While the pound is the center of attention ahead of the Brexit vote and the euro will follow the lead, also the safe haven yen has its role. Here is the view from SocGen:

Here is their view, courtesy of eFXnews:

The improvement in sentiment over the last 10 days has seen sterling sterling bounce with opinion poll readings. That suggests an asymmetric risk to the outcome once again, with a ‘Leave’ decision more damaging for sterling and risk sentiment than a decision to ‘Remain is positive’.

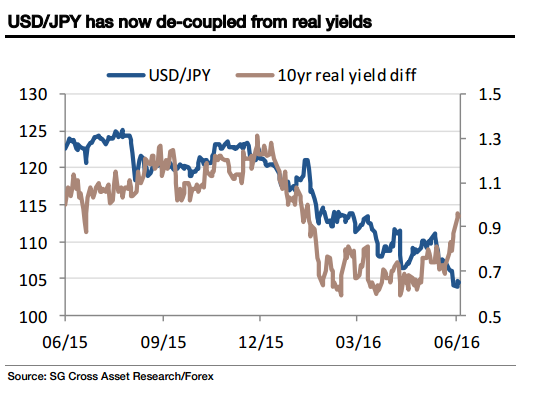

The wider implications for risk sentiment however, can be quite neatly visualised in a chart of USD/JPY and the US/Japanese real yield differential. The untethered yen where he highlights the growing significance of real rate differentials. I think these cause instability in USD/JPY that will persist, because a falling yen drives up inflation expectations and therefore drives real rates down, weakening the currency further – and vice versa. But right now, one thing that is clear is that the yen is stronger than even real rates suggest.

USD/JPY was dragged down by a 70bp fall in US real rates vs. Japanese ones at the start of the year. Half of that has now been reversed and the FX market’s indifference reflects demand for the yen as a safe-haven currency ahead of the UK referendum.

Think ‘remain’? Sell the yen.