Daily Analysis of Major Pairs for April 27, 2016

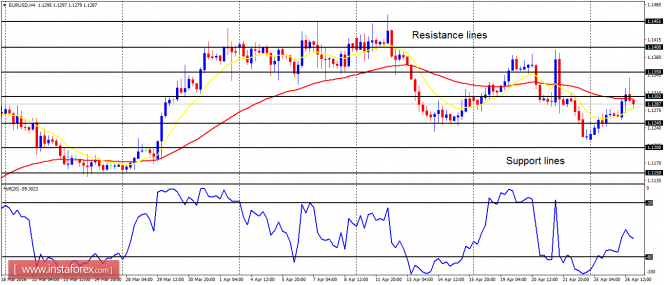

EUR/USD: The EUR/USD is still slightly higher in the context of a downtrend. The downtrend is still a valid thing, therefore the upward bounce could be seen as a short-selling opportunity, provided the price does not go above the resistance line at 1.1400. The bears might target the support line at 1.1200 this week.

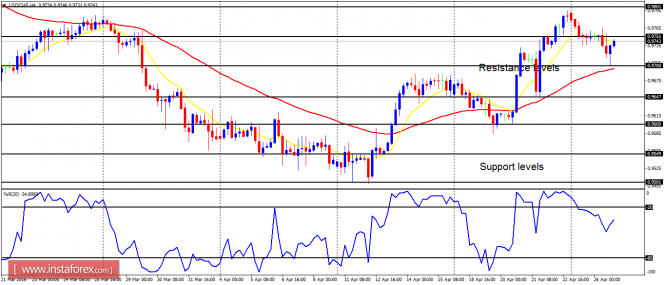

USD/CHF: The bearish retracement that has happened on this pair is still in force. This has even caused the Williams' % Range period 20 to dip a little (though it has not gone into the oversold territory). The bullish bias remains in place, and the price could be seen rallying today or tomorrow, reaching the resistance levels at 0.9750 and 0.9800.

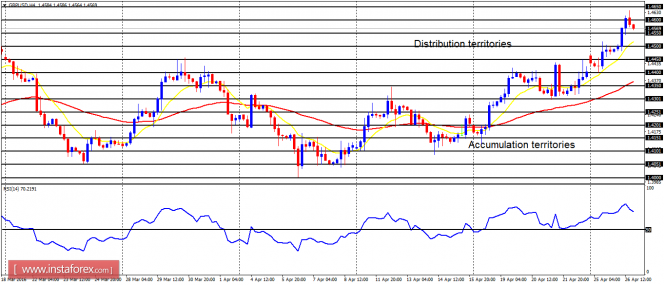

GBP/USD: This currency trading instrument has managed to keep going upwards, testing the distribution territory at 1.4600. The distribution territory can be tested again, while the bulls push the price further upwards. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50, which means the bulls are in control.

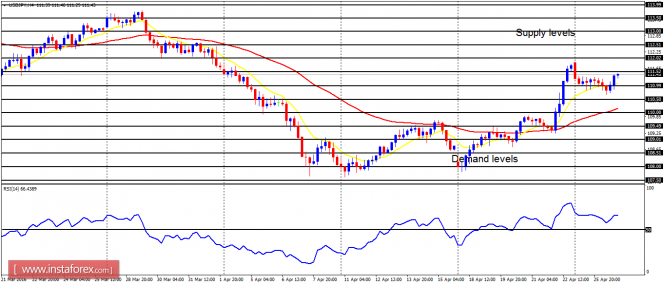

USD/JPY: On this pair, the uptrend is still a valid thing, therefore the current price action could be seen as a buying opportunity, provided the price does not go below the demand level at 109.00. The bulls might target the supply levels at 112.00 and 112.50 this week.

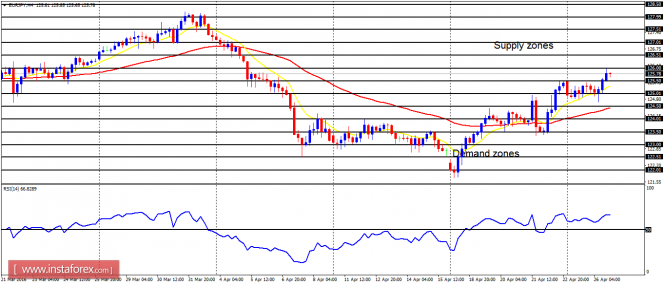

EUR/JPY: The EUR/JPY has managed to go further upwards, following the consolidation that happened at the beginning of this week. There is a Bullish Confirmation Pattern on the 4-hour chart, and it is expected that the market could go upwards, reaching 126.50 and 127.00. However, this does not mean that a pullback cannot occur before the end of the week.

The material has been provided by InstaForex Company - www.instaforex.com