In the run-up to the publication of the Fed's decision on the rate, there is a low activity of traders.

Trading volumes are also small. Investors take into account in the prices of 100% the probability of a rate increase today at 0.25% to 1.5%.

Meanwhile, the dollar keeps positive dynamics. The index of the dollar WSJ on Tuesday rose to a maximum level for the last 3 weeks, near the mark of 87.25. This was the longest period of its continuous growth (for seven consecutive sessions) since November 2016.

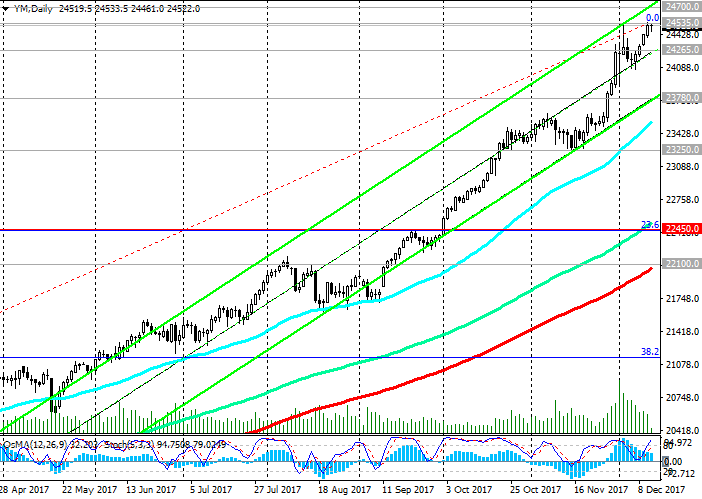

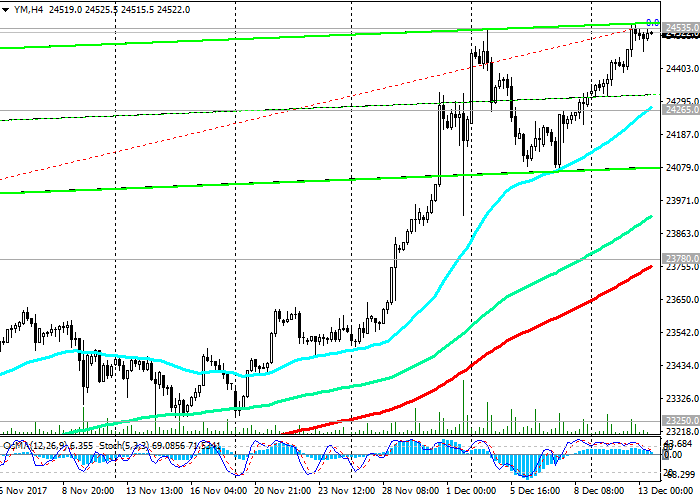

The main US stock indexes also traded with a rise, continuing to develop an upward trend. Dow Jones Industrial Average on Tuesday rose by 0.5%, to 24535 points, the S & P500 increased by 0.2%, to 2664 points. Both indexes closed above previous record highs, gaining support from shares of telecommunications and financial companies.

The dollar and stock indices also received support from Tuesday's strong US macro data. As reported by the US Department of Labor, producer prices compared to the same period of the previous year increased by 3.1%, which was the most significant growth in almost six years. It is expected that the November CPI, which will be released on Wednesday (13:30 GMT), will also show growth (by 0.4% compared to the previous month).

Nevertheless, the main focus of investors will be focused on the Fed's report published at 19:00 (GMT) with an assessment of the current economic situation, as well as with the views of members of the FOMC regarding the prospects for further tightening of monetary policy.

Previously, the leadership of the Federal Reserve planned three increases in the key rate for 2018. In addition, the Fed expects that the rate of annual inflation in the US by the end of 2019 will reach 2%. Nevertheless, if the Fed will expect to maintain low price pressure in the US economy, then the number of key rate increases planned for next year can be reduced to two.

According to the CME Group, investors estimate the likelihood of an increase in the key rate to a range of 1.75% -2% by November next year at 38%. This will require 2 rate hikes by a quarter of a percentage point next year. Many economists expect three increases in the key rate in 2018 and two increases in 2019.

If inflation data is expected to be weak and Fed officials again lower their forecasts for 2018, then the probability of three rate increases in 2018 will decrease, and this will negatively affect the dollar.

If, however, the Fed report or the views of FOMC members contain fears about the future of economic development in the US or accelerate the growth of inflation, the stock indexes may short-term, but sharply decline. A little later (19:30 GMT) the head of the Fed, Janet Yellen will speak. It is expected that volatility during the publication of the report and the speech of Janet Yellen can significantly increase.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support levels: 24265.0, 23780.0, 23340.0,

23250.0, 22450.0, 22100.0

Resistance levels: 24535.0, 24700.0

Trading Scenarios

Buy in the market. Stop-Loss 24400.0. Take-Profit 24700.0

Sell Stop 24400.0. Stop-Loss 24600.0. Take-Profit 24265.0, 23780.0, 23340.0, 23250.0, 22450.0, 22100.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com