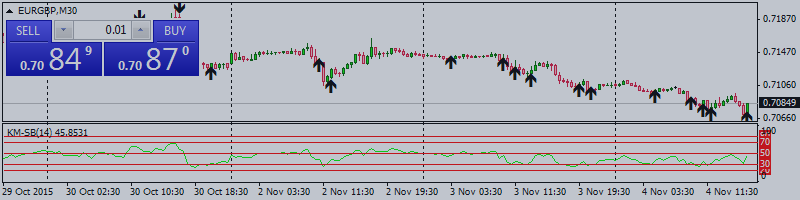

The EUR/GBP

pair hit a fresh session low of 0.7070 as the British Pound remained relatively

resilient to the broad based USD rally.

Monetary policy

divergence at play

The increasing expectation of a Fed rate hike

in December is weighing heavily over the EUR since the EC Bhs hinted at more

easing in December. Meanwhile, the Sterling stays relatively resilient as the

BOE is expected to follow the Fed and raise rates.

Moreover, the markets

now believe the Fed has made up its mind and thus even a slightly better than

expected US data is leading to broad based USD rally and a serious EUR weakness.

The EUR/GBP cross is now approaching 0.7063 (76.4% of Jul-Oct rally).

EUR/GBP Technical Levels

The immediate support

is seen at 0.7063 (76.4% of Jul-Oct rally), under which the pair could extend

the losses to 0.7026 (Aug 18 low). On the other side, resistance is seen at 0.71

and 0.7145 (61.8% of July to Oct rally).