Relationship between commodities and dollar are way more complicated than inverse

The most common explanation of the recent jump in the prices for gold and oil after the Fed's statement has been the drop in the greenback, but the two commodities don’t always have an inverse relationship with the latter.

Commodities priced in dollars often move in the opposite direction of the currency, according to the general rule, as moves in the greenback can influence the attractiveness of those commodities to holders of other currencies.

Many times, however, “it’s almost impossible to see a correlation” between oil and the dollar, said Phil Flynn, senior market analyst at Price Futures Group. “Supply and demand factors overshadow, at times, any concern about the dollar or exchange rate.”

In his opinion, traders won’t care how strong or weak the dollar is, if they really want oil CLK5.

After the economic crash in 2007 to 2008, “the correlation was in lock step with oil and the dollar moving inversely with a 60%-plus correlation rate,” said Flynn.

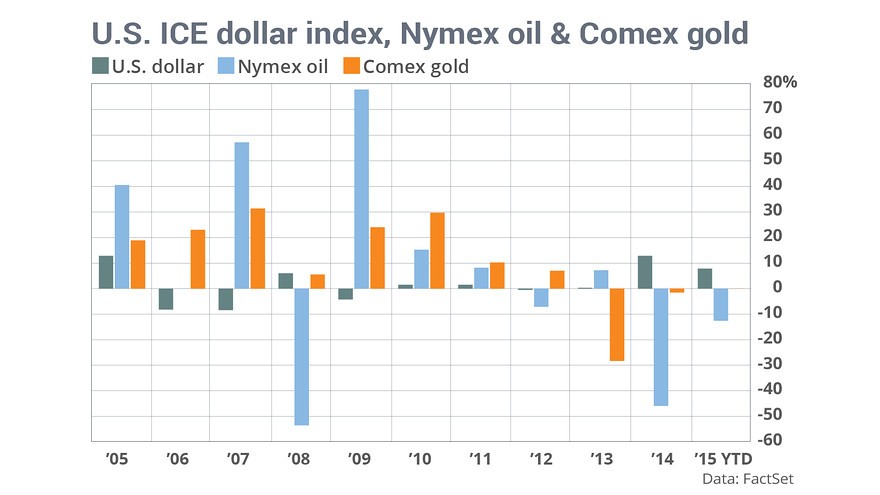

A chart below indicates that in 2009, as the ICE U.S. dollar index DXY got weaker, both gold and oil rallied.

Source: MarketWatch

That occurred because the first Federal Reserve program of quantitative

easing “created a marriage between the dollar and oil,” he said, as QE was the only factor keeping the economy alive and hence keeping oil demand moving.

For gold GCJ5 influences are different, but its relationship with the greenback is complicated, too.

“All other things being equal, a rising dollar means a falling gold price,” said Brien Lundin, editor of Gold Newsletter. So, “over the short term, and especially during periods where monetary or price inflation isn’t a concern, then gold and the dollar do trade in a generally inverse way.”

However, “in a period where every fiat currency is undergoing significant base expansion and the public is concerned about the repercussions, gold can trade higher in all currencies—even the U.S. dollar, and even if the dollar itself is rising against other fiat currencies,” he said.