Hello there, forex friends! If you haven’t been paying attention to Brexit-related events lately, then here are some of the more important things that you need to know about.

A new PM shall lead them (by September 9)

In my previous write-up on the process for an actual Brexit, I noted that David Cameron will be stepping down as British PM by October, and that the next PM will be the one to invoke Article 50 of the TEU to start the formal withdrawal process.

Well, a new PM is expected to be announced by September 9, which is roughly a month before Cameron steps down during the October 2 Conservative Party conference. And election rules in the U.K. mean that the new PM will hail from the Conservative Party, and we’ll be getting the list of candidate soon enough once nominations close later today (June 30, 2016).

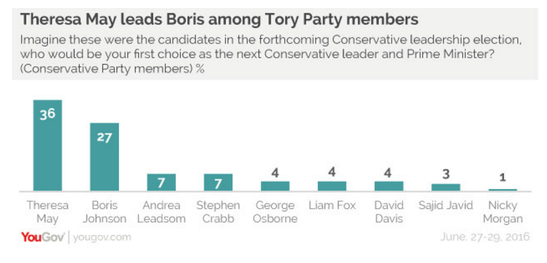

As to who the likely candidates are and who will likely win, YouGov has a poll on that, and it shows that Theresa May is in the lead at 36% with Brexit Boris trailing behind at 27%, which is weird and could be a cause for more turmoil and uncertainty in the financial markets since Theresa May is from the defeated “remain” camp.

Do note that this poll is before Boris Johnson announced that he won’t be running for PM.

Amusingly enough, YouGov posted its track record on predicting leadership elections, which is reproduced below. This is probably to shore up its reputation after getting it wrong on the Brexit referendum.

ECB to hold steady?

According to a dozen unnamed sources interviewed by Reuters, the ECB is willing to ease further if inflation outlook deteriorates, but it’s currently adopting a wait-and-see approach after observing the recovery in financial markets this week. The U.K.’s FTSE 100, for example, has already clawed it way back up, erasing the losses that the equity index suffered due to the pro-Brexit vote.

U.K.’s credit rating downgraded

Before we begin, a country’s credit rating reflects the level of risk associated with investing in said country depending on the vulnerability of that country to default on its financial obligations. And it naturally follows that a country with a high rating will generally have an easier time when it comes to attracting foreign investors, as well as borrowing at a cheaper rate from foreign or international financial institutions.

With that said, S&P lowered its sovereign credit rating on the U.K. from ‘AAA’ to ‘AA’ while setting its outlook on the U.K. to negative. S&P’s decision to downgrade was prompted by the pro-Brexit vote, and it explained that the pro-Brexit vote will have the following effects:

- It “will weaken the predictability, stability, and effectiveness of policymaking in the U.K. and affect its economy, GDP growth, and fiscal and external balances“

- “The result could also trigger a constitutional crisis if it leads to a second referendum on Scottish independence from the U.K.“

- “Brexit could also, over time, diminish sterling’s role as a global reserve currency“

S&P was not the only one that downgraded the U.K.’s credit rating, though, since Fitch also did the same, downgrading its credit rating on the U.K. from ‘AA+’ to ‘AA’ in the wake of the pro-Brexit vote, while setting the outlook on the U.K. also at negative. And compared to S&P, Fitch also had a more comprehensive list of forecasts/conclusions which are are follows:

- The pro-Brexit vote will “induce an abrupt slowdown in short-term GDP growth” due mainly to deferment of business investment

- GDP forecast for 2016 downgraded from +1.9% to +1.6%

- GDP forecasts for 2017 and 2018 downgraded from 2.0% for both to 0.9% for both

- “Medium-term growth will also likely be weaker due to less favourable terms for exports to the EU, lower immigration and a reduction in foreign direct investment“

- Slower growth means lower tax revenue, so general government deficit expected to increase by 3.6% in the next three years (2.8% originally)

- “a second referendum on Scottish independence more probable in the short to medium term“

BOE’s credit rating downgraded

Fitch went one step further and even downgraded its rating on the BOE itself, from ‘AA+’ to ‘AA’. Fitch explained that it downgraded the BOE’s rating because the BOE’s “credit profile is aligned with that of the sovereign government,” given the BOE’s “national strategic importance, as well as its ownership by the UK Treasury.”

Some E.U. members at risk of downgrades

Oh, Fitch is not done yet, forex friends. In yet another press release, Fitch turned its focus on the E.U., and while Fitch said that it did not and likely will not downgrade its credit rating on the E.U. or any of its member states in the short term, “Downgrades or Outlook revisions will become more likely in the medium term if the impact on other economies proves severe or political tail risks materialise.”

Fitch said that it’s keeping an eye on the following factors for downgrading purposes:

- Lower export levels to the U.K. from E.U. member states

- A “sustained significant fall” in the pound, which would “contribute to weaker exports by boosting the UK’s competitiveness and reducing its purchasing power for imports in euros“

And the following E.U. member states are on the top of its watchlist for downgrades because 8% or more of their exports go to the U.K.:

- Ireland

- Malta

- Belgium

- the Netherlands

- Cyprus

- Luxembourg

For the E.U. as a whole, Fitch expressed the following concerns:

- “If the UK were to thrive outside the EU, it might also encourage other countries to follow suit.”

- An actual Brexit and the loss of the U.K.’s contribution to the E.U. budget would mean that “other net contributors will have to pay more, or net recipients will have to accept lower EU expenditure.”

- Luxembourg, Malta, Belgium, Germany, and other member states that have invested heavily or have financial assets in the U.K. would suffer losses if the pound will resume falling

- “If Brexit results in Scotland leaving the UK, this could also intensify secession pressures in other parts of the EU, such as Catalonia in Spain.”

Scotland is stuck in the U.K. (for now)

Speaking of Scotland leaving the U.K., Scottish First Minister Nicola Sturgeon met with E.U. leaders earlier this week in order to try and find a way for Scotland to remain in the E.U., given Scotland’s overwhelming support for the “remain” camp.

Her mission seems to be unsuccessful, however, since E.U. leaders were not unanimous in their support for Scotland, with French President Hollande telling her that “The negotiations will be conducted with the United Kingdom, not with a part of the United Kingdom” while acting Spanish prime minister Rajoy said that “I am extremely against it, the treaties are extremely against it and I believe everyone is extremely against it. If the United Kingdom leaves… Scotland leaves.”

Looks like the only way for Scotland to remain in the E.U. is to part ways with the U.K. via a successful second Scottish independence referendum.