Prior to the publication of the interest rate decision and the ECB's press conference, the major European stock indexes are declining from the new annual highs achieved 3 days ago after the victory of Macron in the first round of the presidential elections in France.

The decision on the interest rate of the ECB will be published at 11:45 (GMT). "The recovery of the Eurozone economy is still unstable, despite signs of improving the economic situation," - more recently, ECB executives commented on economists' forecasts about the possibility of raising interest rates and curtailing the QE program in the euro area.

The ECB's main interest rate is currently 0%, the deposit rate for commercial banks is negative and is -0.4%. From the beginning of April, within the framework of the QE program, the ECB plans to purchase European assets worth 60 billion euros by the end of 2017. It is widely expected that today the ECB will not take any action with regard to interest rates. At a subsequent press conference, ECB President Mario Draghi is likely to confirm the policy of maintaining the soft monetary policy of the bank. The press conference will begin at 12:30 (GMT).

It is unlikely that the ECB will go to change the QE program on the eve of the second stage of the presidential elections in France, which will be held on May 7. However, some economists believe that at the June meeting, the ECB may announce changes in the current QE program. The Eurozone economy is slowly but still recovering. So, according to the data published today, the confidence index in the industry of the Eurozone in April rose by 2.6 versus +1.3 in March, the index of trust in services in April was +14.2 versus +12.8 in March. The index of sentiment in the economy of the Eurozone in April rose to 109.6 against 108.0 in March, thus reaching its highest level since August 2007. However, unemployment still remains at high levels (about 9.5%), and annual inflation fell in March to 1.5% against 2% in February, again below the ECB's target level.

For the market, it will be a big surprise if Mario Draghi declares that it is possible to consider the issue of curtailing or changing the QE program in the direction of reducing support for the region's economy at the ECB's next meeting. The balance of the ECB at $ 4.5 trillion can surpass the Fed's balance already next week. Reducing the balance will be tantamount to a tightening of the monetary policy of the ECB. In this case, the euro will rise sharply, and European stock indexes will fly down. The situation with the elections in France in this case will take a back seat.

Nevertheless, according to most market participants, today Mario Draghi's rhetoric will remain unchanged soft, and interest rates will remain at the same level. The reaction of European indices to such a decision of the ECB is expected to be restrained-positive.

Support and resistance levels

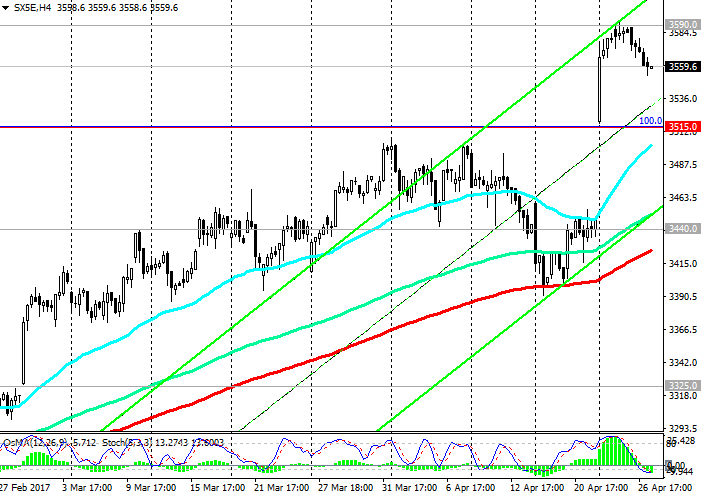

After a sharp rise against the backdrop of Macro's victory in the first round of elections in France, the last three days the EuroStoxx50 index is gradually decreasing. The day before the EuroStoxx50 index reached new highs for the last more than 2.5 years near the mark of 3590.0. Through this level, now passes the upper limit of the newly formed upstream channel on the daily chart.

The OsMA and Stochastic indicators on the daily chart are still on the buyers’ side, however, on the 1-hour and 4-hour charts the indicators turned to short positions. It is likely that up to the second round of elections in France, the EuroStoxx50 index is unlikely to be able to update the recent highs near the 3590.0 mark.

The most likely scenario - the EuroStoxx50 index will remain in the range between the levels of 3515.0 (Fibonacci level 100% correction to the wave of decline since December 2015), 3590.0.

The breakthrough of support level 3440.0 (the lower border of the rising channel and EMA50 on the daily chart, EMA200 on the 4-hour chart) will open the way to further decrease of the EuroStoxx50 index with medium-term targets of 3325.0 (January highs), 3240.0 (EMA200 on the daily chart). The breakthrough to support level 3200.0 (the Fibonacci level of 61.8% correction to the wave of decline since December 2015) will "close" the upward trend of the EuroStoxx50 index.

If the positive dynamics return again, the EuroStoxx50 index will continue to rise in the uplink on the weekly chart, the upper limit of which passes near the level of 3680.0 (July highs of 2015).

Support levels: 3515.0, 3440.0, 3400.0, 3325.0, 3300.0, 3240.0, 3200.0

Resistance levels: 3590.0, 3600.0, 3680.0

Trading scenarios

Sell Stop 3540.0 Stop-Loss 3595.0. Take-Profit 3515.0, 3470.0, 3440.0, 3400.0, 3325.0, 3300.0, 3240.0

Buy Stop 3595.0. Stop-Loss 3540.0. Take-Profit 3610.0, 3680.0, 3700.0

*)Actual and detailed analytics can be found on the Tifia website at tifia.com/analytics