Fundamental Weekly Forecasts for US Dollar, GBPUSD, USDJPY, USDCAD, AUDUSD, NZDUSD and GOLD

US Dollar - "The ECB and PBoC have vowed more easing while the RBA and RBNZ have warned more rate cuts may be appropriate. One of the top spring boards to this point, the BoJ seems a bit winded on QE. However, if all of these groups collectively shift global policy further into the bearish scale, the Greenback will look all the more remarkable for cautious hawkish backing."

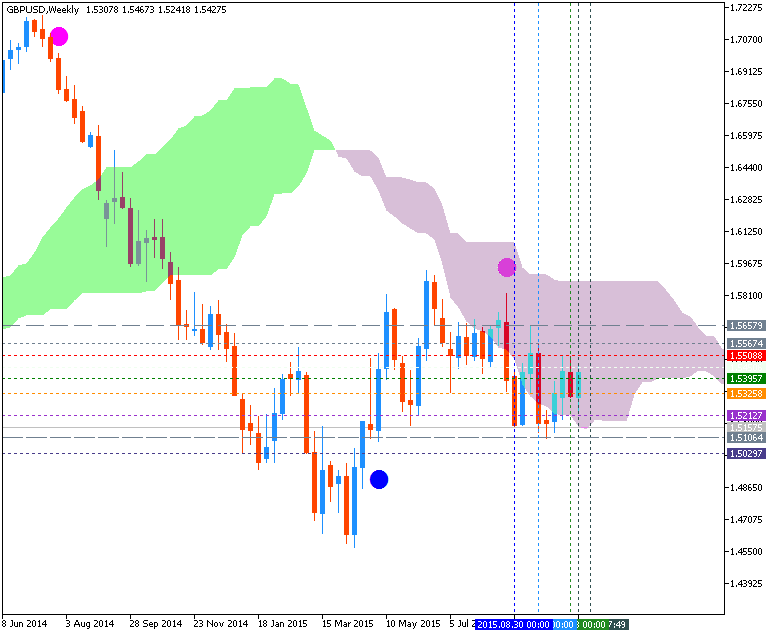

GBPUSD - "Even though GBP/USD largely preserves the opening monthly range for October, the failed attempts to close above the 100-Day SMA (1.5483) may produce range-bound conditions going into first full-week of November, but the risk remains tilted to the downside as the Relative Strength Index (RSI) largely preserves the bearish formation from back in May. With that said, the downside targets remain in focus until GBP/USD breaks out of the downward momentum from earlier this year."

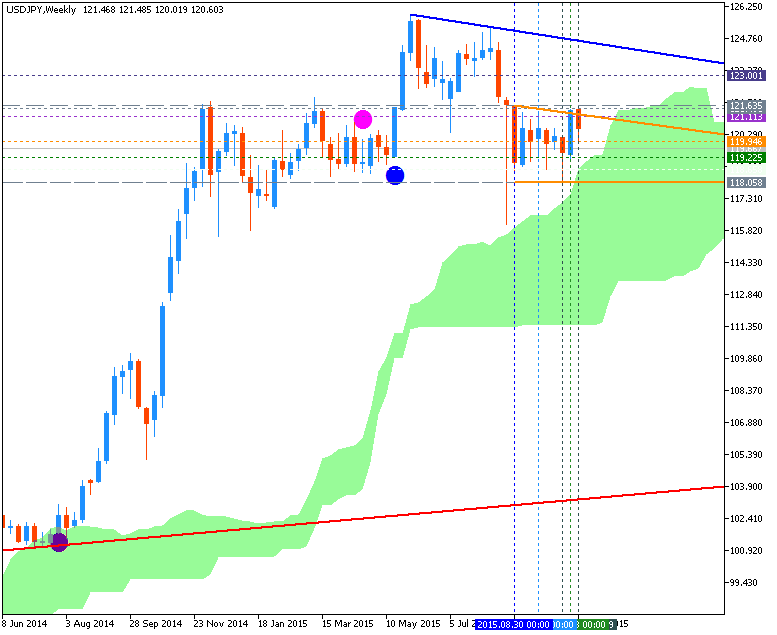

USDJPY - "Any noteworthy disappointments in upcoming US economic data could nonetheless change things in a hurry, and indeed it will be important to watch the results of the highly market-moving US Nonfarm Payrolls report in the week ahead. The US Federal Reserve made it clear that it could choose to raise interest rates at its December meeting and thereby boosted US Dollar versus most major counterparts. Yet the weight of expectations implies that the USD could fall just as quickly if NFPs miss expectations. Keep an eye on the USD/JPY as traders react to the key data release."

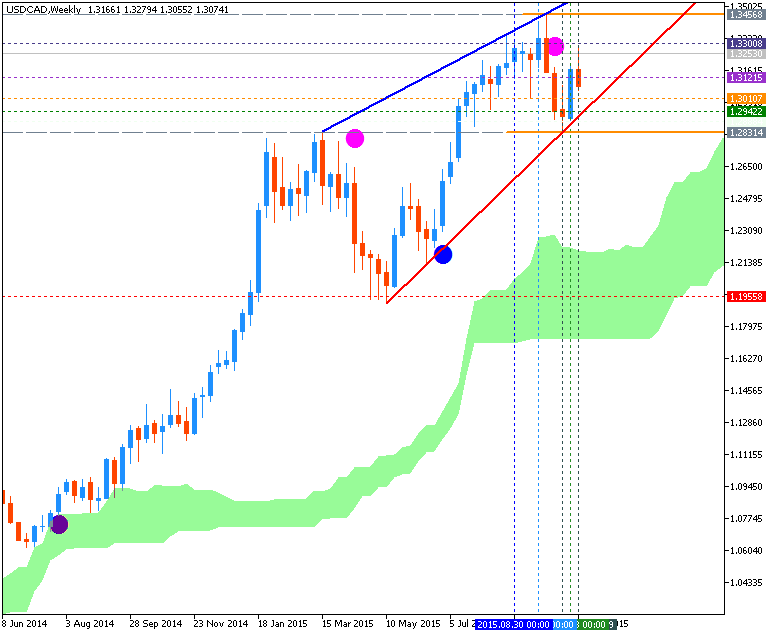

USDCAD - "The highlight on the calendar is Canadian employment, and that will be printing simultaneously with US Non-Farm Payrolls in what will likely be an especially volatile period for markets, particularly USD/CAD. Employment numbers, like Oil, can be looked at as a type of leading-indicator for an economy that could potentially foretell near-term economic performance. But, again, the big factor here for the future of the Canadian economy and the near-term price movements in CAD will likely be driven by Oil prices; and for that reason, we retain our bearish forecast."

AUDUSD - "An upbeat result is likely to increase the likelihood of an FOMC interest rate hike at next month’s policy meeting in the minds of investors. That is likely to push the US Dollar broadly higher, including against the Aussie. Losses may be compounded if the prospect of US tightening against a backdrop of slowing global performance weighs on risk appetite, amplifying selling pressure on the sentiment-linked currency. Needless to say, a soft print will probably yield the opposite dynamics."

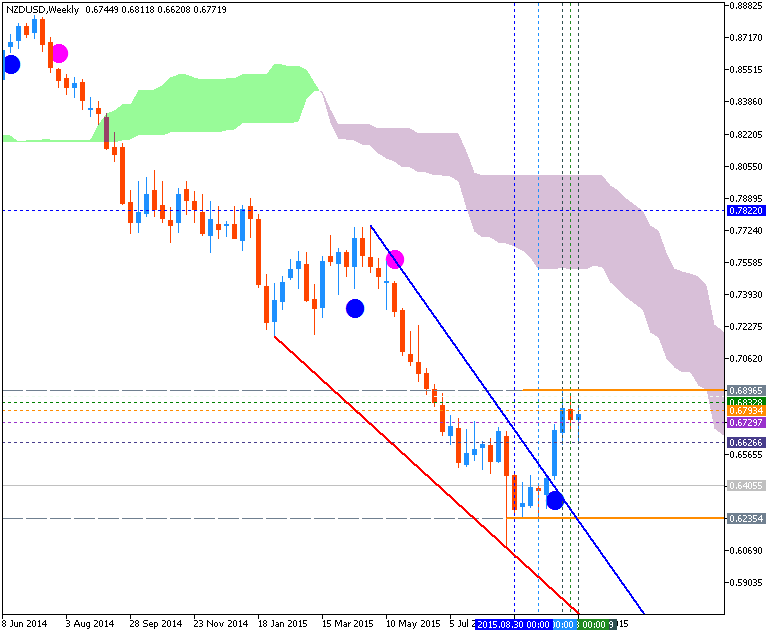

NZDUSD - "A positive print and unemployment could help wipe the negative memory from October 29’s disappointing building permits print; which came in at -5.7% first expectations of four -4.9%. Another trend worth recognizing is the month-end boost to equities and the stabilization of economic data benefiting high-beta FX such as NZD and Emerging Markets. Should equities continue higher, it is unwise to rule out further gains to NZD despite RBNZ rhetoric. Also, AUDNZD hit the lowest price since early May, which opens the doors for a retest of 1.0476, the YTD low."

GOLD - "We’re closing the week / month just above support within the confines of an upward sloping median-line structure extending off the 2015 low. We’ll be looking for a reaction off this mark heading into the September opening range to offer guidance here but the risk remains for a near-term rebound early next week while above 1137."