According to official data released on Thursday, in September, as compared to August, retail sales decreased by 0.8% (the forecast was -0.1% and weak growth in August +0.9%).

In the third quarter, compared to the same period last year, retail sales grew by only 1.2%, and this was the weakest annual growth rate in four years.

The decline in retail sales indicates a decline in the standard of living of the British after voting for an exit from the EU, and this is a worrying signal for a UK-dominated economy that is oriented primarily to the domestic market.

The drop in retail sales occurs against the backdrop of accelerated inflation after last year's referendum on withdrawal from the EU, when the pound fell sharply. Growing inflation drags not only producer prices, but also import and consumer prices, which grew by 3% in September (in annual terms), and this growth rate was the fastest in five and a half years.

The growth of consumer prices for eight months in a row exceeds the target level set by the Bank of England at 2%. This is a very strong argument in favor of an early increase in the interest rate. But even though the referendum on Brexit sharply increased in Great Britain last summer, the Bank of England will be very cautious and cautious about tightening monetary policy.

As the head of the Bank of England Mark Carney said on Tuesday, the unsuccessful negotiations on Brexit can carry with them significant economic risks, not only for the UK, but also for the Eurozone.

Many market participants expect that in November the Bank of England will still raise the key interest rate to 0.5% from the current level of 0.25%, and this will be the first rate increase for the decade. Nevertheless, further increases in rates may become difficult on the backdrop of the difficulties of the growth of the British economy due to Brexit.

Thus, the fundamental factors say in favor of weakening the GBP/USD. The growth will be possible against the backdrop of the weakening of the dollar, especially if it again escalates, for example, the geopolitical confrontation on the Korean peninsula, or there will be unexpected news about the change in the leadership of the Fed.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

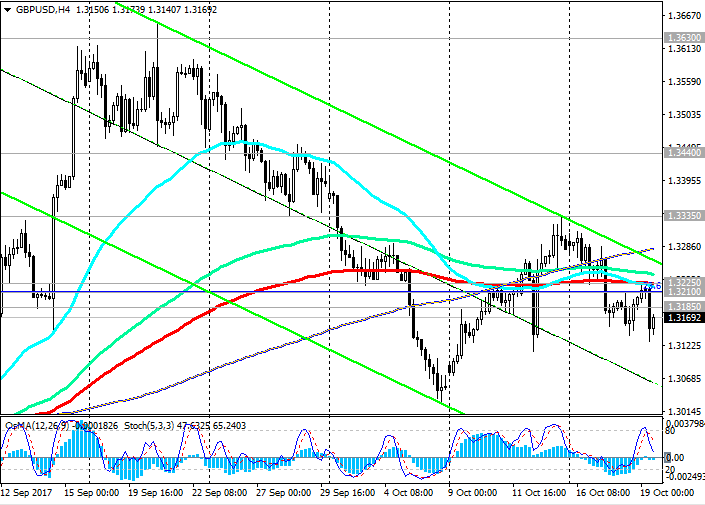

As early as Tuesday, the GBP/USD broke through the important support levels of 1.3185 (EMA50 on the daily chart), 1.3210 (the Fibonacci level of 23.6% correction to the GBP / USD decline in the wave, which began in July 2014 near the level of 1.7200), 1.3225 (EMA200 on the 4-hour and 1-hour charts), and today the decline continues.

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts were deployed to short positions.

Nevertheless, we can say that the GBP/USD maintains a positive trend, which is supported by positive macro data and the expectation of an early rate hike in the UK.

Since the beginning of the year, GBP / USD continues to trade in the upward channel on the weekly chart, the upper limit of which is near resistance level 1.3760 (EMA144 on the weekly chart).

In case of returning to the zone above the resistance level 1.3225 and breaking through the local resistance level 1.3335, it is possible to consider long positions with targets at resistance levels 1.3440 (local highs and the middle of the upward channel on the daily chart), 1.3630 (annual highs), 1.3760.

For now, short positions with targets near the level of 1.3000 (EMA144, EMA200 on the daily chart, EMA50 and the bottom line of the rising channel on the weekly chart) are preferred.

The breakdown of the key support level of 1.3000 will increase the risk of GBP / USD return to the global downtrend that began in July 2014.

Support levels: 1.3120, 1.3100, 1.3000, 1.2975

Resistance levels: 1.3185, 1.3210, 1.3225, 1.3300, 1.3335, 1.3440, 1.3500, 1.3630, 1.3760

Trading Scenarios

Sell Stop 1.3120. Stop-Loss 1.3190. Take-Profit 1.3100, 1.3000, 1.2975

Buy Stop 1.3190. Stop-Loss 1.3120. Take-Profit 1.3210, 1.3225, 1.3300, 1.3335, 1.3440, 1.3500, 1.3630, 1.3760

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com