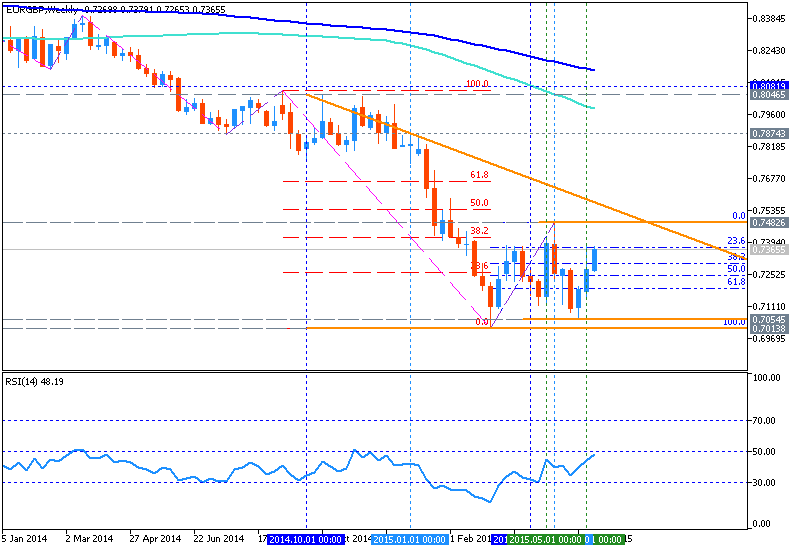

EURGBP Price Action Analysis - the price broke 38.2% Fibo level at 0.7303 on close weekly bar within the ranging bearish market condition

10 June 2015, 15:11

0

147

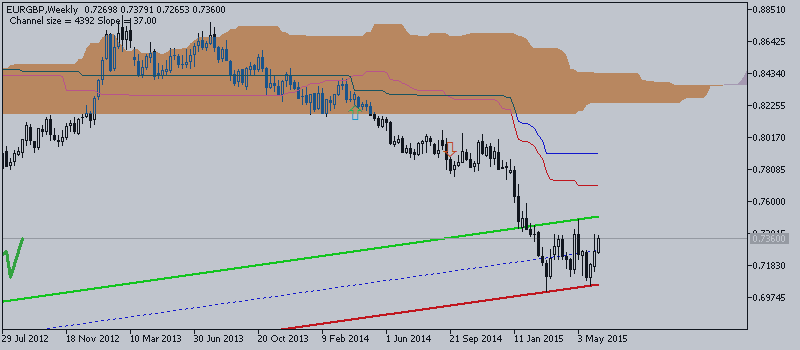

W1 price is located below 200 period SMA and below 100 period SMA for the primary bearish with secondary ranging between 0.7482 resistance level and 0.7013 support level:

- the price is ranging between ranging between 0.7482 and 0.7013 levels;

- the price broke 38.2% Fibo level at 0.7303 on close weekly bar from below to above for possible bear market rally and stopped near 23.6% Fibo at 0.7371 for local uptrend to be continuing;

- if weekly price will break 0.7482 resistance

level so the secondary rally will be fully started within the primary bearish market condition, otherwise the price will be ranging within the familiar levels;

- “Double Bottom Pattern looks to have attractive risk.”

- “The failure on EURGBP brings a clear message for the time being. The message is that the market has little to no interest in additional exposure long GBP and short EUR below 0.7000. The inability for the market to build momentum past this point favors the new move higher. A key way to recognize this lack of momentum is to see whether price and volume are in agreement or disagreement around this level. Because volume dropped when approaching this key zone, we’ll look for a trade set up that favors a new directional bias.”

Trend:

- H4 - ranging bullish

- D1 - ranging bearish

- W1 - ranging bearish

- MN1 - bearish breakdown (reversal to the primary bearish condition)