As expected, the RB of New Zealand maintained the current interest rate at the current level of 1.75%. The RBNZ meeting under the leadership of the new manager Grant Spencer took place after the general elections in New Zealand, which did not bring an obvious result. Previously published GDP data showed only a moderate recovery in the country's economic growth after six months of slowdown. At the same time, inflation in the second quarter weakened to 1.7%, which is below the midpoint of the target range of the central bank. If, however, New Zealand begins a period of political instability, then this will have the most negative impact on the national currency of the country.

The New Zealand dollar reacted rather weakly to the decision of the RBNZ. At the same time, the US dollar continues to grow in the foreign exchange market, including against the New Zealand dollar. The next round of escalation of geopolitical tensions on the Korean Peninsula negatively affects the quotations of currencies in the Asia-Pacific region, including the quotations of the New Zealand dollar.

Yesterday, the US Republican Party published a draft tax reform, which, according to their calculations, will revitalize the economy, and this week's speech by representatives of the Fed increased investor confidence that interest rates will be raised again in December. The index of the dollar WSJ, which estimates its rate to a basket of 16 currencies, increased by 0.1%, to the level of 86.59 after rising by 0.5% on Wednesday, when it achieved the maximum three-day growth since the beginning of the year.

The yield on 10-year US Treasury bonds rose to 2.352% from 2.309% on Thursday, while earlier it showed the highest daily gain since March, indicating an increase in the propensity of investors to buy more risky assets of the US stock market. The growth in the yield of US bonds is accompanied, as a rule, by the growth of quotations of the US dollar.

Investors began to assess the higher probability of a third rate increase this year, which supports the dollar, as this increases the profitability of US assets. According to the CME Group, investors are now expecting an increase in Fed rates by the end of this year with a probability of 83%.

Of the news for today, we are waiting for the publication at 12:30 and 13:30 (GMT) of a block of important macro statistics for the US, including the inflation index of personal consumption expenditure and annual GDP data for the second quarter (adjusted values). It is expected that GDP growth in the second quarter was 3% (in annual terms), which will support the US dollar.

Also at 13:45 and 14:15, representatives of the Federal Reserve Bank Esther George and Fed Vice Chairman Stanley Fischer will speak. It is likely that they will support the head of the Fed and will also speak in favor of a third interest rate increase this year that will also support the dollar.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

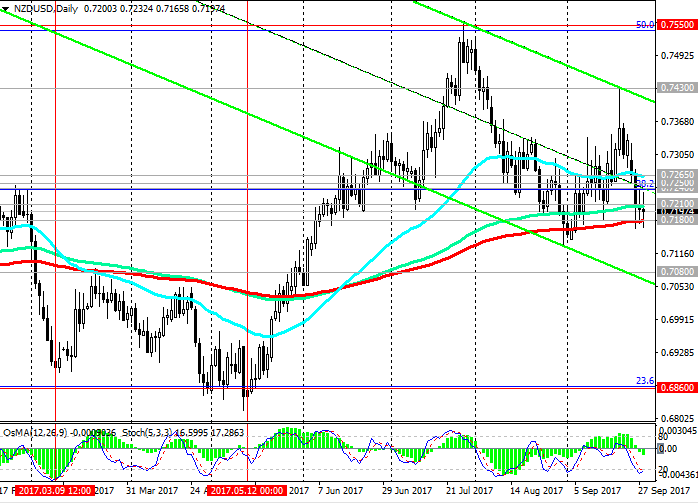

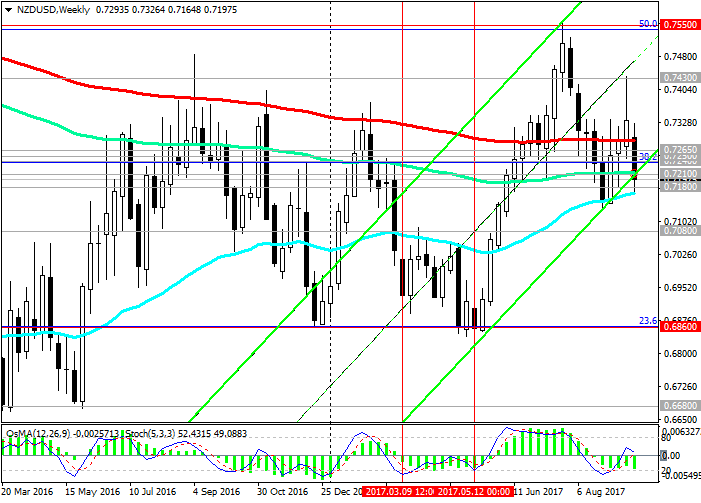

The NZD / USD pair declines for the fourth consecutive day after the elections in New Zealand last weekend.

At the beginning of the European session, the pair NZD / USD is trading near a strong support level of 0.7180 (EMA200 on the daily chart), restraining the pair from further decline.

In case of breakdown of this level, the NZD / USD pair decline will accelerate.

The immediate goal of further decline is the support level of 0.7080 (the lower boundary of the descending channel on the daily chart and EMA200 on the monthly chart).

The break of 0.6860 (the Fibonacci level of 23.6% and the lower limit of the range between 0.7550 and 0.6860) will mean the end of the upward correction, which began in September 2015, and return to the downtrend.

An alternative scenario involves a return to the zone above the resistance levels of 0.7240

(the Fibonacci level of 38.2% of the upward correction to the global wave of decline of the pair from the level of 0.8800, which began in July 2014, here are the minimums of December 2016), 0.7250 (EMA200 on the 1-hour graph0, 0.7265 (EMA200 on the 4-hour chart) and the resumption of growth in the uplink on the weekly chart, the upper limit of which passes near the level of 0.7850 (Fibonacci level 61.8%).

The nearest target in case of continuation of growth will be resistance level 0.7430 (September highs and the top line of the descending channel on the daily chart).

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts were deployed to short positions.

Support levels: 0.7200, 0.7180, 0.7100, 0.7080

Resistance levels: 0.7210, 0.7240, 0.7250, 0.7265

Trading Scenarios

Sell Stop 0.7160. Stop-Loss 0.7240. Take-Profit 0.7100, 0.7000, 0.6900

Buy Stop 0.7240. Stop-Loss 0.7160. Take-Profit 0.7265, 0.7300, 0.7400, 0.7430, 0.7500, 0.7550

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com