The US dollar is falling after stock indexes. The DXY dollar index, which tracks the US currency against a basket of 6 other major currencies, has been dropping on Thursday for the third day in a row. DXY futures traded at the beginning of the American session near the 94.74 mark, 40 points lower than the opening price of the trading day.

Nevertheless, the dollar, in general, maintains its position and upward trend against the background of good economic data and high levels of business and consumer confidence. His current decline should be considered so far as corrective.

The dollar also receives support from a $ 1.5 trillion tax cut in December. Investors expect growth this year to be a sustainable fiscal stimulus. Markets expect the Fed to raise interest rates again this year, as well as three times next year. Amid further increases in interest rates, the investment attractiveness of the dollar will grow.

However, on Thursday, the US dollar fell, including against the Australian dollar. "The Fed is making a mistake", Trump told reporters after the worst fall in stock markets in more than seven months. "I think the Fed has lost its head", he added.

Trump made this statement amid falling American stock market. According to Trump, the fall in the stock market is "a correction that we have been waiting for a long time. Nevertheless, I really disagree with the actions of the Fed", he said.

At the same time, the Australian dollar remains under pressure.

According to Lucy Ellis, senior economist at the Reserve Bank of Australia, monetary policy should remain soft to reduce unused production capacity. "Removing reserve capacity may take some time. In this regard, for several years, a stimulating monetary policy may be needed," Ellis added. RBA has kept its key interest rate at a record low of 1.5% for more than two years. Some economists expect the Central Bank to keep rates at such levels until 2020.

Thus, the different orientation of the monetary policies of the Fed and the RBA remains the main fundamental factor in favor of further reducing the pair AUD / USD. In the long run, the pair is likely to decline. The most pessimistic forecasts suggest a fall to the support level of 0.6300 (2009 lows).

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and Resistance Levels

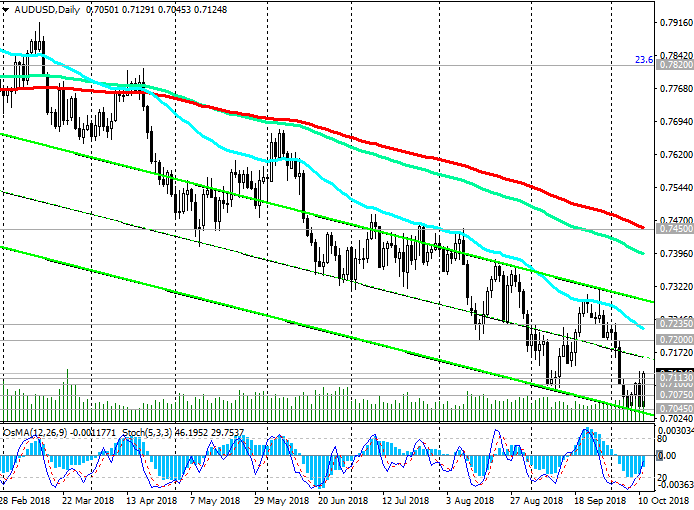

Despite the upward correction, negative dynamics persist and prevail.

Breakdown of the local support level of 0.7045 will resume the decline of AUD / USD with targets at the support levels of 0.6910 (lows of September 2015), 0.6830 (2016 lows).

AUD / USD is in a global downtrend that began in August 2011. Short positions are preferred.

Only if AUD / USD returns to the zone above the key resistance level of 0.7450 (ЕМА200 on the daily chart) can we consider long-term long positions with targets at 0.7820 (ЕМА200 on the weekly chart and Fibonacci level 23.6% of the correction to the decline wave of the pair since August 2011 years and the level of 1.1030. The minimum of this wave is near the level of 0.6830).

The signal for the development of this scenario will be the breakdown of the short-term resistance level of 0.7113 (ЕМА200 on the 1-hour chart).

Support Levels: 0.7075, 0.7045, 0.7025, 0.6910, 0.6830

Resistance Levels: 0.7100, 0.7113, 0.7150, 0.7200, 0.7235, 0.7300, 0.7400, 0.7450, 0.7700, 0.7820

Trading Scenarios

Sell in the market. Stop Loss 0.7140. Take-Profit 0.7045, 0.7025, 0.6910, 0.6830

Buy Stop 0.7140. Stop Loss 0.7070. Take-Profit 0.7200, 0.7235, 0.7300, 0.7400, 0.7450

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com