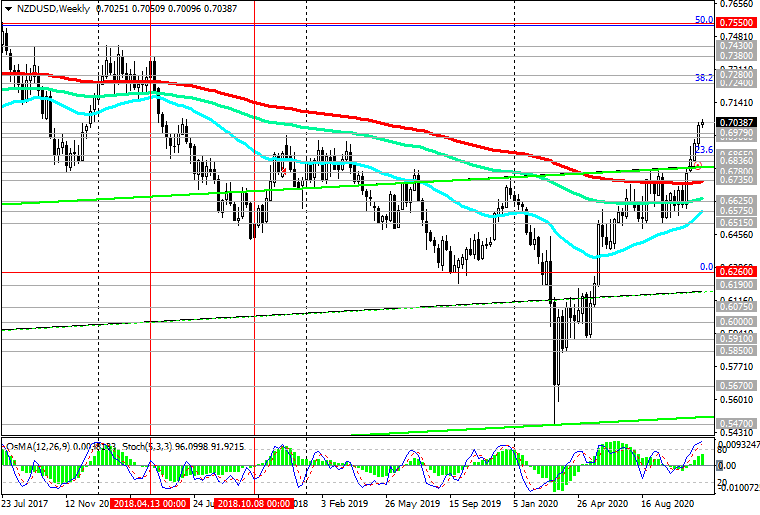

The NZD / USD pair has been rising for the 5th week in a row, hitting 30-month highs and trading at the start of today's European session near 0.7040 mark.

Last week, the New Zealand dollar received support from a strong third quarter retail sales report, which rose +28.0% (vs. +19.0% forecast and -14.8% prior). In annual terms, retail sales grew by +8.3% in the third quarter. It is an important indicator of consumer spending that speaks to consumer confidence and is seen as an indicator of the rate of development of the New Zealand economy. 65% of New Zealand's GDP comes from the budget revenues from the service sector, the lion's share of which is retail sales. Strong data suggests an accelerating recovery in New Zealand's economy, which is arguably the least affected (of the world's strongest economies) by the coronavirus pandemic and has had one of the lowest COVID-19 incidence rates.

From the news for today regarding the New Zealand dollar and the NZD / USD pair, it is worth paying attention to the publication after 14:00 (GMT) of data from a dairy auction organized by the New Zealand company Fonterra (specialized trading platform GlobalDairyTrade - GDT). The Global Dairy Trade Dairy Price Index came out two weeks ago at +1.8%, indicating a rise in prices. The rise in world prices for dairy products provides additional support to the New Zealand economy, increasing the level of export foreign exchange earnings.

At 15:00 (GMT) the speech of the head of the FRS in the US Congress will begin. Jerome Powell has previously stated that economic indicators indicate a "significant improvement" in the state of the economy, but the further path of its recovery remains "extremely uncertain".

Also at 15:00 (GMT), a block of important macro statistics for the US will be published, which will also increase volatility in the financial market, including in the NZD / USD pair.

NZD / USD maintains long-term positive dynamics, remaining trading above key support levels 0.6625, 0.6575 (see “ Technical analysis and trading recommendations”).

*) for trading, I choose THIS BROKER and use VPS (to get a bonus, enter the promo code - zomro_17601)

*) my signals: https://www.mql5.com/en/signals/author/edayprofit