The focus of traders at the end of the week is the G7 meeting. Leaders of the G-7 countries are due to meet in Québec on Friday for a two-day meeting, during which the issues of trade relations will be discussed after the introduction of the US import duties on steel and aluminum.

As is known, since June 1, import duties on steel and aluminum imported from the EU, Canada, and Mexico have started to operate in the United States. Steel and aluminum from other countries are subject to import duty (25% and 10%, respectively) as early as March.

At the end of May, G7 finance ministers held a meeting in Canada, following which a public protest was issued against the introduction of new import duties on steel and aluminum. The European Union is ready to introduce counter restrictions of € 6.4 billion, Canada - $ 12.8 billion. Nevertheless, the White House insists on continuing pressure on trading partners. "When the foreign trade deficit is almost 800 billion dollars a year, one can not afford to lose a trade war", Trump wrote on his Twitter page on Saturday. "The US has been ripped off by other countries for years, it's time to start thinking", he added.

French President Macron said on Thursday that due to the recently announced US steel and aluminum duties against the EU and Canada, the remaining six members of the G-7 will have to unite in their own strength. Prime Minister of Canada Justin Trudeau said that he will remain faithful to the interests of Canadian citizens, even if this entails contradictions between neighbors. To this Trump replied on Twitter: "Please tell Prime Minister Trudeau and President Macron that they are charging huge fees and imposing non-tariff restrictions on the United States".

Many investors believe that the tension in trade issues will increase the restless situation in the stock markets.

The yield of 10-year US government bonds fell to 2,915% today from 2,933%. The demand for asylum assets - yen, franc, gold - is again growing.

World stock markets on Friday are falling amid growing tension in trade on the eve of an important G7 summit.

It is likely that up to the end of today's trading day, stock indices in Europe and the US will remain under pressure.

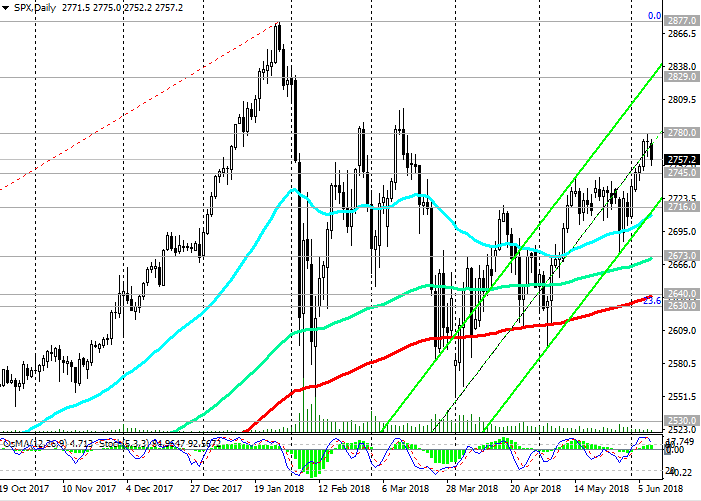

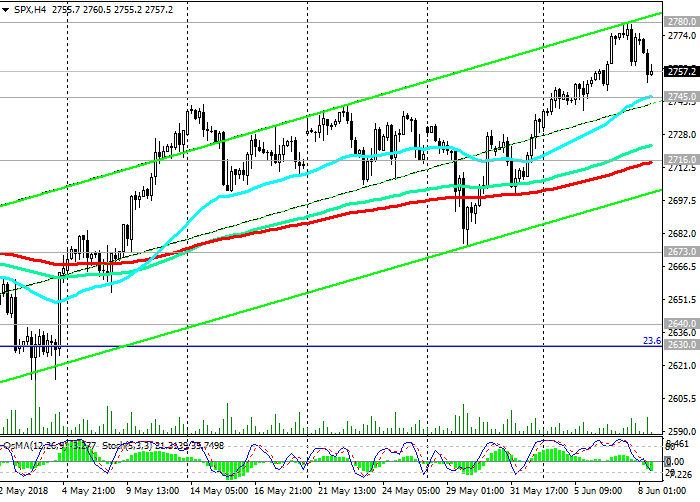

Nevertheless, the bullish trend of the US stock market so far remains in force.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 2745.0, 2716.0, 2673.0,

2640.0, 2630.0, 2530.0

Resistance levels: 2780.0, 2800.0, 2829.0, 2877.0, 2900.0

Trading Scenarios

Sell Stop 2740.0. Stop-Loss 2785.0. Objectives 2716.0, 2673.0, 2640.0, 2630.0

Buy Stop 2785.0. Stop-Loss 2740.0. Objectives 2800.0, 2829.0, 2877.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com