Trading recommendations

Sell Stop 1.0990. Stop-Loss 1.1045. Objectives 1.0950, 1.0900, 1.0875, 1.0820, 1.0800, 1.0780

Buy Stop 1.1045. Stop-Loss 1.0990. Objectives 1.1100, 1.1200, 1.1280

The dollar continues to remain under pressure in the foreign exchange market after publication on Friday weaker than expected inflationary indicators for the US in April. Weak inflation data provoked purchases of 10-year US Treasury bonds, which was accompanied by a decrease in their yield and the weakening of the dollar. Inflation indicators, weaker than expected, can force the Fed to postpone the interest rate increase to a later date. Thus, according to the CME Group, the probability of an increase in Fed rates in June is estimated by investors at 74% against 83% a week earlier. The index of the dollar WSJ, which reflects the value of the US dollar against the basket of 16 other currencies, continues to decline, falling to the level of 89.85.

The EUR / USD pair is growing today for the third trading session in a row, once again approaching the highs of the month near the 1.1020 mark reached last Monday, when it became clear that Macron won the presidential elections in France.

To date, the publication of a number of important macroeconomic data for the UK, the Eurozone, and the United States is scheduled. Therefore, it is necessary to take into account the expected increased volatility in the foreign exchange market. Investors will closely monitor the data on the Eurozone's GDP for the first quarter (preliminary value). Publication of data is scheduled for 09:00 (GMT). The GDP is expected to grow by 0.5% and by 1.7% in annual terms.

In the period from 12:30 to 13:15 (GMT), a block of important macroeconomic data will arrive from the United States. A report will be presented on the dynamics of new building permits in the US in April, which is an important indicator of the housing market and the report of the Federal Reserve Board of Governors on the volume of industrial production and use of production facilities in the US in April. High indicators will strengthen the US dollar. Negative data will weaken the USD.

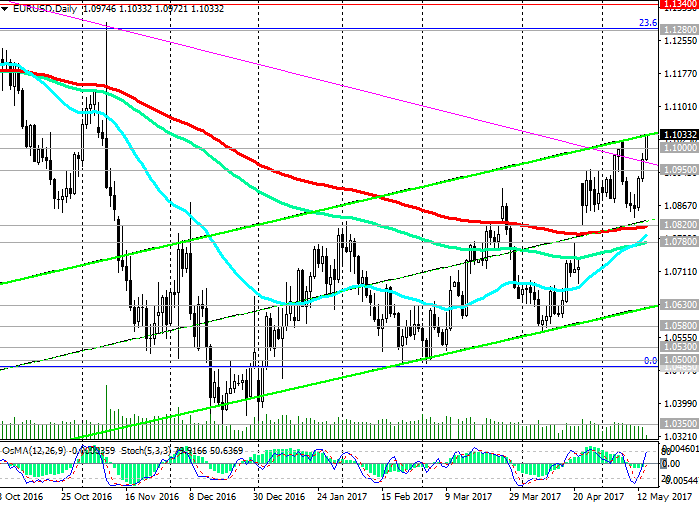

The pair EUR / USD keeps positive dynamics above support level 1.0820 (200-period moving average on the daily chart). Technical indicators on the 4-hour, daily, weekly, monthly charts were turned to long positions.

The EUR / USD pair came close to the upper border of the rising channel on the daily chart near the 1.1030 mark. In case of breakdown of the level 1.1030 and continuation of growth, the nearest targets will be the levels of 1.1100, 1.1200, 1.1280 (Fibonacci level of 23.8% of corrective growth from the minimums reached in February 2015 in the last wave of global decline from 1.3900 level).

In case of rebound from the level of 1.1030, the pair EUR / USD will go deep into the ascending channel on the daily chart. Medium-term short positions can be considered after the pair EUR / USD has fallen to support level 1.0820.

Support levels: 1.1000, 1.0950, 1.0900, 1.0875, 1.0820, 1.0800, 1.0780

Resistance levels: 1.1030, 1.1050, 1.1100, 1.1200, 1.1280

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.