As Joe Biden fills in the economic advisory team and there are encouraging macro data coming out indicating continued economic recovery, lingering fears about the coronavirus are holding back risky asset markets from further stronger growth so far.

At the same time, the growing already large number of COVID-19 infections and the risk of a significant slowdown in global economic growth in the short term support the dollar, keeping it from weakening more strongly.

Fed Chairman Jerome Powell and Treasury Secretary Stephen Mnuchin will address the Senate Banking Committee on Wednesday. Probably, Powell in his speech will again recall the need to allocate additional state aid to the economy, since the balance of risks, in his opinion, is inclined towards its slowdown.

The American economy needs additional budgetary support. But with this issue, it seems, concerns remain: agreement between Republicans and Democrats on the size of the financial aid package in the form of fiscal stimulus is complicated by the different approaches of representatives of these parties to this issue. Democrats insist on a $ 2.2 trillion aid package, while Republicans believe that $ 500 billion will be enough. The Democrats' lack of an absolute majority in Congress complicates this task.

Probably, the Fed leaders will again have to take on the issue of additional support for the economy in the form of strengthening quantitative easing, and at a meeting on December 16, the Fed may decide to increase asset purchases, which will again put pressure on the dollar, which still retains the status of a defensive asset.

And this week, the focus of investors will be the publication of monthly data from the US labor market.

Due to the large number of cases of coronavirus and new quarantine restrictions, many businesses will be closed again, which may affect the report on the labor market. Official US employment data for November will be released on December 4 (13:30 GMT). Forecast for November (+0.520 million versus +0.638 million in October of new jobs created outside the agricultural sector, and the unemployment rate of 6.8% versus 6.9% in October, 13.3% in May and 14.7% in April) may not be justified, which is likely to put pressure on stock indices, giving a positive impetus to the dollar.

And today it is worth paying attention to the publication (at 14:45 GMT) of the PMI Chicago (from the Chicago division of ISM), which will assess the economic activity in the states of Illinois, Indiana and Michigan. Despite the relative decline in the index (to 59.2 against 61.1 in October), it is still above 50, which indicates an acceleration in business activity. If the data turns out to be worse than the forecast (and especially below the value of 50), then this may cause an increase in volatility and negative sentiment in the stock market in the short term.

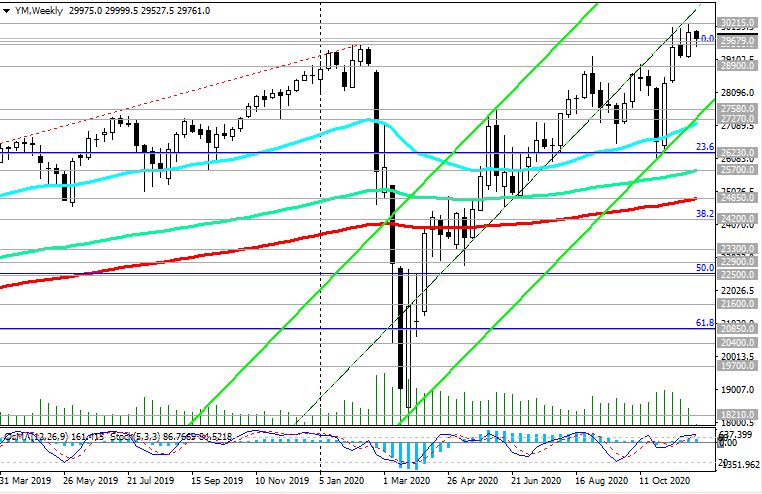

Despite the fact that last week the US stock index DJIA reached a new all-time high near 30215.0 mark, the new week for it and other major US stock indexes started on a minor note. During today's Asian session, futures for them fell.

The DJIA declined 1.5%. The DJIA was able to recover slightly early in today's European session, climbing from an intraday low of 29528.0 to 29755.0 (see “Technical analysis and trading recommendations“)

*) for trading, I choose THIS BROKER and use VPS (to get a bonus, enter the promo code - zomro_17601)

*) my signals: https://www.mql5.com/en/signals/author/edayprofit