Congresspersons Start Asking Questions About Hedge Funds Betting on Lawsuits.

30 August 2015, 18:02

0

116

The "suit fund" industry incites a distrustful look from two capable Republican legislators

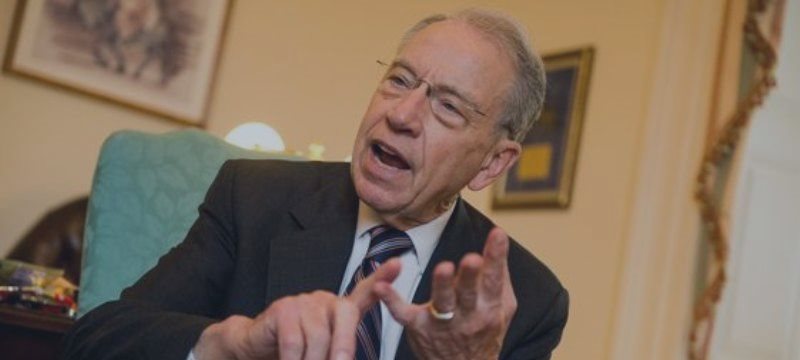

Multifaceted investments have been theorizing on claims, another type of monetary designing that some business premiums say supports inefficient court fighting. Presently two top Republican congresspersons—Chuck Grassley of Iowa and John Cornyn of Texas—have a couple inquiries they could call their own. The legislators reported a move to begin "looking at the effect of outsider prosecution financing is having on common suit." Their beginning stage is not one of excitement.

"Suit theory is growing at a disturbing rate," Grassley, executive of the Senate Judiciary Committee, said in a joint proclamation discharged on Thursday. "But, on the grounds that the presence and terms of these assentions need straightforwardness, the effect they are having on our common equity framework is not completely known."

Grassley and Cornyn, the Senate larger part whip, sent letters to three of the biggest business case fund firms—Burford Capital, Bentham IMF, and Juridica Investments—asking for subtle elements on the cases they back, the terms of their speculations, and their profits. Burford specifically has helped move claim account into the corporate standard. While its most famous, and slightest fruitful, speculation upheld a legal claim against Chevron in Ecuador, Burford for the most part funds suits started by significant organizations and took care of by huge corporate law offices, for example, Simpson Thacher & Bartlett, King & Spalding, and Latham & Watkins.

Burford and its rivals put resources into claims in return for an offer of any recuperation. The U.S. Council of Commerce, for one, has criticized this action as "a modern plan for betting on case" that professedly fills injurious suits and makes irreconcilable situations. Prosecution money firms counter that they empower honest to goodness guarantees that generally would sit lethargic on the books of their corporate customers.

With new consideration from the Senate, and the possibility of open hearings, which in some cases take after from advisory group request, we may take in more about the upsides and downsides of spreading interests https://www.mql5.com/en/signals/111434

Multifaceted investments have been theorizing on claims, another type of monetary designing that some business premiums say supports inefficient court fighting. Presently two top Republican congresspersons—Chuck Grassley of Iowa and John Cornyn of Texas—have a couple inquiries they could call their own. The legislators reported a move to begin "looking at the effect of outsider prosecution financing is having on common suit." Their beginning stage is not one of excitement.

"Suit theory is growing at a disturbing rate," Grassley, executive of the Senate Judiciary Committee, said in a joint proclamation discharged on Thursday. "But, on the grounds that the presence and terms of these assentions need straightforwardness, the effect they are having on our common equity framework is not completely known."

Grassley and Cornyn, the Senate larger part whip, sent letters to three of the biggest business case fund firms—Burford Capital, Bentham IMF, and Juridica Investments—asking for subtle elements on the cases they back, the terms of their speculations, and their profits. Burford specifically has helped move claim account into the corporate standard. While its most famous, and slightest fruitful, speculation upheld a legal claim against Chevron in Ecuador, Burford for the most part funds suits started by significant organizations and took care of by huge corporate law offices, for example, Simpson Thacher & Bartlett, King & Spalding, and Latham & Watkins.

Burford and its rivals put resources into claims in return for an offer of any recuperation. The U.S. Council of Commerce, for one, has criticized this action as "a modern plan for betting on case" that professedly fills injurious suits and makes irreconcilable situations. Prosecution money firms counter that they empower honest to goodness guarantees that generally would sit lethargic on the books of their corporate customers.

With new consideration from the Senate, and the possibility of open hearings, which in some cases take after from advisory group request, we may take in more about the upsides and downsides of spreading interests https://www.mql5.com/en/signals/111434