EUR/USD: Euro remains under pressure. Trading recommendations

The euro remains under pressure due to problems in Italy. Last week, the Italian government presented a plan for the state budget, which investors fear may cause disapproval of the EU authorities. This time, the euro is falling after the comments of the head of the budget committee of the lower house of parliament, Claudio Borghi, that Italy “could solve most of the internal (economic) problems” with the help of its national currency.

The yield of government bonds in Italy jumped to the highest level in 4.5 years.

By the beginning of the US trading session, the EUR / USD pair was trading near the 1.1525 mark, which is 55 points lower than the opening price of the trading day.

Meanwhile, the US dollar continues to rise from the opening of today's trading day. The DXY dollar index, which tracks the US currency against a basket of 6 other major currencies, has been rising 4 days in a row after the Fed raised its main interest rate by 0.25% to 2.25% last week, and Fed Chairman Powell confirmed plans for another interest rate increase in 2018 and 3 interest rate increases in 2019. At the beginning of the European trading session, DXY futures traded with an increase of 28 points, near the mark of 95.24.

On Tuesday, investors will pay attention to Powell's speech, which will begin at 16:45 (GMT).

Most likely, the reaction to his speech will be minimal. But, if he makes unexpected statements about the monetary policy of the Fed, then volatility in trading in financial markets may increase. Any hint of Powell's for a cautious approach to raising the interest rate will cause the dollar to fall and the growth of US stock markets.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Trading scenarios

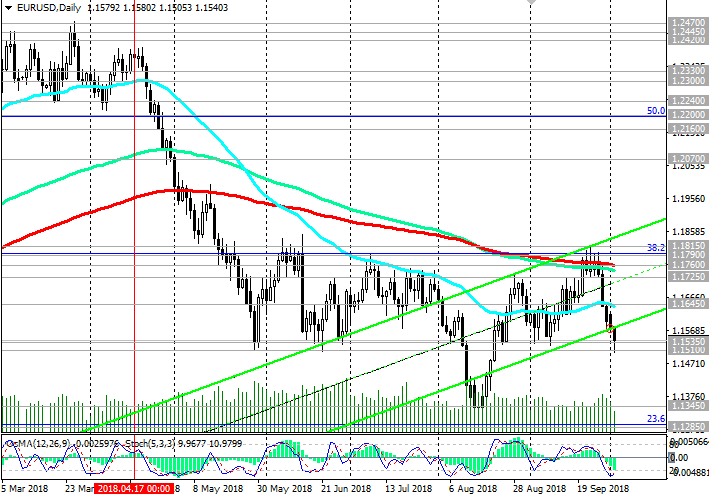

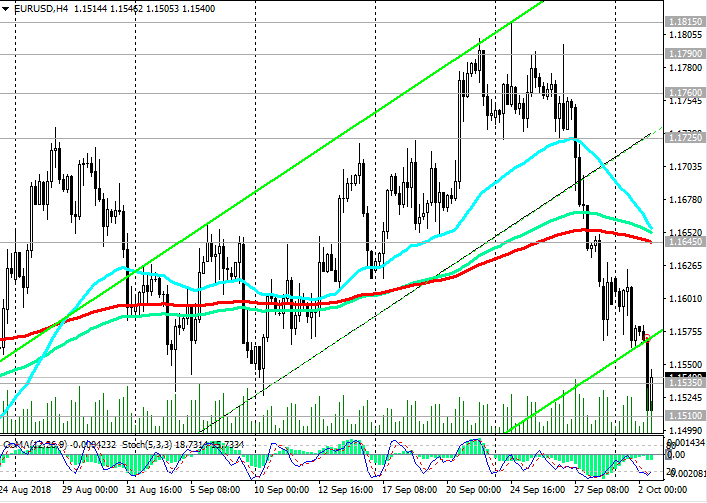

During the 5-day decline, the EUR / USD pair reached a local support level of 1.1510 (May, June lows).

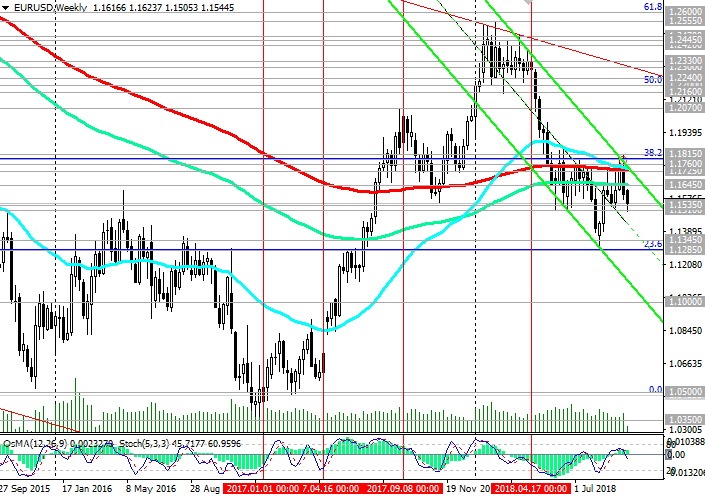

The trend line at the support level of 1.1645 (ЕМА200 on the 4-hour chart, ЕМА50 on the daily chart) is broken.

Indicators OsMA and Stochastic on the 4-hour and daily, weekly charts went to the side of the sellers. Negative dynamics persist. In this situation, short positions are preferred.

The farther target of the decline is at the support level of 1.1100 (lower limit of the downward channel on the weekly chart).

Consideration of long positions is possible only after returning EUR / USD to the zone above the resistance level of 1.1645.

Support Levels: 1.1535, 1.1510, 1.1400, 1.1345, 1.1285, 1.1100

Resistance Levels: 1.1645, 1.1700, 1.1725, 1.1760, 1.1790, 1.1815

Trading recommendations

Sell in the market. Stop Loss 1.1610. Take-Profit 1.1510, 1.1400, 1.1345, 1.1285, 1.1100

Buy Stop 1.1610. Stop-Loss 1.1490. Take-Profit 1.1645, 1.1700, 1.1725, 1.1760, 1.1790, 1.1815

) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com