How to Trade Commodity Channel Index (CCI) in Forex

Commodity Channel Index (CCI) is an oscillator introduced by Donald Lambert in 1980. Though its name refers to commodities, it can also be useful in equities and currency trading as well.

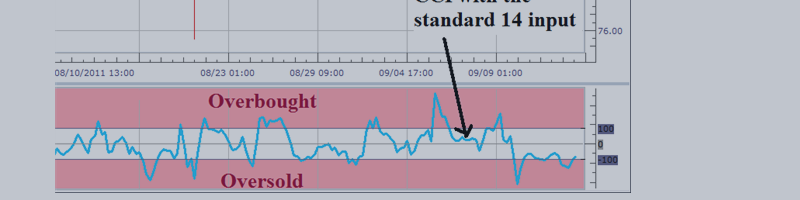

CCI measures the statistical variation from the average. It is an unbounded oscillator that generally fluctuates between +100 and -100. Traders use the CCI in a variety of ways. Three common uses are:

-CCI in retracements

-CCI on breakouts

-CCI in divergent trades

This article will be the first of three regarding common uses of CCI and will focus on how to use this oscillator in retracements.

CCI in Retracements

Approximately 70-80% of the values tend to fall inside the +100 to -100 range. Above the +100 value is considered overbought while below the -100 value is considered oversold. As with other overbought/oversold indicators, this means that there is a large probability that the price will correct to more representative levels. Therefore, if values stretch outside of the above range, a retracement trader will wait for the cross back inside the range before initiating a position.

Rules to trade a CCI retracement

First identify the direction of the prevailing trend. If you are trading off of a 4 hour chart, determine the direction of the daily trend. If you are trading off a 15 minute chart, determine the direction of a trend on the 2 hr chart.

Up Trends

If the trend is up, wait for the CCI to move below -100 (oversold territory) and cross back above -100 to create a buy signal. Place your stop loss just below the swing low. Look to take profits at least twice the distance to your stop loss so you are maintaining at least a 1: 2 risk to reward ratio.

Down Trends

If the trend is down, wait for the CCI to move above the +100 (overbought territory) and cross back below +100 to create a sell signal. Place your stop loss just below the swing high. Look to take profits at least twice the distance to your stop loss so you are maintaining at least a 1: 2 risk to reward ratio.