EuroStoxx50: Centrist Emmanuel Macron leads the presidential race

According to the latest information, during the first round of the presidential elections in France, Emmanuel MacRon won 23.9% of the vote, the second among Marin Le Pen with 21.4%. It is likely that during the second round of elections, Macron can defeat Le Pen. Conservative Francois Fillon, who took third place, has already called on his supporters to vote for Macron.

Macro's economic policy is favorable for the Eurozone and European financial markets. In the implementation of its economic program, the former Minister of Economy centrist Macron plans to reduce taxes for companies and increase public investment by 50 billion euros. Macron also advocates the expansion of economic partnership within the Eurozone, primarily with Germany. The victory of Macron during the first round of elections can provoke the growth of demand for euro and European assets.

According to EPFR Global, the inflow of funds into the market of shares in the region is increasing, the funds have already begun moving to the European market. The macroeconomic statistics of the Eurozone is improving, the stocks have appreciably fallen in price since the beginning of the month, and all points to the probability of activization of buyers of European assets after the elections in France. So, according to the latest data, business activity in France is growing at the fastest pace in almost six years. IHS Markit's purchasing managers' index in March was 57.1 (the value above 50 indicates activity growth).

Nevertheless, one should be careful when opening long positions on the EuroStoxx50 index this week. On Thursday (11:45 GMT) the ECB's interest rate decision will be published in the Eurozone. The modest growth rates of the Eurozone economy remain, the unemployment rate still remains at high levels (about 9.5%), and annual inflation fell to 1.5% in March against 2% in February, again below the ECB's target level.

As several ECB leaders announced last week, it is not yet time to make changes in the monetary and credit policy of the bank. "The recovery of the economy is still unstable," despite signs of improving the economic situation in the Eurozone. The next meeting of the ECB will be held on April 26-27, and, according to the statements of key figures of the ECB leadership, the European Central Bank will not change the extra soft monetary policy.

And this will become a supporting factor for the European stock market. At the same time, the victory of Macron can give the European Central Bank an opportunity to consider the question of the beginning of the curtailment of the stimulation of the Eurozone economy. If during the next press conference the head of the ECB Mario Draghi only hints at the possibility of starting the curtailment of the QE program in the Eurozone, the European stock indexes will react with a decrease.

If the ECB declares the continuation of the economic stimulus program, the rally on the European stock markets will continue, given the victory of Macron in the first round of elections and the increase in the probability of his victory in the second round of elections.

Support and resistance levels

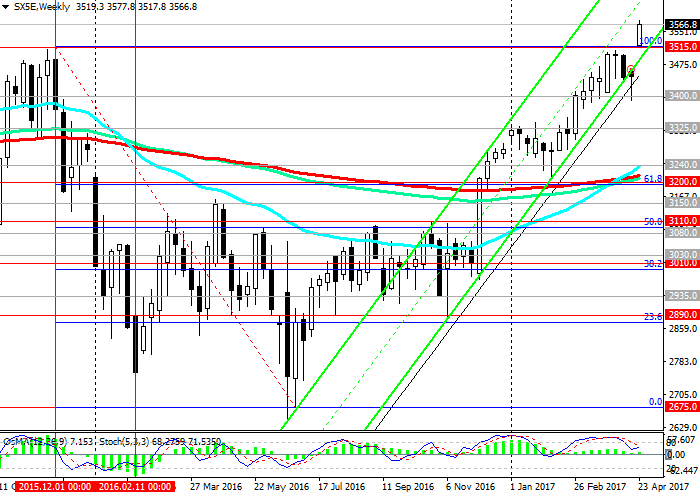

The EuroStoxx50 index has been actively growing since the beginning of December and began to decline in April ahead of the presidential elections in France. Having opened with a gap up, the EuroStoxx50 index today broke through an important resistance level of 3515.0 (the Fibonacci level is 100% correction to the wave of decline since December 2015) and exceeded this level by 50 points. At the beginning of today's European session, the EuroStoxx50 index trades near the level of 3568.0 (the upper limit of the ascending channel on the daily chart).

Indicators OsMA and Stochastics on the 4-hour, daily, weekly charts turned to long positions. If the positive dynamics continue, the EuroStoxx50 index will continue to rise in the uplink on the weekly chart, the upper limit of which runs near the level of 3680.0 (July highs of 2015).

An alternative scenario for the decline of the index will be linked both to the results of the second round of elections in France, if Marin Le Pen wins, or to the position of the ECB if the bank signals for the curtailment of the QE program in the Eurozone.

The signal for opening of the medium-term short positions on the EuroStoxx50 index will be a breakdown of the support level 3400.0 (EMA50 and the lower limit of the ascending channel on the daily chart).

In this case, the reduction targets will be support levels 3325.0 (January highs), 3240.0 (EMA200 on the daily chart).

Positive dynamics is maintained, while the EuroStoxx50 index is above the levels of 3240.0, 3200.0 (Fibonacci level 61.8% correction to the wave of decline since December 2015).

Support levels: 3515.0, 3400.0, 3325.0, 3300.0, 3240.0, 3200.0

Resistance levels: 3578.0, 3600.0, 3680.0

Trading Scenarios

Sell Stop 3510.0 Stop-Loss 3560.0. Take-Profit 3470.0, 3400.0, 3325.0, 3300.0, 3240.0

Buy Stop 3585.0. Stop-Loss 3545.0. Take-Profit 3600.0, 3680.0, 3700.0