Published on Friday, the macro data, pointed to the growth of inflation in the US. According to the US Ministry of Labor, CPI in December rose by 0.1% compared to the previous month, the base CPI index excluding food and energy prices increased by 0.3% (+1.8% in annual expression). Economists expect that by April, annual inflation will be above 2%. This is the most important fundamental factor, as the FRS relies on this basic CPI index when assessing the need for tightening monetary policy.

Janet Yellen, leaving the post of the head of the Federal Reserve on February, said earlier that the weakness of inflation observed last year is a temporary phenomenon. The growth of inflationary pressures against the backdrop of a stable labor market and positive macro statistics gives the Fed the opportunity to raise rates this year at least three times, as expected.

At the moment, the dollar is falling large.

The US dollar index DXY fell to its lowest level since December 2014. This was promoted, first of all, by the growth of the euro. Published on Thursday, the ECB's protocols showed that leaders at the beginning of this year can change the targets of leading indicators if economic growth remains strong. Expectations of tightening monetary policy outside the United States, especially in the Eurozone, contributed to the weakening of the dollar and the growth of the euro.

The euro in the basket of 6 currencies in the dollar index DXY takes about 57%, and its growth contributes to an active decline in the dollar.

However, investors probably can underestimate the Fed's determination to raise interest rates.

In addition, the tax reform and the consistently low unemployment rate in the US (about 4.1%) create the preconditions for accelerating the growth of wages, and this is also a factor that accelerates consumer inflation. There is a high probability that in the current year rates can be raised not three, but four times.

There may be a situation where investors, skeptical about inflation and raising rates in the US, will be taken by surprise when the Fed starts raising rates quarterly, and the bearish trend of the dollar against this background will suddenly be broken.

In conditions of an increase in the interest rate, the investment attractiveness of the dollar will grow.

Meanwhile, this week investors will focus on the publication of inflation indicators in Germany and the UK (Tuesday), the Eurozone (Wednesday), China's GDP (Thursday), the Bank of Canada decision on the interest rate (Wednesday), the publication of the Beige Book Fed (Wednesday) and data from the Australian labor market (Thursday 00:30 GMT).

Economists expect that data on employment in Australia for December will be weak. Unemployment will remain at the same level of 5.4% and an excess of labor resources will remain.

It is likely that the RBA is unlikely to decide to change the current monetary policy in conditions of weak growth in the labor market and the purchasing power of the population. While the growth rate of wages in the country will not grow, the RBA will not go on raising the interest rate, despite the emerging trend towards an early tightening of monetary policies in other major world central banks.

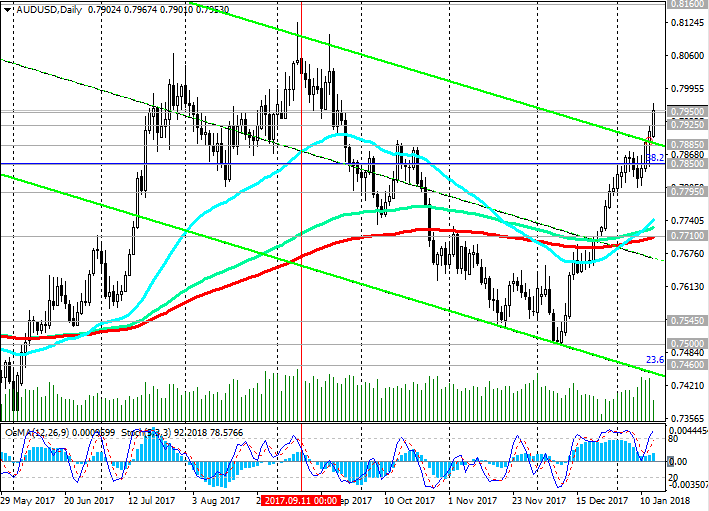

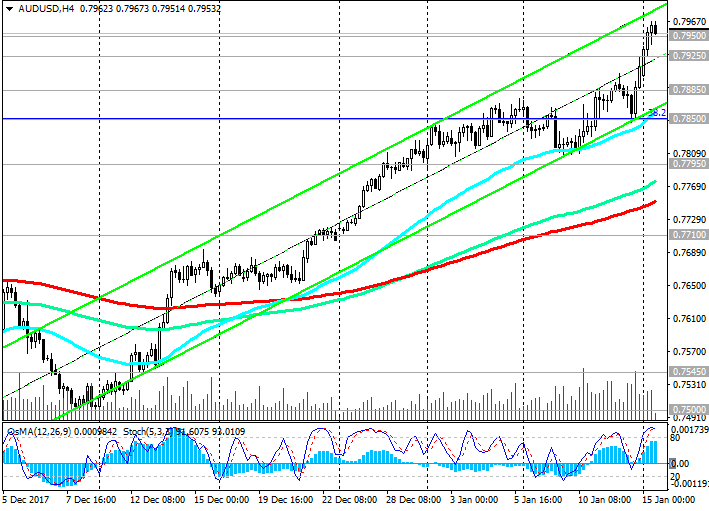

The current growth in the AUD / USD pair is explained, first of all, by the weakening of the US dollar. If the ratio of investors to the US dollar starts to change for the better, then the bullish trend of the AUD / USD pair will not stand.

At the moment, the number of short speculative positions on the AUD / USD pair in the foreign exchange market is 90%.

Today in the US, a day off, US stock exchanges do not work, and against a background of a reduced volume of trades, large players can push the quotes of the AUD / USD pair even higher.

Well, tomorrow, with the opening of the Asian session, the situation may change in the opposite direction. It is necessary to be vigilant when building long positions in the AUD / USD pair.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 0.7950, 0.7900, 0.7850, 0.7795, 0.7710, 0.7600, 0.7545, 0.7500, 0.7460

Resistance levels: 0.8000, 0.8100, 0.8160

Trading Scenarios

Sell Stop 0.7925. Stop-Loss 0.7975. Take-Profit 0.7900, 0.7850, 0.7795, 0.7710

Buy Stop 0.7975. Stop-Loss 0.7925. Take-Profit 0.8000, 0.8100, 0.8160

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com