Presented at the beginning of today's European session, data on consumer inflation in the UK caused a surge in volatility in the dynamics of the pound. The consumer price index (CPI) of Great Britain in November grew by 3.1% (in annual terms), exceeding the forecast by 0.1% and the target inflation rate by 1%.

Consumer prices in the UK in November grew at the fastest pace in the past six years, and signs of a weakening of price pressure are not observed.

Accelerating inflation increases the pressure on household budgets, which has a negative impact on consumer spending and the economy as a whole, focused mainly on the domestic market.

A significant share of the UK's GDP is made up of consumer spending. Due to the sharp drop in the pound after the referendum on Brexit, both imported consumer goods and raw materials imported to the UK rose in price. This, in turn, increased the producers' selling prices, and as a result, accelerated the growth of prices for consumer goods.

In November, the Bank of England raised its key interest rate for the first time in ten years, intending to slow inflation to a target level of 2%. As stated in the Bank of England, during the next three years the rate can be increased 2 more times, by 0.25% each time.

However, the data published today indicate that high inflation rates may remain in the UK longer than economists had expected.

It is possible that the leaders of the Bank of England will again soon have to think about another increase in the interest rate in order to bring down the growing inflation.

On Thursday, there will be the next meeting of the Bank of England. It is widely expected that the rate will be maintained at the current level of 0.5%. Investors will be interested in the report on monetary policy with the results of voting on the rate and other issues, as well as comments on the state of the economy and the minutes of the Bank of England's Monetary Policy Committee (MPC), with the votes cast for and against the increase / decrease in the interest rate. The main risks for the UK after Brexit are associated with expectations of a slowdown in the country's economic growth, as well as a large current account deficit in the UK's balance of payments.

The determining factor in the dynamics of the pound is still the situation around Brexit. Now "galloping" inflation is added to this list. Thus, the intrigue about the further actions of the Bank of England remains.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

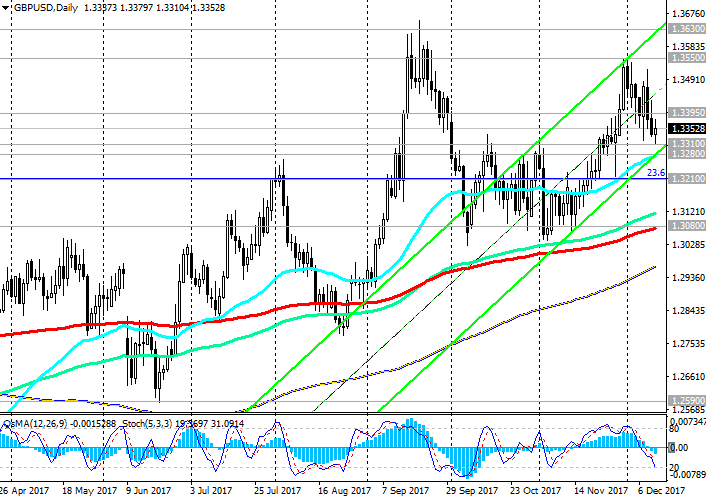

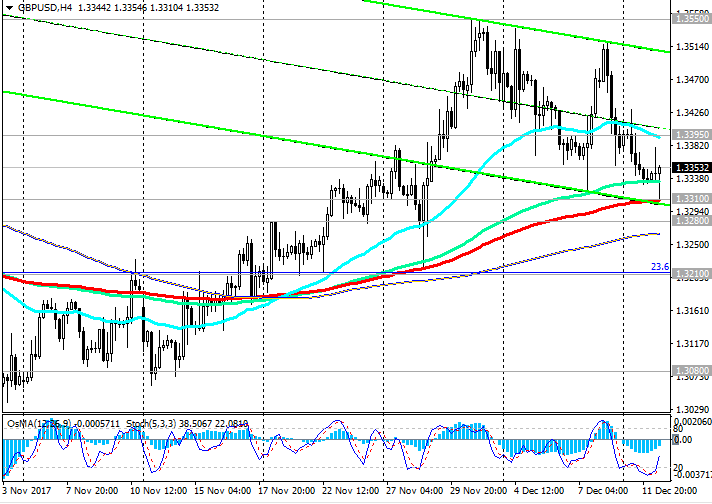

Support levels: 1.3310, 1.3280, 1.3210,

1.3080

Resistance levels: 1.3395, 1.3500, 1.3550, 1.3630, 1.3720, 1.3970, 1.4050

Trading Scenarios

Sell Stop 1.3290. Stop-Loss 1.3410. Take-Profit 1.3280, 1.3210, 1.3100, 1.3080

Buy Stop 1.3410. Stop-Loss 1.3290. Take-Profit 1.3500, 1.3550, 1.3630, 1.3720, 1.3970, 1.4050

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com