Welcome to the second half of the year! Can you believe we only have another six months to go this year? Let’s take a quick look at the major economic themes that rocked the forex markets in Q2 2016 to complete your H1 2016 analyses!

But first, check out my Q1 2016 market recap to see how similar (and different) this quarter’s trading has been compared to the last.

Ready? Here we go!

1. BREXIT

Can’t have a list and not talk about the biggest market-mover of the quarter! See, the fallout from Britain choosing to divorce itself from the European Union (EU) wasn’t isolated to the pound. In fact, the Brexit issue has been affecting market sentiment since David Cameron first announced the schedule of the referendum.

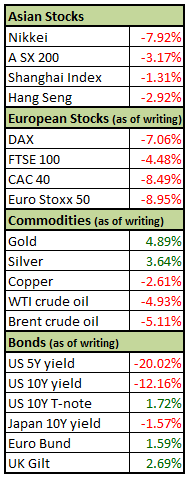

Boy, were they right! Despite the tight polls, few had anticipated that the LEAVE votes would actually win. The Brexit vote led to the pound falling to significant lows against its counterparts while the other major currencies, equities, and bonds markets also saw bloodbaths.

Right now all eyes are on how fast Britain can pull off the exit. Since David Cameron has made it clear that there won’t be any filing of Article 50 under his watch, the earliest we can expect the two-year process to begin is on October.

Unfortunately, the longer the U.K. delays the process, the longer consumers and investors will put off their investments and purchases. Bank of England (BOE) Mark Carney has already signalled that the central bank is cooking up a stimulus package. The question is, how much and for how long will Britain need the crutch?

2. Oil: oversupply or nah?

Oil prices had been rocking the forex markets even before the Brexit issue started to cause ripples in the forex market. If you recall, oil prices reached remarkable lows in Q1 2016 as oversupply concerns plagued the industry.

The Black Crack started Q2 2016 on slippery (hah!) ground as the highly-anticipated meeting between the major oil producers in Doha, Qatar failed to produce results. Back then market players had expected to see concrete plans (e.g. output freezes or quotas) from the meeting.

The odds may not have turned as quickly as Jon Snow’s on the “Battle of Bastards” episode, but things started turned around for the commodity. A second meeting was held in Vienna in early June and while there were still no concrete plans, the perceived amity between Saudi Arabia and Iran, as well as statements about the oil market “rebalancing” improved the appetite for oil and for high-yielding currencies.

3. Central bank shenanigans

With China’s economic meltdown out of the way (for now), the major central banks had time to communicate their interest rate policies and biases. Here’s a list of the more interesting developments you might have missed:

Fed: To hike or not to hike?

For a while the dollar’s price action centered around the possibility of

a June rate hike. Remember that back-to-back surprises in the U.S. jobs

reports had market players pricing in a rate hike in June.

Unfortunately, the Fed started Q2 2016 by making it clear that Uncle Sam’s low inflation and a weak global growth had them pushing their rate hike schedule back. Janet Yellen then threw a plot twist and hinted that “a rate hike in the coming months may be appropriate.” Talk about giving mixed signals!

Mark Carney and the “R” word

Once upon a time Bank of England (BOE) Governor Mark Carney hinted that

the next move for the central bank would be to tighten its policies.

Threatened by a possible Brexit, he warned of possible weaknesses for

the pound, unemployment, and even cried “recession” before the

referendum. But the big, bad Brexit came anyway and now he and his gang

are living in a reverse-Cinderella story of tightening to easing.

Surprise rate cut from the RBA

Australia’s surprisingly low inflation in Q1 2016 had Reserve Bank of

Australia (RBA) Governor Glenn Stevens hitting the rate cut button in

May. The central bank cut its rates from 2.0% to a record low of 1.75%

and lowered its inflation estimates. The move is widely seen as

pre-emptive though, as the RBA is still generally optimistic on the

economy.