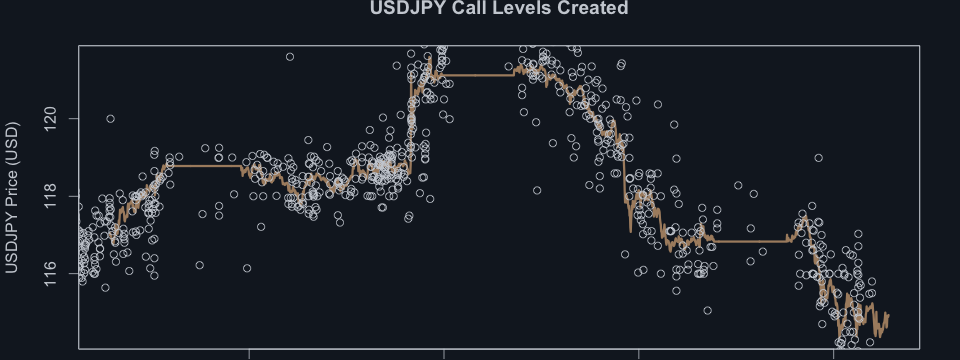

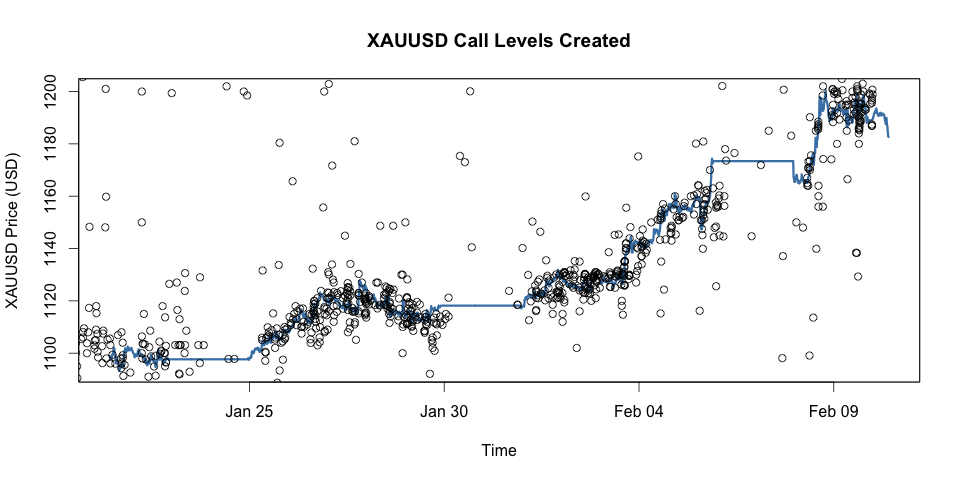

Market momentum slows and risk appetite continues to wane, despite benchmark Brent crude prices cautiously edging higher from last week’s lows. Meanwhile, the BoJ’s dramatic move to negative interest rates last week saw JPY touch 14-month highs against USD, with more gains to come.

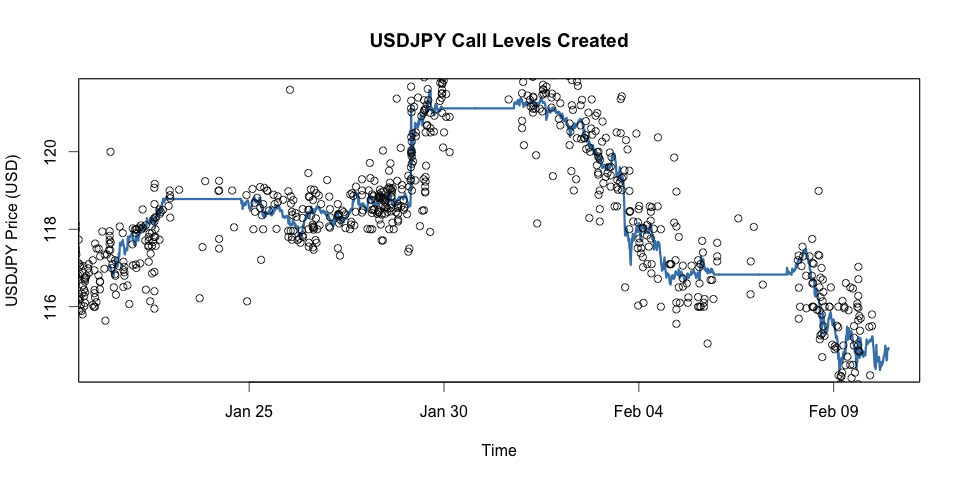

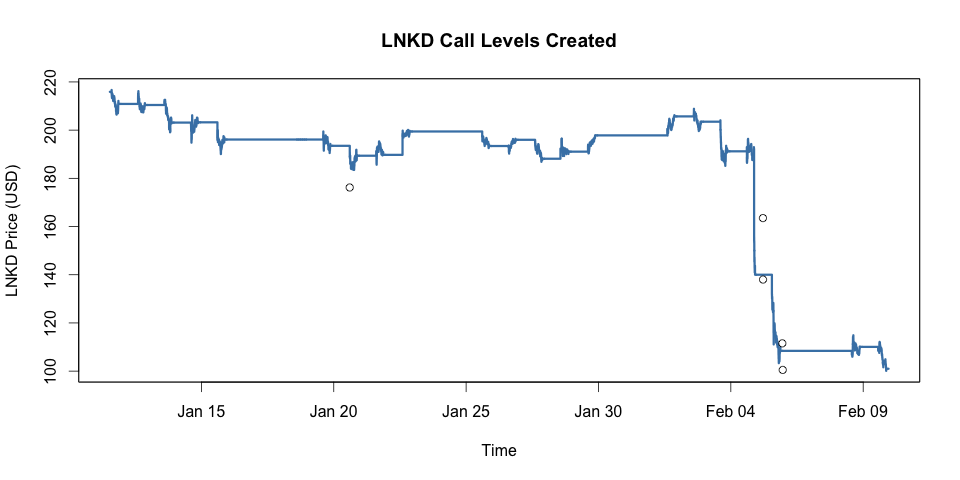

Haven asset investments like gold continue to gain popularity, as panic sourced from the Chinese economy gave way in favour of turmoil in global equities. In particular, tech stocks continue to disappoint as LNKD sank -45% last week; causing this week’s earnings expectations for TWTR, FEYE and TSLA to plummet.

Expect volatility to continue, following the buildup to the Fed’s Wednesday meeting on future rate hikes as uncertain economic conditions and EM turbulence persists.

Follow USDJPY @ 116.50 - http://www.calvl.co/EX8Nz59J/

Follow XAUUSD @ 1200 - http://www.calvl.co/kXyQymDX/

Follow BZ.NYMEX @ 34.00 - http://www.calvl.co/KOYjngMJ/

Follow LNKD @ 87.00 - http://www.calvl.co/ZX1zYAEO/

Trading Updates with The Market Master

The S&P 500 continues to trade with a good amount of volatility with the more bearish head and shoulders pattern prevailing at this time after 1872 gave way. For now, we maintain a view that a bounce to the 1960-1990 region should materialise in the coming sessions despite how bad everything looks. Our alternative bearish scenario if the market were to close under 1812 would be to see 1770 next before a more substantial bounce is seen.

Current Position - LONG 1000 XIV @ 22.47

[Originally published on 2016-02-10 at http://blog.call-levels.com/alls-fair-in-love-and-the-war-for-growth-as-global-stocks-extend-losses/. Reproduced with permission.]