S&P500: US stock indexes are falling before the speech of Donald Trump

Major US stock indexes are down on the eve of the speech of US President Donald Trump. On Monday, Trump wrote on Twitter that he would announce a decision on the Iranian nuclear agreement on Tuesday. The deadline for the adoption of this decision by the US expires on May 12.

Traders took a wait-and-see position before the decision of US President Donald Trump on the Iranian nuclear deal. If Trump still decides to withdraw from the agreement and the US restores economic sanctions against Iran, it will lead to a reduction in the supply of oil from Iran, reduce the world supply of oil and cause an increase in oil prices.

In this case, the Fed may begin to respond more acutely to consumer price growth, which is partly related to the expected increase in oil prices, and to raise interest rates faster than previously expected. This is a negative factor for stock indices, although the dollar will benefit from this.

The strengthening of inflationary pressures in the US can stimulate the Fed to further raise interest rates this year. According to the futures quotations for interest rates of the Fed, investors estimate the probability of four rate increases of 50% (against 32% a month earlier). In this case, the probability of an increase in the rate in June is estimated at 100%. Strong recent economic data from the US has strengthened investors' expectations about 4 Fed interest rate rises in 2018, despite the fact that the Fed is still signaling about 2 more rate hikes. Meanwhile, the yield on 10-year US Treasury bonds is 2.954%, which indicates the expected increase in inflation, and therefore, at a higher rate of tightening of the monetary policy of the Fed.

It is also necessary to take into account the impressive deficit of the US foreign trade balance and the federal budget deficit, which can be further aggravated against the backdrop of the new tax and economic policy of the White House and expectations of a significant increase in budget expenditures.

In recent weeks, the main US stock indices are hesitating in anticipation of the Fed's actions and trade negotiations between the US and China, which ended on Friday with nothing.

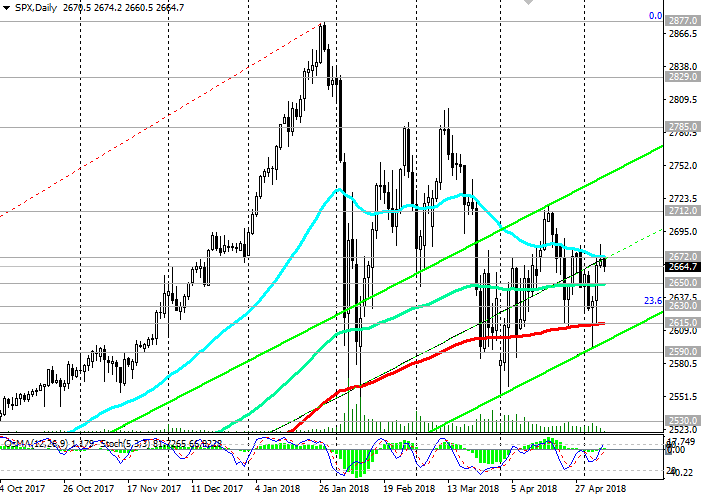

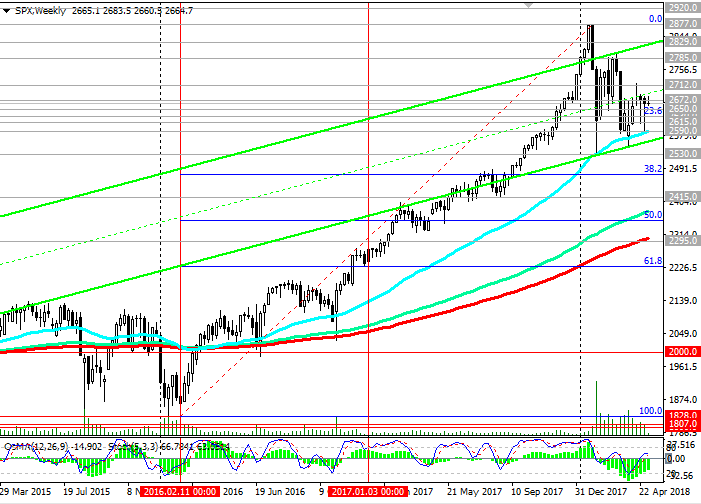

Negative dynamics of US stock indexes persists in the medium term, although in the long run, indices are still in a long-term bull trend.

Recall that the beginning of the performance of Donald Trump is scheduled for 18:00 (GMT).

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 2650.0, 2630.0, 2615.0, 2590.0, 2530.0, 2480.0

Resistance levels: 2672.0, 2712.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

Trading Scenarios

Sell Stop 2640.0. Stop-Loss 2685.0. Objectives 2630.0, 2615.0, 2590.0, 2530.0, 2480.0

Buy Stop 2685.0. Stop-Loss 2640.0. Objectives 2712.0, 2785.0, 2800.0, 2829.0, 2877.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com