EUR/USD: US Rate Hike Getting Closer?

EUR/USD Current Price: 1.1310

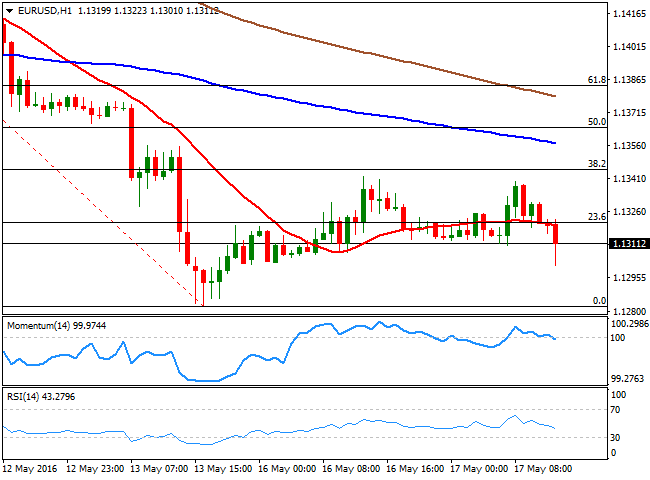

The EUR/USD pair advanced up to 1.1339 this Tuesday, as risk appetite dominated the first half of the day. The pair however, retreated towards its daily lows in the 1.1310 region, as European share markets lost momentum following a strong opening. The EU released its Trade Balance figures for March that came in at €28.6B, above the forecast of €22.5B and previous of €19.0B, but the news did little for the common currency. It was however, US CPI data which defined the pair, as US inflation for April came in at 0.4% above previous 0.1% and the 0.3% expected. Core yearly inflation remain flat, at 2.1%, with the overall reading being positive and putting a rate hike in June back on the table.

The EUR/USD pair fell down to 1.1301 right after the release, and the dollar is generally higher across the board, poised to extend its rally against the common currency, as in the 1 hour chart, the price is accelerating its decline below its 20 SMA, whilst the technical indicators accelerated their declines within bearish territory. In the 4 hours chart, the early advance was contained by a sharply bearish 20 SMA, whilst the technical indicators have resumed their declines within negative territory, supporting also supporting further slides. Should the price extend below 1.1280, the bearish momentum should accelerate with scope then to test the 1.1200 region.

Support levels: 1.1280 1.1240 1.1200

Resistance levels: 1.1340 1.1370 1.1410