ITV calls it. The BBC and Sky News follow. It is over. Here is what has happened and what might be seen in the next few days.

Things became clearer as the night progressed, with the minimal margin for Remain in Newcastle and the big Leave win in Sunderland. When more and more results flowed in, we had bigger pushes to the downsides. Nevertheless, also corrections came along thanks to Remain wins in Scotland and London Boroughs.

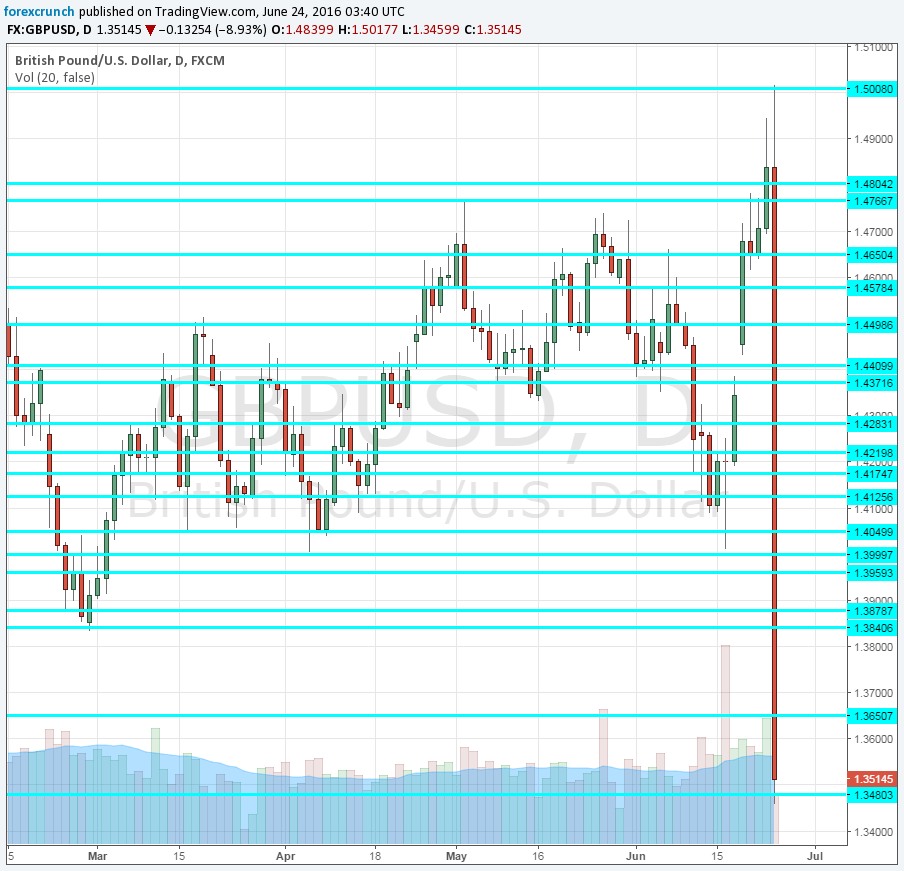

These served as selling opportunities. Volatility is huge and will continue. GBP/USD dipped to the lowest level since 1985, under the post crisis low of 1.35.

Also EUR/USD fell by over 3% at the time of writing to around 1.10 and USD/JPY totally crashed to 98.82 before staging a huge recovery, that seems inspired by the BOJ. Commodity currencies also dropped by 2-3%.

Risks were clearly asymmetrical: markets were leaning towards Bremain in the last days. A Remain vote would have led to limited rally and the actually Brexit is a total earthquake.

This is a night to remember in markets. We may still see corrections and markets are never a one way street. Nevertheless, this is a huge decision with implications on UK politics, Scotland, the fate of the European Union, the Fed hikes (forget about them), currency interventions and you name it.

A drop of GBP/USD below 1.35 will not be surprising. This may come after a big correction, but the picture is not bright for the UK. In addition, the euro could further react to the downfall. It did not get totally carried away and things may come later on.

Do these 3 things if you opt to jump on the Brexit train

The last time that GBP/USD traded at these levels, it was 1985. The No.1 hit on the radio was Careless Whisper. This song seems appropriate.