Today the market participants will focus on the ECB meeting. Its decision on rates will be published at 11:45 (GMT), and at 12:30 the bank's press conference will begin, during which its head Christine Lagarde will explain the decision and, probably, indicate the nearest prospects for the bank's monetary policy.

Many observers are inclined to believe that the ECB will not change interest rates, and in general, its monetary policy will remain unchanged for now.

The measures taken by the ECB support risky European assets, however, there remains a high degree of uncertainty in macroeconomic prospects and a lack of clarity around whether the response of the authorities of the Eurozone countries to the crisis will be sufficient. The EU summit, which is supposed to discuss the creation of a recovery fund, is scheduled for July 17-18, after the end of the ECB meeting.

However, the ECB also has no room for further easing of monetary policy, compared to the Fed, which may remain more active and pursue a deeper stimulating policy than the ECB. This should support the EUR / USD pair.

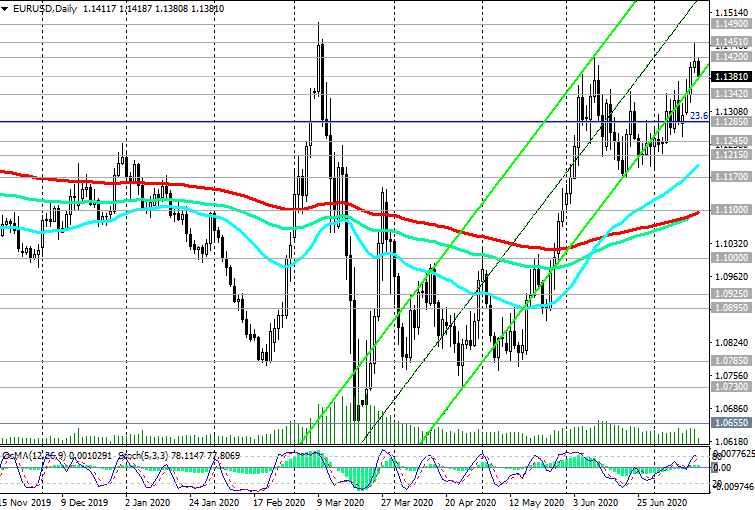

The EUR / USD rose in the first half of this week, reaching a local 4-month high last Wednesday near 1.1451. The pair is trying to break through the key resistance level 1.1375 (ЕМА200 on the weekly chart) again, trading at the beginning of today's European session near the 1.1385 mark.

Despite the decline during the Asian session, the pair remains positive, has been traded above the long-term support level 1.1085 (ЕМА200 on the daily chart) and short-term support levels 1.1245 (ЕМА200 on the 4-hour chart), 1.1342 (ЕМА200 on the 1-hour chart).

The tendency for further growth in EUR / USD remains, primarily due to the weakness of the dollar.

In the alternative scenario and after the breakdown of the support levels 1.1285 (EMA144 on the weekly chart and the Fibonacci level 23.6% of the upward correction in the wave of the pair's decline from the level 1.3870, which began in May 2014) and 1.1245 will resume the pair's decline towards the support levels 1.12151.1170.

A breakdown of the support level 1.1170 (June lows) could trigger a deeper decline in EUR / USD, and a return into the zone below the support level of 1.1100 (ЕМА200 on the daily chart) would herald a renewed bearish trend.

Support Levels: 1.1342, 1.1285, 1.1245, 1.1215, 1.1170, 1.1100

Resistance Levels: 1.1400, 1.1420, 1.1451, 1.1490

Trading Recommendations

Sell Stop 1.1370. Stop-Loss 1.1405. Take-Profit 1.1342, 1.1285, 1.1245, 1.1215, 1.1170, 1.1100

Buy Stop 1.1405. Stop-Loss 1.1370. Take-Profit 1.1420, 1.1451, 1.1490