According to a report published on Tuesday on economic and financial conditions in New Zealand, forecasts for the growth of the New Zealand economy were revised with a slight decrease.

Finance Minister Stephen Joyce said that in the next four years, the average growth rate of New Zealand's GDP could reach 3%, whereas earlier it was forecasted an average annual growth rate of 3.1%.

The New Zealand dollar is actively declining since the beginning of August. Over the past two days, the NZD / USD pair has declined by about 100 points or by 1.3%.

This is also promoted by the growth of quotations of the US dollar on the eve of the economic conference in Jackson Hole, which will be held on August 24-26. The conference will feature the heads of the world's leading central banks. From the chairman of the Fed, Janet Yellen is waiting for statements in favor of a third increase in interest rates in the US for the current year.

The dollar fell more than 7% this year, it will have a significant growth space if the Fed's rhetoric points to their tendency to tighten monetary and credit policy.

The growth of the US dollar is also facilitated by the fact that investors are less concerned about the tensions between the US and North Korea, as well as political uncertainty in Washington. Yesterday's comments by Paul Ryan, Speaker of the House of Representatives of the US Congress, and Mitch McConnell, leader of the republican majority in the Senate, that the tax reform and raising the public debt limit will be implemented without difficulty, also contribute to improving investor sentiment towards the US currency.

Today (22:45 GMT) important data on New Zealand's foreign trade balance are published. A slight increase in the balance deficit in July (-200 million New Zealand dollars) is expected, which should negatively affect the New Zealand dollar with the confirmation of the forecast. Any change in the state of the foreign trade balance of New Zealand will support the New Zealand currency.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

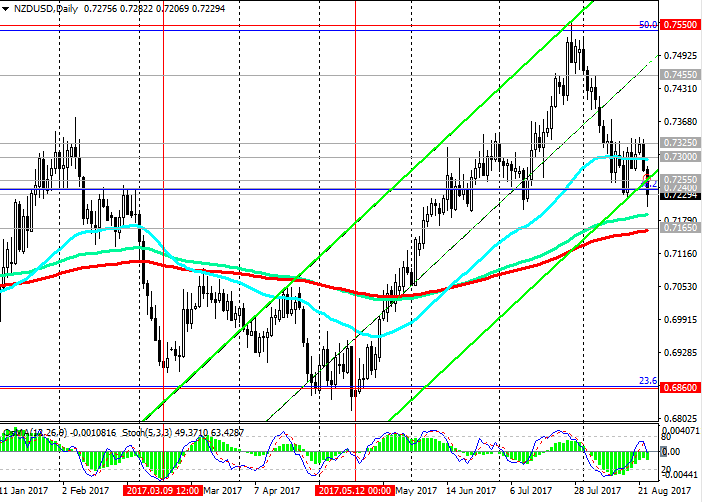

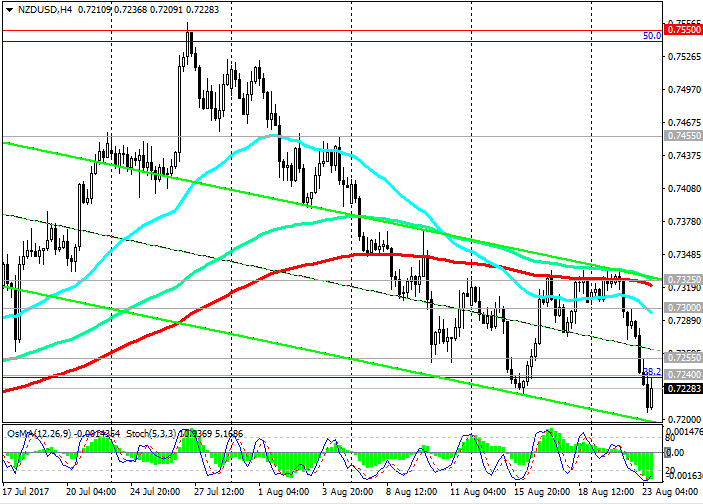

The pair NZD / USD broke through important short-term support levels of 0.7325 (EMA200 on the 4-hour chart), 0.7300 (EMA200 on the 1-hour chart) and currently trades at the support level of 0.7240 (Fibonacci level of 38.2% of the upward correction to the global fall wave Pair from the level of 0.8800, which began in July 2014, the minimums of December 2016).

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts went to the side of sellers, signaling a strong negative impulse.

While NZD / USD is trading above the support level of 0.7165 (EMA200 on the daily chart), the upward dynamics is maintained. In case of breakdown at the level of 0.7165, a further decline to support levels of 0.6860 (Fibonacci level of 23.6% and a lower limit of the range located between the levels of 0.7550 and 0.6860) is possible. At the level of 0.6860 are also the minimums of December 2016 and May 2017. A break at the level of 0.6860 will mean the end of the upward correction, which began in September 2015, and a return to the downward trend.

The alternative scenario involves a return to the zone above the level of 0.7325 and the resumption of growth towards the annual maximum and the resistance level of 0.7550 (50% Fibonacci level and the upper limit of the rising channel on the weekly chart). Meanwhile, it is too early to talk about long positions on the NZD / USD pair. Only a breakdown at 0.7550 would mean the end of the global bearish trend.

Support levels: 0.7240, 0.7165

Resistance levels: 0.7255, 0.7300, 0.7325, 0.7455, 0.7500, 0.7550

Trading scenarios

Sell Stop 0.7205. Stop-Loss 0.7255. Take-Profit 0.7165

Buy Stop 0.7255. Stop-Loss 0.7205. Take-Profit 0.7300, 0.7325, 0.7455, 0.7500, 0.7550

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com