USD Weakness: Looking For Higher Targets In EUR/USD And GBP/USD

The U.S. March payrolls report from last Friday came in weaker than anticipated and that outcome has led to a fresh round of dollar weakness. While a next Federal Reserve rate hike in June is already priced-in, the odds of four rate hikes this year have decreased following the NFP report. Market participants now only price-in a 25 percent chance of a fourth hike in 2018.

The most important piece of economic data this week will be the U.S. Consumer Price Report on Wednesday. On the same day we also have the FOMC meeting minutes due for release. Apart from upcoming economic reports, the primary focus remains, however, on the trade talks between the U.S. and China.

Meanwhile, China’s President Xi Jinping struck a conciliatory tone in his highly-anticipated speech Tuesday morning, calming investors’ fears about an escalation in trade tensions between the world’s largest two economies. However, political uncertainties and the unpredictable nature of U.S. President Trump pose a risk to the markets.

GBP/USD has broken above the 1.41-reisstance area and traders now prepare for another round of GBP strength. Given that assumption, we now expect a higher target to be at 1.42 or 1.4220. For bullish momentum to continue the pound would need to hold above 1.40.

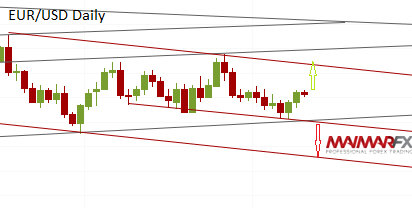

The price action in the EUR/USD was recently characterized by a sideways trend, leaving room for both bullish and bearish scenarios. On the downside, we now see a crucial support at 1.22 while on the upside, a next hurdle could come in around 1.24-1.2420. A break below 1.2190 could reinvigorate bearish potential, whereas a break above 1.2460 could drive the pair towards 1.25. Let us be surprised.

Here are our daily signal alerts:

Daily Forex Signals:

Additional daily and long-term entries are available for subscribers.

View our daily signal alerts http://www.maimar.co/category/daily-signals/

Subscribe to our daily signal service http://www.maimar.co/signals/