USD/CAD: The rate remained at the same level, however ...

The Canadian dollar fell after the Bank of Canada left the rate at the previous level of 1.25% on Wednesday. In the accompanying statement, the central bank expressed its concern over international trade conflicts and weaker economic expectations, pointing to the problems of the export sector and the housing market.

"Despite the higher demand in the world economy, the growth of investment (Canadian) companies focused on exports will be limited by the increased uncertainty surrounding foreign trade and concerns about regulatory rules. In addition, after the tax reform in the United States, the question of likely investors switching to US assets", the central bank said.

The decision to keep the key rate at the previous level was widely expected. Many of the economists pointed to the uncertainty surrounding the North American Free Trade Agreement (NAFTA) as the main reason for this outcome of the next meeting of the central bank.

According to a statement issued on Wednesday, the Bank of Canada will remain cautious and will focus on incoming economic data. Despite the decision of the Bank of Canada to keep the rate at the same level, many economists believe that the statement of the Bank of Canada was "balanced".

Despite the decline, after the decision of the Bank of Canada, the Canadian dollar gets support from rising oil prices. The bulk of Canadian exports accounted for the share of oil and petroleum products. As the world's largest exporter of oil, petroleum products and liquefied gas, the Canadian economy is receiving tangible benefits from rising oil prices.

Apparently, the pair USD / CAD decline will resume if the oil market still has a bullish trend, and in the negotiating process for NAFTA there will be tangible progress. The Bank of Canada also said on Wednesday that "raising interest rates will be justified with time", however, there are no more precise terms.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

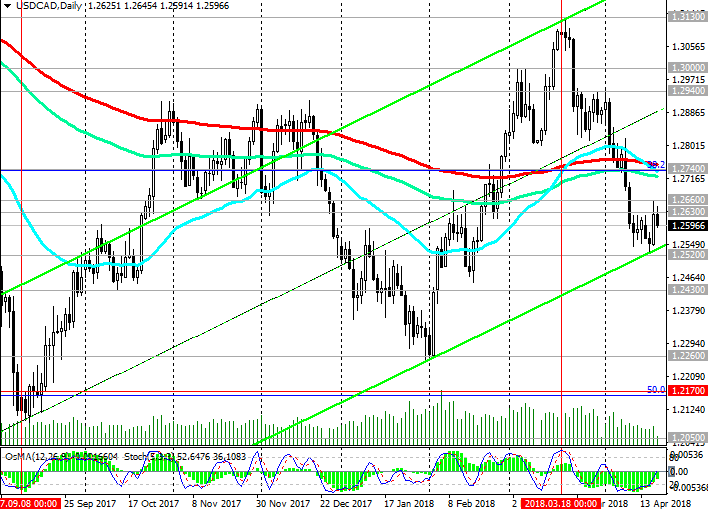

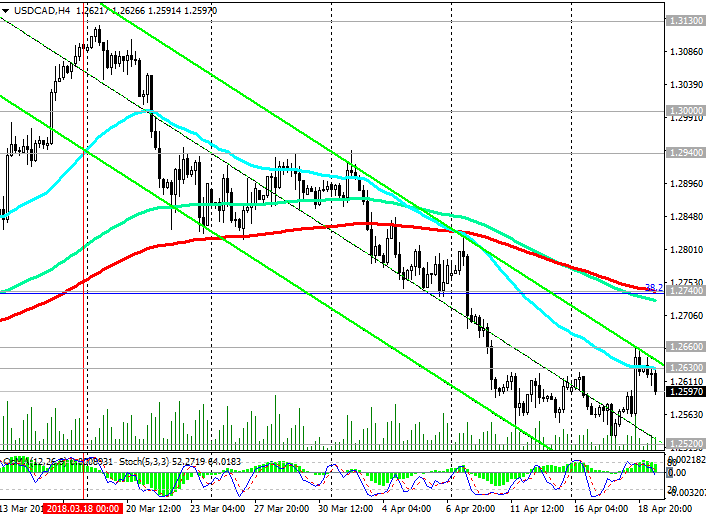

Support levels: 1.2600, 1.2520, 1.2430,

1.2360, 1.2260, 1.2170, 1.2100, 1.2050

Resistance levels: 1.2630, 1.2660, 1.2700, 1.2740, 1.2770, 1.2820, 1.2900, 1.2940, 1.3000, 1.3130, 1.3200

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com