EUR/USD: The euro is under pressure before the weekend

As reported on Wednesday (10:00 GMT) by the European Statistical Agency (Eurostat), consumer prices in the Eurozone in February rose by 1.2% (in annual terms). The data suggest that inflation growth rates were the weakest since December 2016 and well below the ECB target level (just below 2%). In February, the rate of inflation slowed for the third month in a row. This index is a key indicator for the ECB in assessing inflation. The current value of the index indicates that the leaders of the ECB will continue to be cautious when considering the issue of reducing the stimulation of the European economy.

As ECB President Mario Draghi said on Monday, it is too early to talk about curtailing the quantitative easing program, since inflation is still far from the target level.

At the same time, the Eurozone economy continues to grow at a good pace (it is expected that GDP growth in 2017 was 2.5%). In 2017, the economy of the Eurozone grew at the fastest pace over the past 10 years, and, apparently, will keep momentum this year.

Mario Draghi again stressed that the ECB will continue its course on monetary policy without any changes. At a recent meeting of the ECB in 2017, it was decided that the program for the purchase of European assets will continue, at least until September 2018. At the same time, ECB interest rates will remain at the same low level for a long time after the end of the QE program.

Meanwhile, optimistic statements by Fed Chairman Jerome Powell on the US economy, made by him on Tuesday, supported the dollar. The dollar index DXY, reflecting its value against the basket of 6 other currencies, reached the highest level since early February, rising to around 90.40, completely closing the decline for the last two weeks.

Jerome Powell drew attention to improving economic prospects, which was considered by investors as an indication that this year the central bank can raise interest rates 4 times. Investors have corrected the forecasts for interest rates. According to CME, the probability of 4 rate increases this year is estimated at 34%. On Monday, this probability was 24%, and a month ago - 23%.

The EUR / USD fell 350 points from the peaks in February to a minimum in seven weeks near the 1.2200 mark.

The euro remains under pressure also because of investors' preoccupation before the elections in Italy and voting in the Social Democratic Party of Germany on the establishment of the ruling coalition this weekend.

Today, market participants will closely monitor the macro data that will be published today in the US (13:30 GMT).

Among the published data - annual GDP (for the 4th quarter), the index of expenditure on personal consumption and the price index of personal consumption expenditure. The growth of indicators is expected. Thus, GDP in Q4 is expected to grow by 2.5%, and for the entire 2017 GDP growth was also + 2.5%, which is higher than the average of 2% observed in the early 2000s.

When confirming the data, the dollar is likely to continue to strengthen, including in the EUR / USD.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

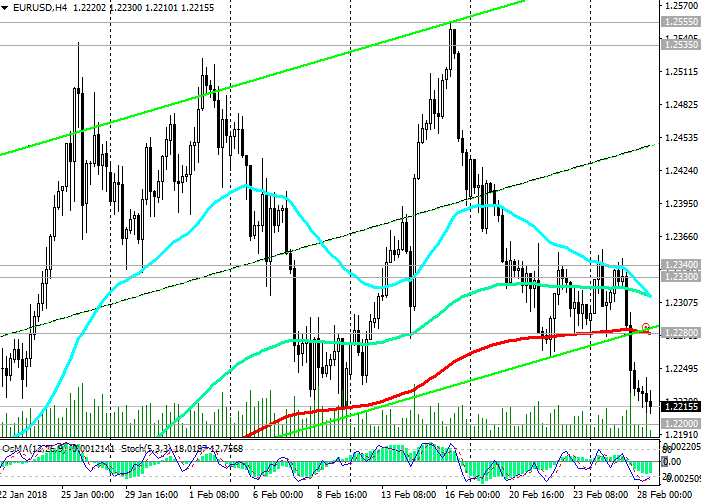

After in the middle of this month the EUR / USD has reached the next multi-month maximum near the mark of 1.2555, the last two weeks there has been a decline in EUR / USD.

As a result of yesterday's decline against the background of the strengthening of the dollar after the statements of Jerome Powell, EUR / USD broke through the support level 1.2280 (EMA200 on the 4-hour chart) and at the beginning of today's European session is trading near support level 1.2200 (low in February, lower mid-January consolidation zone, EMA50 on day chart and the Fibonacci level 50% of correction to the fall from the level of 1.3900, which began in May 2014).

This is a strong level of support, the breakdown of which will significantly worsen prospects for the bullish trend EUR / USD.

Long-term upward dynamics persists as long as EUR / USD is trading above the key support levels 1.1790 (Fibonacci 38.2% and EMA200 on the daily chart), 1.1700 (EMA200 on the weekly chart).

The signal for the resumption of purchases will be a return to the zone above the resistance level 1.2280. In this case, EUR / USD will again move towards the recent highs near the level of 1.2555.

Support levels: 1.2200, 1.2100, 1.2060, 1.2000, 1.1920, 1.1790, 1.1700

Resistance levels: 1.2280, 1.2330, 1.2340, 1.2400, 1.2535, 1.2555, 1.2600

Trading Scenarios

Sell Stop 1.2180. Stop-Loss 1.2220. Take-Profit 1.2100, 1.2060, 1.2000, 1.1920, 1.1790, 1.1700

Buy Stop 1.2220. Stop-Loss 1.2180. Take-Profit 1.2285, 1.2330, 1.2340, 1.2400, 1.2535, 1.2555, 1.2600

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com